Highlights:

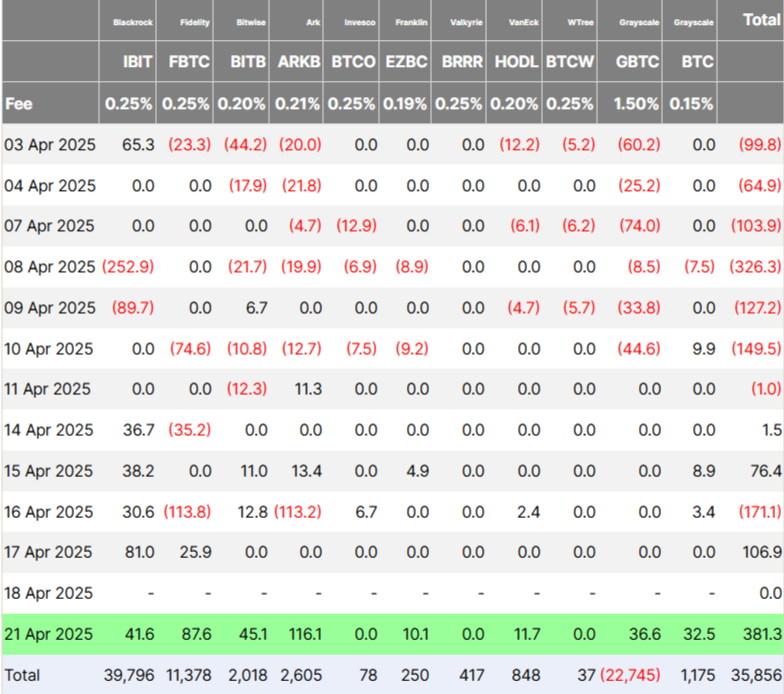

- Spot BTC ETFs record $381.3 million in net inflows, marking the largest since January.

- ARK 21Shares Bitcoin ETF led inflows with $116.1 million on April 21.

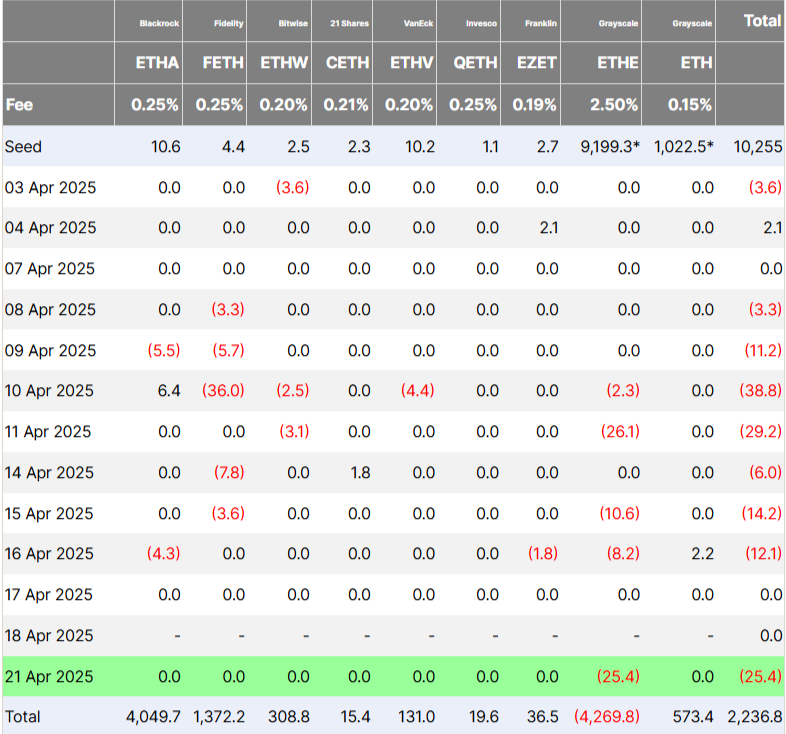

- Ethereum ETFs struggled with $25.42 million in outflows, extending an eight-week losing streak.

U.S. spot Bitcoin (BTC) exchange-traded funds (ETFs) saw $381.3 million in net inflows on April 21, as per data from Farside.This marked the biggest inflow day since January 30, when ETFs attracted $588.1 million, shortly after Bitcoin hit its near six-figure peak. The ARK 21Shares Bitcoin ETF (ARKB) led the way, adding $116.1 million.

On Monday, Fidelity’s Wise Origin BTC Fund (FBTC) recorded the second-largest inflow of the day, totaling $87.6 million. Meanwhile, Grayscale’s primary Bitcoin Trust and its Mini Trust ETF (BTC) combined for $69.1 million in net inflows.

Bitwise’s BITB brought in $45.1 million, followed closely by BlackRock’s IBIT with $41.6 million in inflows. VanEck’s HODL and Franklin Templeton’s EZBC posted modest yet noteworthy gains of $11.7 million and $10.1 million. Grayscale also contributed to the rise, with GBTC and its Bitcoin Mini Trust pulling in $36.6 million and $32.5 million, respectively.

The wave of inflows came after last week’s reversal of a two-week outflow streak. On Monday, total trading volume for the spot Bitcoin ETFs hit $3.75 billion, up from $1.55 billion on Thursday.

While Bitcoin ETFs have seen a strong rebound, Ethereum-focused funds are still struggling, facing $25.4 million in outflows this week. This extends their losing streak to eight consecutive weeks, with total outflows nearing $910 million.

Bitcoin Surges Amid Market Instability and Trump’s Criticism of Powell

The surge happened as Trump renewed his criticism of Powell. He posted on Truth Social, saying Powell’s “termination can’t come fast enough” after Powell suggested delaying interest rate cuts. Trump also hinted at a push for more aggressive monetary easing, with reports indicating his team is exploring legal options to remove Powell.

Simultaneously, escalating U.S.-China trade tensions and ongoing inflation worries have driven gold prices to new highs, with Bitcoin seeming to follow the trend. Investors are increasingly seeing both assets as safe havens amidst wider market instability.

U.S. markets reopened on April 21 with negative sentiment. The S&P 500 declined by 2.4%, while the Nasdaq and Dow both dropped by 2.5%. The U.S. dollar hit multi-year lows, shifting investor focus to alternative assets. Despite the equities downturn, crypto markets stayed strong. BTC surged above $88,500, with its market cap surpassing $1.75 trillion.

At the time of writing, BTC was trading at $88,516 reflecting a 1.29% increase in the past 24 hours. Meanwhile, Ether dropped 0.79%, settling at $1,630.

Ethereum Faces Challenges as ETH/BTC Ratio Reaches 5-Year Low and Key Metrics Drop

Ethereum continues to trail Bitcoin. The ETH/BTC ratio has dropped to 0.01787, its lowest since January 2020. This drop highlights Ethereum’s persistent struggle to keep pace with Bitcoin. Even after the Dencun upgrade, Ethereum’s performance remains weak. Network fees have fallen to multi-year lows, DeFi engagement is slipping, and rival chains like Solana and BNB Chain are attracting liquidity away.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.