Highlights:

- US Bitcoin ETFs had $64.8M in inflows on August 22, led by IBIT.

- BlackRock’s IBIT now holds over 350,000 BTC, becoming the third-largest holder.

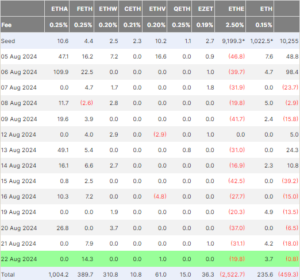

- Spot Ethereum ETFs saw $874,610 in outflows, a significant decrease from previous days.

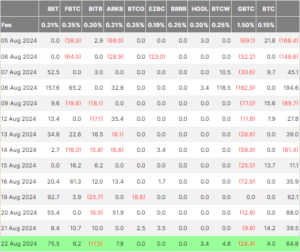

US-listed spot Bitcoin (BTC) exchange-traded funds (ETFs) reported $64.8 million in net inflows on August 22, extending their streak of positive flows to six days. According to Farside Investors, BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot bitcoin ETF by net assets, topped the list with approximately $75.5 million in net inflows.

Fidelity’s Bitcoin fund (FBTC) saw approximately $9 million in net inflows, while ARK Invest/21Shares’s Bitcoin ETF (ARKB) received nearly $8 million in new investment. WisdomTree’s Bitcoin fund (BTCW) followed this with $4.8 million, Grayscale’s Bitcoin Mini Trust (BTC with $4 million, and VanEck’s Bitcoin ETF (HODL) with $3.4 million in net inflows.

In contrast, Grayscale’s Bitcoin Trust (GBTC), which has the highest management fees among US spot Bitcoin products, experienced over $28 million in outflows on Thursday. Since its conversion into an ETF, GBTC has seen nearly $20 billion in withdrawals. Additionally, Bitwise’s BITB recorded $11.5 million in net outflows.

However, substantial outflows have eased in the past two weeks. GBTC’s withdrawals fell to nearly $10 million yesterday, marking the lowest outflow of the month. On Thursday, the total trading volume for the 12 spot bitcoin ETFs was $889.67 million, a substantial drop from the $1.42 billion recorded on Wednesday.

With GBTC’s outflow slowing and steady capital flowing into other competing Bitcoin ETFs, primarily BlackRock’s IBIT, US spot Bitcoin funds have seen consistent inflows for six straight trading days. These ETFs have recorded over $250 million in net inflows this week.

BlackRock’s Bitcoin Holdings Exceed 350,000 BTC

BlackRock’s aggressive Bitcoin acquisitions have raised its total holdings to over 350,000 BTC, according to data from IBIT’s website. This places the fund as the third-largest BTC holder globally, just behind Satoshi Nakamoto and Binance. BlackRock’s IBIT has attracted significant institutional interest from major firms such as Morgan Stanley and Goldman Sachs.

Blackrock owns over 350,000 Bitcoin ~20 billion dollars worth

Yet, some people still call crypto a scam

Giving it a few more years until Bitcoin becomes completely unaffordable to the middle class. >500k$ pic.twitter.com/PkXO0Uz7K5

— Mr. B♟️ (@mrBcryptooo) August 21, 2024

Last week, Morgan Stanley disclosed holdings of about $187 million in IBIT. Additionally, the bank has become the first major Wall Street firm to permit its financial advisors to recommend Bitcoin ETFs to select clients. Goldman Sachs also revealed a significant investment in US spot Bitcoin ETFs, including approximately $238 million in IBIT.

Spot Ether ETFs See Modest Outflows

Meanwhile, the nine spot Ethereum ETFs in the US saw $0.8 million in net outflows on Thursday, a significant decrease from the $18 million in outflows reported the previous day. The Grayscale Ethereum Trust (ETHE) maintained its trend of negative flows, experiencing $19.8 million in net outflows. It was the only spot Ethereum ETF reported outflows on the day.

Fidelity’s FETH saw the largest inflows, totaling $14.3 million. The Grayscale Ethereum Mini Trust (ETH) had $3.7 million in inflows, while VanEck’s ETHV recorded $1 million. The remaining five spot ETH ETFs reported no flows. The total daily trading volume for these Ether ETFs dropped to $93.87 million on Thursday, down from $201 million on Wednesday. At the time of writing, BTC was trading at $61,091, reflecting a 0.47% increase in the past 24 hours, while ETH rose 1.55% to $2,73, according to CoinMarketCap.