Highlights:

- Spot Bitcoin and Ethereum ETFs recorded losses on January 13 to extend their outflows streak.

- $284.19 million left BTC ETFs, while ETH ETFs forfeited $39.43 million.

- Institutional investors continue to show strong faith in Bitcoin with consistent token acquisitions.

After experiencing losses on the last trading day of the previous week, a new week has begun with Bitcoin (BTC) and Ethereum (ETH) Exchange Traded Funds (ETFs), extending their losses streak. Bitcoin ETFs extended their outflow trend to the third straight day, while Ethereum funds witnessed their fourth consecutive day of losing money.

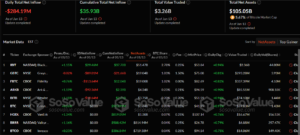

According to the popular on-chain ETF tracker, SosoValue, Bitcoin ETFs let out $284.19 million on January 13. The net outflow was led by Fidelity Bitcoin ETF (FBTC). FBTC recorded the only losses above $100 million with its $113.64 million cash outflows.

On January 13, the total net outflow of Bitcoin spot ETFs was $284 million. The Bitcoin spot ETF with the largest net inflow yesterday was BlackRock ETF IBIT, with a net inflow of $29.4646 million. https://t.co/59u0BnEqLG pic.twitter.com/semf38ojcs

— Wu Blockchain (@WuBlockchain) January 14, 2025

Aside from FBTC, ARK 21Shares Bitcoin ETF (ARKB), Grayscale Bitcoin ETF (GBTC), and Bitwise Bitcoin ETF (BITB) experienced losses. They forfeited $92.36 million, $89.01 million, and $18.64 million, respectively.

Notedly, the only cash inflows came from BlackRock Bitcoin ETF (IBIT). IBIT gained $29.46 million, while the remaining seven ETFs had neither inflows nor outflows. As expected, yesterday’s losses dropped Bitcoin ETF cumulative net inflows from $36.22 billion to $35.93 billion. Similarly, the total value traded reduced from $3.26 billion to $3.17 billion, while the total net assets depreciated from $107.64 billion to $105.05 billion.

Unimpressive ETFs Trend Draws Bitcoin’s Price Concerns

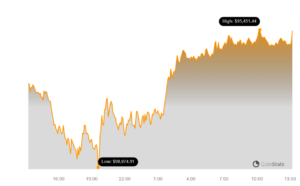

At the time of writing, Bitcoin is up by about 2.25% and trading at approximately $95,500. While the token’s current selling price might seem encouraging, it is worth noting that BTC plummeted below $90,000 in the past 24 hours. Therefore, it shouldn’t be surprising if market participants raise concerns about BTC’s possible price decline

According to CoinGecko’s statistics, BTC 24-hour-to-date price change data reflected minimum and maximum prices, ranging between $89,800.03 and $95,443.55. Moreover, based on its current price, Bitcoin’s market capitalization recovered slightly as it now boasts a $1.878 trillion valuation. Its 24-hour trading volume is up by 159.58%, with a $72.26 billion worth.

Bitcoin’s Institutional Interests Remain Strong

Despite Bitcoin’s shaky price movements, institutional investors have remained significantly bullish on the digital assets. Notably, MicroStrategy, the largest corporate holder of Bitcoin, announced yesterday that it expanded its BTC holdings.

The business intelligence platform purchased 2,500 BTC, increasing its total Bitcoin holdings to 450,000 tokens. Notedly, yesterday’s acquisition marked MicroStrategy’s tenth consecutive weekly Bitcoin procurement, highlighting strong faith in BTC.

Like MicroStrategy, health-care-based firm Semler Scientific also announced its Bitcoin purchase yesterday. According to Semler Scientific’s founder’s tweet, the company bought 237 BTC valued at about $23.3 million. The latest purchase cost the healthcare firm $98,267 per BTC. Following the new acquisition, Semler Scientific’s total Bitcoin stores increased to about 2,321 tokens, worth $191.9 million.

Semler Scientific has acquired 237 BTC for ~$23.3 million at ~$98,267 per #bitcoin and has generated BTC Yield of 99.3% since adopting our BTC treasury strategy in May 2024. As of 1/10/2025, we held 2,321 $BTC acquired for ~$191.9 million at ~$82,687 per bitcoin. $SMLR

— Eric Semler (@SemlerEric) January 13, 2025

Spot Ethereum ETFs Record Reduced Activeness

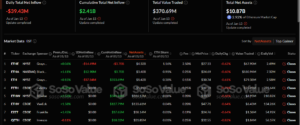

On January 13, only three out of nine Ethereum ETFs were active as the funds succumbed to a $39.43 million net outflow. Among the active ETFs, only BkackRock Ethereum ETF (ETHA) witnessed gains by attracting $12.90 million.

The two Grayscale Ethereum ETFs were the other active funds. The mini version (ETH) lost $37.84 million, while ETHE forfeited $14.49 million. Should the present trend persist, chances abound that the ETFs will conclude the week with another weekly net outflow.

Moreover, following yesterday’s losses, Ethereum ETFs’ cumulative net inflows plunged from $2.45 billion to $2.41 billion. The total value traded increased from $370.70 million to $489.22 million, while the total net assets reflected a $10.87 billion valuation.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.