Highlights:

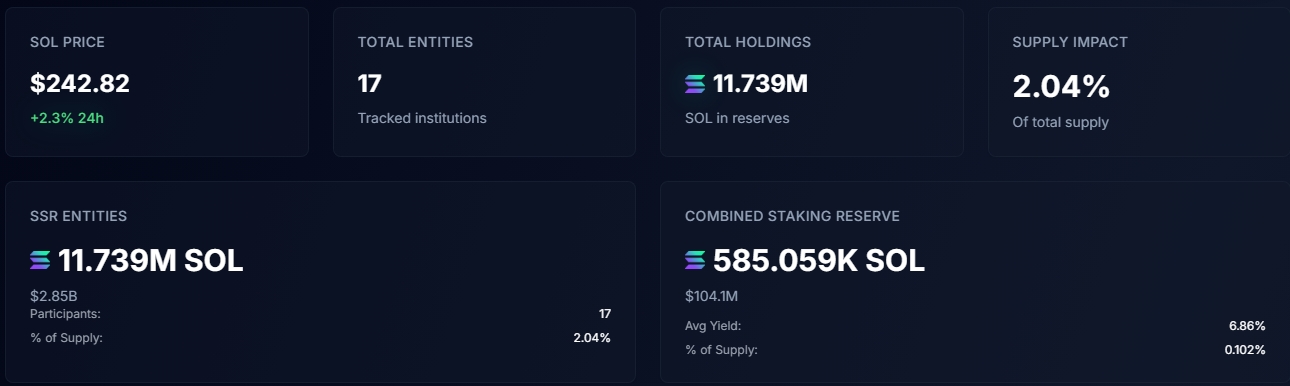

- Solana treasury holdings reach $2.85 billion as 17 companies acquire 11.739 million SOL tokens.

- The number of acquired SOL represents 2.04% of the token’s circulating supply.

- Public companies own the highest SOL Treasuries with over 6 million tokens.

SSR data has revealed that 17 firms currently own Solana (SOL) strategic treasuries valued at $2.85 billion. According to the tracking platform, these companies have amassed 11.739 million SOL, representing 2.04% of the token’s circulating supply.

