Highlights:

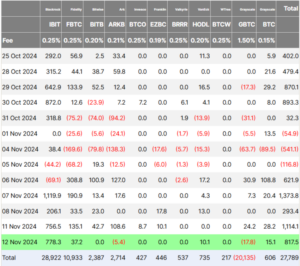

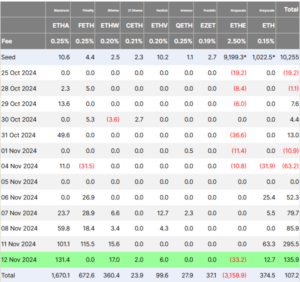

- Spot BTC ETFs saw $817.5 million in inflows, while ETH ETFs recorded $135.9 million.

- BlackRock’s iShares Bitcoin Trust and Ethereum Trust led inflows, with $778.3M and $131.4M.

- Trading volumes for Bitcoin and Ether ETFs were strong despite recent market pullbacks.

On November 12, United States-based Spot Bitcoin exchange-traded funds (ETFs) experienced $817.5 million in daily net inflows, according to the data from Farside Investors. The substantial inflows into Bitcoin ETFs occurred amid a broader crypto market rally. BTC hit new highs repeatedly in recent days following President-elect Donald Trump’s victory. The rally has paused, with Bitcoin dropping 1.53% in the last 24 hours, reaching $87,670 after briefly surpassing $90,000 on Tuesday. Ether also fell 7.14%, trading at $3,155.

On Tuesday, BlackRock’s iShares Bitcoin Trust (IBIT) led the inflows, with $778.3 million flowing into the product. IBIT’s total cumulative net inflow has reached approximately $28.92 billion. Fidelity Wise Origin Bitcoin Fund (FBTC) had the second-largest inflow, with $37.2 million.

Grayscale’s Mini Bitcoin Trust (BTC) and VanEck Bitcoin ETF (HODL) recorded inflows of $15.1 million and $10.1 million, respectively. On the other hand, Grayscale Bitcoin Trust (GBTC), the second-largest spot BTC ETF by net assets, saw $17.8 million leave the fund, while ARK 21Shares Bitcoin ETF (ARKB) recorded net outflows of $5.4 million. The remaining BTC ETFs did not experience any inflows or outflows on Tuesday.

The daily trading volume for the 12 spot bitcoin ETFs was $5.7 billion, down from $7.3 billion on Monday and $2.8 billion last Friday, according to SoSoValue data. Bloomberg analyst Eric Balchunas praised the success of Bitcoin ETFs, highlighting that their total assets under management have now exceeded $90 billion, reaching 72% of the asset levels held by gold ETFs.

Bitcoin ETFs have crossed $90b in assets, after yesterday's $6b jump ($1b in flows $5b in mkt appreciation).. they now 72% of the way to passing gold ETFs in assets. pic.twitter.com/7I3TMC8CfZ

— Eric Balchunas (@EricBalchunas) November 12, 2024

Ether ETFs Surge in Inflows with Strong Market Interest, BlackRock Leads

On November 12, the nine spot Ether ETFs saw $5.9 million in net inflows, the second-highest since launch, after a record $5 million inflow on November 11. This also marked the fifth straight day of inflows for ETH ETFs.

BlackRock’s iShares Ethereum Trust (ETHA) saw its second-largest inflow since launch, totaling $1.4 million. This came just behind the record $6.5 million inflow on July 23.

Bitwise Ethereum ETF (ETHW) saw inflows of nearly $17 million, while Grayscale Ethereum Mini Trust (ETH) recorded $12.7 million in inflows. Grayscale’s high-fee Ethereum Trust (ETHE) fund was the only Ether ETF to report negative flows, with $33.2 million leaving the fund. VanEck Ethereum ETF (ETHV) and 21Shares Core Ethereum ETF (CETH) saw inflows of $6 million and $2 million, respectively.

The trading volume for spot ether ETFs fell to $582.2 million on Tuesday, down from $913 million the previous day. However, Tuesday’s volume remains the second-highest since July 29. ETF Store President Nate Geraci noted on X that BlackRock’s fund ranked as a top-six ETF launch in 2024. With total inflows reaching $1.67 billion, it has not yet recorded a single net outflow day.

Spot eth ETFs now w/ net *positive* flows since launch…

Have overcome $3.2bil outflows from ETHE.

ETHA a top 6 ETF launch of 2024.

— Nate Geraci (@NateGeraci) November 13, 2024

In a Nov. 13 post on X, Geraci said that the intersection of crypto and ETFs is very interesting. He pointed out that it involves major asset managers, politicians, and regulators.

IMO, nothing more interesting in asset management right now than intersection of crypto & ETFs…

Involves largest asset managers, politicians, regulators, everyone.

Remember, ETFs simply a bridge for mainstream to access crypto.

Once that bridge fully built, no going back.

— Nate Geraci (@NateGeraci) November 13, 2024