Highlights:

- Bitcoin ETFs surpassed $100 billion in assets, fueled by Bitcoin’s all-time high nearing $100,000.

- Stablecoin inflows hit a record high of $9.7 billion, signaling rising investor interest in crypto.

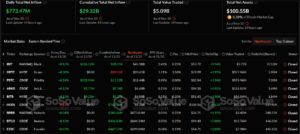

- Bitcoin ETFs saw $773 million in inflows, while Ethereum ETFs faced $30.29 million in outflows on Wednesday.

On November 20, the total assets of Bitcoin (BTC) exchange-traded funds (ETFs) in the United States reached $100.55 billion. BlackRock’s IBIT held $45.4 billion in net assets, while Grayscale’s GBTC held $20.6 billion, making them the largest spot Bitcoin ETFs. This milestone comes as Bitcoin hits an all-time high of $98,310, approaching the $100,000 mark.

Bitcoin ETFs See Surge in Inflows Amid Growing Optimism

Institutional data shows that Bitcoin ETFs saw a net inflow of $773 million on Wednesday. The momentum comes amid growing optimism about Bitcoin’s future. This optimism is fueled by improving regulatory clarity under President-elect Donald Trump, who has pledged to make the United States the “crypto capital of the planet.”

Most of the Nov. 20 inflows went to BlackRock’s IBIT ETF. It attracted $626.52 million in just one day. With this boost, IBIT’s total net inflows have surpassed $30 billion. This solidifies its position as the dominant player in the Bitcoin ETF market.

Other ETFs also saw significant inflows. Fidelity’s FBTC ETF received $133.94 million, while ARK and 21Shares’ ARKB and Bitwise’s BITB had smaller inflows of $9.25 million and $3.77 million, respectively. Data on Grayscale’s Bitcoin Mini Trust is unavailable, but other Bitcoin ETFs remained neutral. On Nov. 20, the total trading volume for Bitcoin ETFs reached $5.71 billion, up from $4.78 billion the previous day.

Ethereum ETFs Experience Outflows

In stark contrast to Bitcoin’s bullish momentum, spot Ethereum ETFs saw their fifth consecutive day of outflows on Nov. 20. A total of $30.29 million left the funds. Fidelity’s FETH led the outflows, losing $30.75 million. Grayscale’s ETHE followed with $16.29 million in outflows, bringing its total losses since launch to $3.29 billion.

Interestingly, BlackRock’s ETHA ETF defied the trend, attracting $16.74 million in inflows. Meanwhile, the other Ethereum-focused ETFs remained neutral.

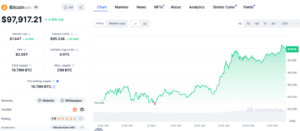

Bitcoin is steadily moving toward $100,000, currently priced at $97,917 after a 4.79% increase in 24 hours. Meanwhile, Ethereum remains stable at around $3,144, showing little movement. Investors are closely monitoring the market as Bitcoin continues to set new highs and solidify its dominance. With BTC surpassing $98K, the $100K milestone is within reach, and analysts predict BTC could double by year-end.

Stablecoin Inflows Hit Record High, Signaling Stronger Investor Interest

Stablecoin inflows to crypto exchanges hit a record high of over $9.7 billion, signaling rising investor interest. This surge could help Bitcoin reach $100,000 by the end of November.

According to Leon Waidmann, head of research at The Onchain Foundation, said:

“Stablecoin inflows to exchanges hit $9.7B in 30 days! The LARGEST monthly inflow EVER. Stablecoin liquidity is back. Speculative demand continues to explode!”

Rising stablecoin inflows to crypto exchanges may indicate increased buying pressure. Stablecoins are the main on-ramp for investors moving from fiat to crypto. Increasing stablecoin inflows can have a significant impact on Bitcoin’s price. Tether minted $1.3 billion worth of USDt from Aug. 5-9, as Bitcoin hit a five-month low of $49,500. This helped Bitcoin recover, surging 21% to $60,200 by Aug. 9.

Stablecoin inflows to exchanges hit $9.7B in 30 days!

The LARGEST monthly inflow EVER.🔥

Stablecoin liquidity is back.💵

Speculative demand continues to explod!📈 pic.twitter.com/9DQ5j6dCHK

— Leon Waidmann | Onchain Insights🔍 (@LeonWaidmann) November 21, 2024