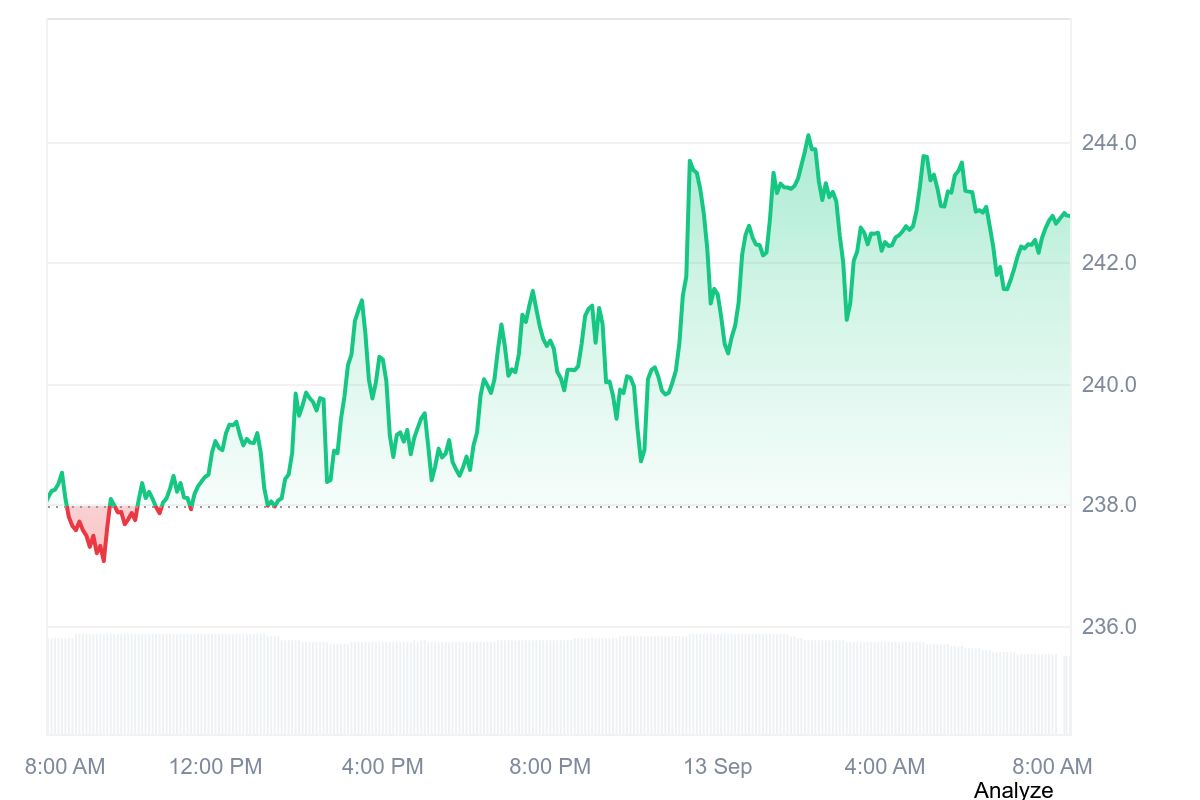

SSR data also showed that 585.059K SOL of the total acquired tokens were staked. Worth $104.1 million, the staked tokens represented 0.102% of SOL’s circulating supply with a 6.86% average yield. Meanwhile, over the past seven days, Corporate SOL holdings have spiked significantly.

For context, firms acquired 11.02 million SOL on September 6. The figure increased to 11.12 million SOL and 11.279 million SOL on September 7 and 8, respectively. By September 11 and 12, the number of purchased SOL tokens reached 11.651 million and 11.777 million, respectively. These figures underscore strong institutional interests in Solana’s long-term potential as a sustainable store of value.

Companies with SOL Treasuries Ranking

Over the past few months, institutional interest in Solana has recorded a remarkable spike. From public companies and digital asset firms to biotech outlets and miners, diverse institutional investors have accumulated significant SOL tokens.

Public companies occupied the top three spots, with each holding over 2 million SOL tokens. Sharps Technology Inc. has the highest SOL holdings, valued at about $517.4 million for 2.14 million SOL tokens. DeFi Development Corp followed closely in second spot. The company owns 2.028 million SOL worth $490.3 million, with 158.886K staked tokens. Upexi Inc. ranked third with 2 million SOL valued at about $483.2 million.

Top @solana Treasury Companies from @ReserveSolana

Note: @defidevcorp moves past @UpexiTreasury into #2 with 2.028m $SOL. pic.twitter.com/5ffddm9sHw

— MartyParty (@martypartymusic) September 5, 2025

Other companies with over 1 million SOL in their treasuries included Forward Industries, a corporate treasury firm; Galaxy Digital Inc., a digital assets company; Mercury Fintech, another corporate treasury; and Ispecimen Inc., a healthcare services provider. They own 1.45 million SOL, 1.35 million SOL, 1.083 million SOL, and 1 million SOL, respectively. Sol Strategies Inc. possesses the highest amount of staked tokens. It has 433.319K SOL worth $104.7 million in its treasury with 426.173K tokens staked.

Other companies with over 10K SOL holdings include Classover Holdings Inc., Artelo Biosciences, Sol Global Investments Corp, Torrent Capital Ltd., BIT Mining Limited, ALALO, and DeFi Technologies Inc. They own 61.048K SOL, 45.883K SOL, 40.350K SOL, 40.039K SOL, 27.19K SOL, 15.564K SOL, and 12.775K SOL, respectively. Notably, two other companies hold less than 10K SOL. They include Neptune Digital Assets Corp, with 9.573K SOL, and MemeStrategy Inc., with 2.440K SOL.

Have you wondered why $SOL is pumping lately? It's not just memes or DeFi hype, it's the treasury boom. Public companies are stacking SOL like it's the new corporate gold standard. Let's break down Solana treasuries and why they're a game-changer for the market.

— Trading Tank (@TheTradingTank) September 13, 2025

Accumulation Efforts Soar as Firms Rally to Expand Their Solana Treasury Holdings

On September 13, renowned crypto transactions tracker Lookonchain reported that Galaxy Digital acquired almost 5 million SOL tokens within three days. The on-chain tracker also noted that a significant portion of the purchased tokens were moved to Coinbase Prime.

Lookonchain stated:

“Galaxy Digital has bought nearly 5M SOL ($1.16B) in the past 3 days, of which 4,719,937 SOL ($1.11B) has been moved to Coinbase Prime for custody. And their wallet still holds 219,830 SOL ($53.5M).”

On September 12, Crypto2Community reported that Upexi and BIT Mining added to their SOL stash. According to the publication, Upexi bought almost 18,000 SOL, while BIT Mining secured 17,221 tokens. Meanwhile, Forward Industries recently closed a PIPE financing round, raising $1.65 billion to expand its Solana treasury.

SOL’s Price Records Slight Upswing

Solana reacted to the growing accumulation with a 2% upswing in the past 24 hours. The fifth most valuable cryptocurrency, with a $131.37 billion market cap, is changing hands at $242.16, with high supply inflation at 16%, high volatility at 6.43%, and a bullish sentiment.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.