Highlights:

- Spot Bitcoin ETFs recorded four straight days of inflows, led by BlackRock’s iShares BTC Trust.

- Rising BTC price, open interest, and ETF inflows signal strong bullish sentiment.

- Fidelity suggests Bitcoin rivals gold, highlighting similar Sharpe ratios and value potential.

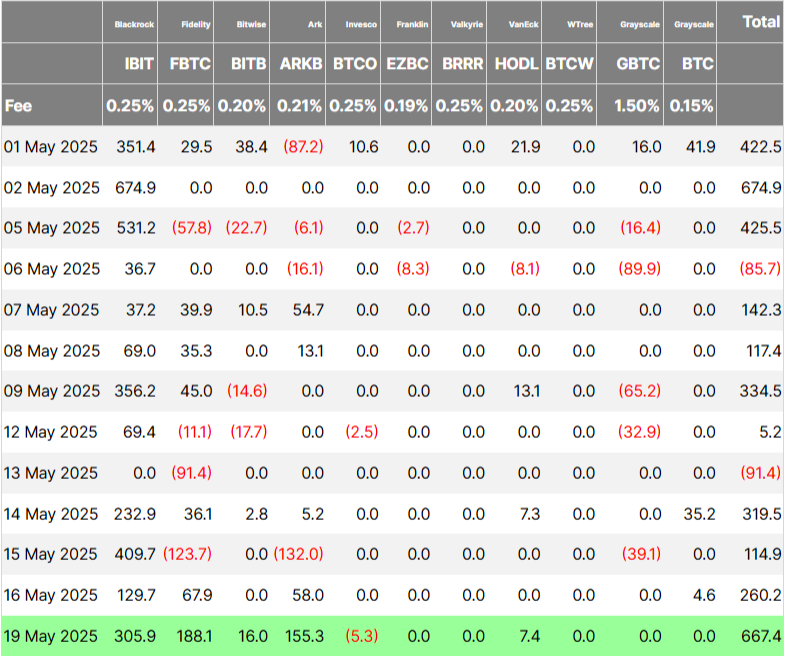

On Monday, US-listed spot Bitcoin (BTC) exchange-traded funds (ETFs) saw over $667.4 million in net inflows, marking their largest daily gain since May 2. It was the fourth consecutive day of positive inflows into these funds. This shows growing interest as the market starts to recover.

BlackRock’s iShares Bitcoin Trust (IBIT) led with a net inflow of $305.92 million, followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC) with $188.1 million. The ARK 21Shares Bitcoin ETF (ARKB) recorded $155.3 million in inflows, while Bitwise Bitcoin ETF (BITB) and VanEck Bitcoin ETF (HODL) saw inflows of $16 million and $7.4 million, respectively. Invesco Galaxy’s BTCO was the only ETF to record an outflow, totaling $5.3 million. The remaining five spot Bitcoin ETFs reported no inflows for the day.

Bitcoin Shows Strong Bullish Signals

The latest ETF inflows align with Bitcoin’s upward momentum. BTC is up 2.14% in the past 24 hours. It is currently trading at $105,342 with growing bullish sentiment. Futures open interest has also risen 1.5%, reaching a year-to-date high of over $68 billion. When an asset’s open interest rises alongside its price, it shows that new money is entering the market to support the upward move. This pattern reflects strong bullish sentiment among traders. It suggests confidence in the asset’s future gains. As a result, there is potential for a sustained rally in Bitcoin’s price.

Popular crypto analyst Benjamin Cowen suggests BTC may soon witness a “golden cross” formation, possibly within days. This development could indicate the likelihood of a major bullish move ahead.

#Bitcon golden cross should occur in a few days. Will probably make a video soon discussing this and looking back at historical moves following it pic.twitter.com/qRqIweAopD

— Benjamin Cowen (@intocryptoverse) May 20, 2025

Meanwhile, data firm CryptoQuant reports a rise in Bitcoin’s spot net volume delta (USD) on Binance, reflecting higher buying interest in the spot market. This suggests a drop in selling pressure, according to CryptoQuant. The boost in spot purchases is viewed as a positive sign for Bitcoin’s short-term price outlook.

BTC Could Be the Next Gold, Says Fidelity Executive

Fidelity’s Jurrien Timmer believes BTC has the potential to regain its role as a top store of value. He notes that Bitcoin’s Sharpe ratio closely aligns with that of gold. The Sharpe ratio compares the returns of an investment to its risk by measuring performance against a risk-free benchmark and its volatility. The chart displays weekly data spanning from 2018 through May 2025. It reveals that Bitcoin’s returns are gradually approaching those of gold.

After a strong run by gold, perhaps the baton is being passed again to Bitcoin, with Bitcoin back above $100k and the two Sharpe Ratios now converging. I still think a ratio of 4:1 (gold vs Bitcoin) makes sense in terms of how much gold vs Bitcoin might co-exist in a… pic.twitter.com/OivsxkDVJt

— Jurrien Timmer (@TimmerFidelity) May 16, 2025

Currently, gold’s relative value stands at $22.48, while Bitcoin’s is $15.95. Timmer advises maintaining a portfolio ratio of four parts gold to one part Bitcoin to help safeguard value. He finds it surprising that gold and BTC often move in opposite directions. He says BTC has a strong balance of risk and reward. Timmer believes there is no other asset like Bitcoin.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.