Highlights:

- Bitcoin ETFs saw a $293.4 million inflow on Friday, while Ethereum ETFs followed with $85.9 million.

- BlackRock’s Bitcoin and Ethereum ETFs led with significant inflows, reflecting strong market interest.

- Trump’s election victory boosted Bitcoin’s market, driving ETF inflows and market activity.

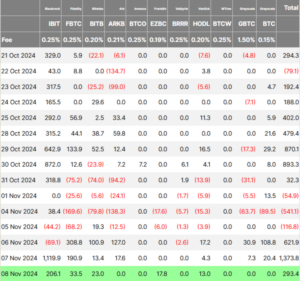

On November 8, US spot Bitcoin (BTC) exchange-traded funds (ETFs) saw a net inflow of $293.4 million, marking the third consecutive day of positive flows. This development highlights the increasing interest and investment in Bitcoin-based financial products following Trump’s victory in the 2024 US election.

On Friday, BlackRock’s iShares Bitcoin Trust ETF (IBIT) led with $206.1 million in net buying, followed by Fidelity Wise Origin Bitcoin Fund (FBTC) with $33.5 million. The Bitwise Bitcoin ETF (BITB) experienced $23 million in net inflows, while Franklin Bitcoin ETF (EZBC) recorded $17.8 million. Meanwhile, VanEck Bitcoin ETF (HODL) attracted $13 million.

On the other hand, Grayscale’s Bitcoin Trust (GBTC), WisdomTree Bitcoin ETF (BTCW), Valkyrie Bitcoin ETF (BRRR), Invesco Bitcoin ETF (BTCO), Grayscale’s Bitcoin Mini Trust ETF (BTC), and ARK 21Shares Bitcoin ETF (ARKB) reported no net inflow or outflow.

As of the latest report, the total net asset value of BTC ETFs is $78.908 billion. The net asset ratio, comparing the market value of ETFs to Bitcoin’s total market value, stands at 5.21%. The cumulative historical net inflow for Bitcoin spot ETFs has reached over $25.8 billion, highlighting sustained interest and investment.

After Trump’s election win, Bitcoin saw more activity, with BTC hitting a new ATH of $77,239. Investors expect favorable crypto policies, and his win has paved the way for several crypto ETFs awaiting approval.

BlackRock’s BTC ETF Surpasses Gold ETF in Assets After Trump’s Election Victory

Two days after Donald Trump’s election, BlackRock’s Bitcoin ETF (IBIT) surpassed its Gold ETF (IAU) in assets under management. As of Thursday’s market close, IBIT reached $33.1 billion, overtaking IAU, which held $32.9 billion. By Friday’s close, BlackRock’s Bitcoin ETF (IBIT) had reached $34.3 billion in net assets, while IAU’s assets remained unchanged. IBIT amassed over $10 billion in assets within just two months, a milestone the first gold ETF took nearly two years to reach.

iShares Bitcoin ETF (IBIT) has now surpassed iShares Gold ETF (IAU) in assets…

Did this in 10mos.

IAU launched in January 2005.

Absolutely wild. pic.twitter.com/dLi16A28Gc

— Nate Geraci (@NateGeraci) November 8, 2024

The success of Bitcoin ETFs over gold ETFs is notable, as gold has been a traditional safe-haven asset. The growing interest in Bitcoin signals a shift, with more people viewing it as an alternative or complement to gold. André Dragosch, Bitwise’s European research head, highlighted that Bitcoin ETF inflows have outpaced gold ETFs by over 10 times in their first year.

Gold vs Bitcoin.

ETF inflows into Bitcoin are literally off the chart since trading launch and more than 10 x times bigger than Gold in Year 1.

Bitcoin plays in a totally different league imo. pic.twitter.com/JoyR5779Lq

— André Dragosch, PhD | Bitcoin & Macro ⚡ (@Andre_Dragosch) November 8, 2024

Ethereum ETFs See $85.9 Million Inflow, Highest Since August

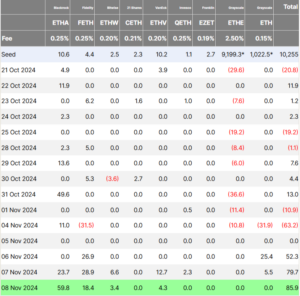

US-based spot Ethereum (ETH) ETFs saw a net inflow of $85.9 million on November 8, according to the data from Farside Investors. BlackRock’s iShares Ethereum Trust (ETHA) recorded $60.3 million in inflows. This is the highest since August 6, when it saw $109.9 million. The notable inflow occurred as Ether’s price hovered near $3,000 for the first time since August.

Meanwhile, the Fidelity Ethereum Fund (FETH) recorded $18.4 million in daily inflows, the VanEck Ethereum Fund (ETHV) saw $4.3 million, and the Bitwise Ethereum ETF (ETHW) experienced $3.4 million in inflows. Other ETH ETFs recorded no flows on Friday.