Highlights:

- US spot Bitcoin ETFs surpass $50B inflows, led by BlackRock and Fidelity funds.

- Bitcoin rallies past $112K as institutional demand continues gaining strong momentum.

- Ethereum funds see significant inflows, supporting a bullish trend in the market.

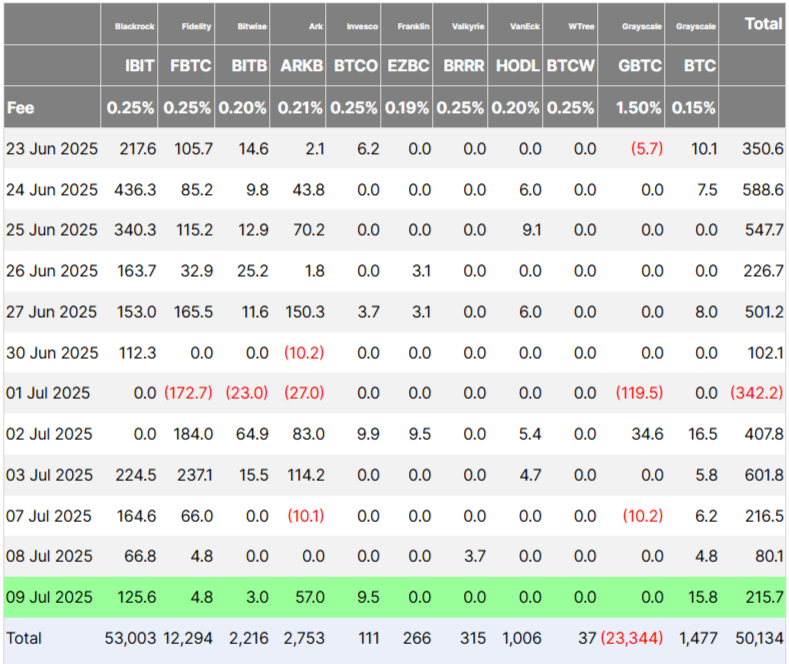

US spot Bitcoin exchange-traded funds (ETFs) have hit a major milestone, surpassing $50 billion in total net inflows as of Wednesday. This significant achievement comes just 18 months after their launch in January 2024. Leading the way is BlackRock’s iShares Bitcoin Trust (IBIT), which attracted a massive $53 billion in net inflows. Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed, bringing in $12.29 billion. However, not all funds saw gains. Grayscale’s Bitcoin Trust (GBTC) was the only ETF to record net outflows, with investors pulling out $23.34 billion, according to data from Farside Investors.

Bitcoin Hits $112K as BTC ETFs Pull In $218M in a Single Day

On Wednesday alone, these funds recorded a combined daily net inflow of $218 million. BlackRock’s iShares Bitcoin Trust (IBIT) led the pack once again, bringing in $125.6 million in fresh inflows. Following closely was the Ark & 21Shares fund (ARKB), which saw $57 million in net additions. Grayscale’s Mini Bitcoin Trust also reported positive flows, adding $15.8 million. Other issuers, including Fidelity, Bitwise, Valkyrie, and Invesco, also recorded inflows on the day, highlighting broad investor confidence in spot Bitcoin ETFs across multiple providers.

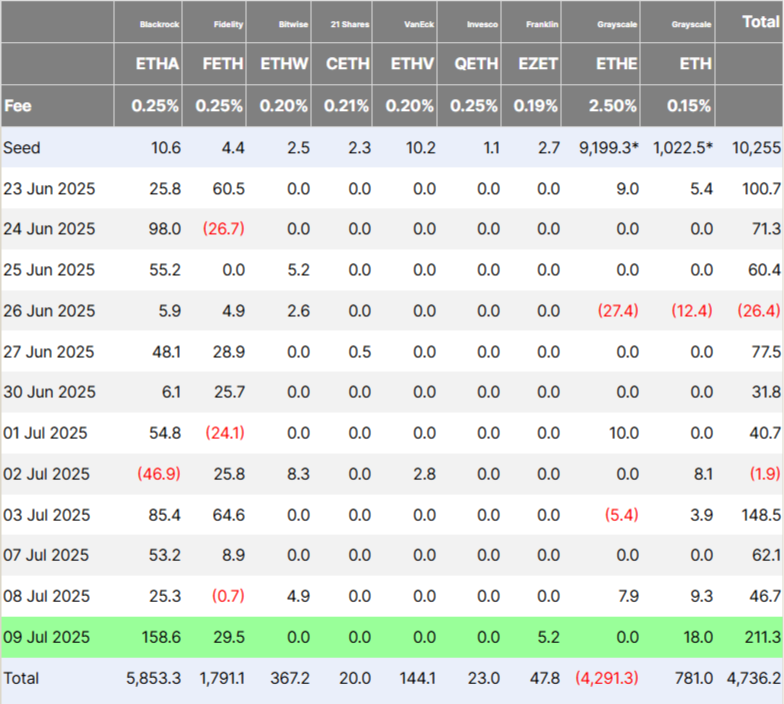

On July 9, Bitcoin spot ETFs recorded a total net inflow of $218 million, marking five consecutive days of net inflows. Ethereum spot ETFs saw a total net inflow of $211 million, with four consecutive days of net inflows.https://t.co/ueXcZjuIVU

— Wu Blockchain (@WuBlockchain) July 10, 2025

Bitcoin set a new all-time high on Wednesday, climbing to $112,152 as market fears tied to Trump’s tariff-related volatility eased. The cryptocurrency has since slightly pulled back and is now trading at $111,286, marking a 1.84% gain over the last 24 hours.

Ethereum Nears $3K as Spot ETH ETFs See $211M Inflows in One Day

Meanwhile, spot Ethereum ETFs also maintained their strong inflow momentum, drawing in $211.32 million on Wednesday alone. This continues a growing trend seen in recent weeks. So far, these Ether-focused funds have accumulated a total of $4.72 billion in net inflows.

Besides Bitcoin, analysts believe Ether could hit $3,000 this week, supported by a strong bullish trend. Over the past 24 hours, ETH has jumped 6.28% and is now trading at $2,791, according to CoinMarketCap.

More Corporations Add Bitcoin as Institutional Interest Grows

Bitcoin continues to attract strong interest from corporations, with many establishing or expanding their BTC holdings throughout 2024. Data from bitcointreasuries.net shows that 143 public companies now hold a total of $93.3 billion in Bitcoin. Strategy, which began this trend in 2020, holds the largest share, around $66 billion, making up over two-thirds of the total.

Recently, Japan-based Metaplanet made headlines by purchasing $237 million worth of Bitcoin, pushing its total holdings above 15,500 BTC. This move positioned the company as the fifth-largest corporate holder of Bitcoin globally.

Meanwhile, two European firms also increased their Bitcoin reserves. France’s The Blockchain Group added $12.5 million worth of BTC, while the UK-based Smarter Web Company invested $24.3 million to strengthen its crypto treasury. Additionally, Japanese firm Remixpoint, listed on the Tokyo Stock Exchange, revealed plans to purchase 3,000 BTC after securing $215 million in fresh funding.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.