Highlights:

- SharpLink starts massive $1.5 billion stock buyback and has already repurchased 939,000 shares.

- The investment firm believes its shares are undervalued and has made efforts to restore the stock valuation.

- SharpLink Gaming noted that it would continue buying the shares with funds realised from different sources.

The largest corporate holder of Ethereum (ETH), SharpLink Gaming, has officially kicked off its $1.5 billion share buyback program, as disclosed in the company’s press release on September 9, citing confidence in its ETH holdings. According to the announcement, SharpLink has already completed 939,000 shares buyback at an average cost of $15.98 per share.

The company plans to repurchase more shares if market conditions remain favourable. It also stated that capital for the buybacks will come from available cash and proceeds from operations, including staking and other financing sources.

SharpLink always acts in the best interest of its stockholders.

In today’s market, the most accretive action is to repurchase our common stock to drive long term stockholder value.

We’re fully committed to being the most transparent treasury with institutional grade discipline.… https://t.co/qUB9mZ9E86

— Joseph Chalom (@joechalom) September 9, 2025

SharpLink Expresses Confidence in its Shares’ Buyback Exercise

SharpLink Gaming raised considerable concerns about shares’ undervaluation, noting that it plans to restore value and regain investors’ confidence through its stock buyback programs. The company also stated that it will not issue new shares if its stock continues to trade below the company’s net asset value (NAV), as it will weaken the value of existing investors’ stake in its Ethereum holdings.

Joseph Chalom, one of SharpLink Gaming’s Chief Executive Officers, stated:

“We believe the market currently undervalues our business, and rather than issue equity while trading below NAV, we are focused on disciplined capital allocation – including share repurchases – to increase stockholder value.”

Notably, the company might consider issuing shares through its at-the-market (ATM) facility if market conditions improve, with SharpLink stock rising above its NAV to benefit shareholders.

The Co-CEO added:

“Maximising stockholder value remains our top priority as we execute on our vision of being the most trusted ETH treasury company in the market.”

SharpLink Robust ETH Holdings

Aside from the shares’ buyback, SharpLink Gaming disclosed its latest ETH holdings data. Currently, the company holds a massive stash of Ethereum, valued at $3.6 billion. With all ETH tokens staked for passive income generation, SharpLink has maintained a debt-free balance sheet, underscoring good management policies.

CoinGecko showed that SharpLink Gaming ranked second among the 11 public companies with an Ethereum strategic reserve. According to the ranking platform data, BitMine remains the largest holder of Ethereum with over two million tokens worth roughly $8.9 billion, while SharpLink holds 837,230 ETH, valued at about $3.6 billion.

In the past thirty days, SharpLink Gaming completed five purchases, adding 314,362 ETH to its treasury. Within the same timeframe, BitMine bought 1,236,306 ETH, over 300% more than the total tokens SharpLink purchased, which reflects strong faith in ETH’s long-term reward potential.

NEW: SharpLink begins utilizing its $1.5B share buyback program, repurchasing ~1M shares of $SBET.

We believe our stock is significantly undervalued. Buying back stock at NAV < 1 is immediately accretive and compounds long-term stockholder value.

Key facts:

– $3.6B of $ETH on… pic.twitter.com/Wr0WEYLqlb

— SharpLink (SBET) (@SharpLinkGaming) September 9, 2025

ETH Slips Slightly as SharpLink Starts $1.5B Stock Buyback

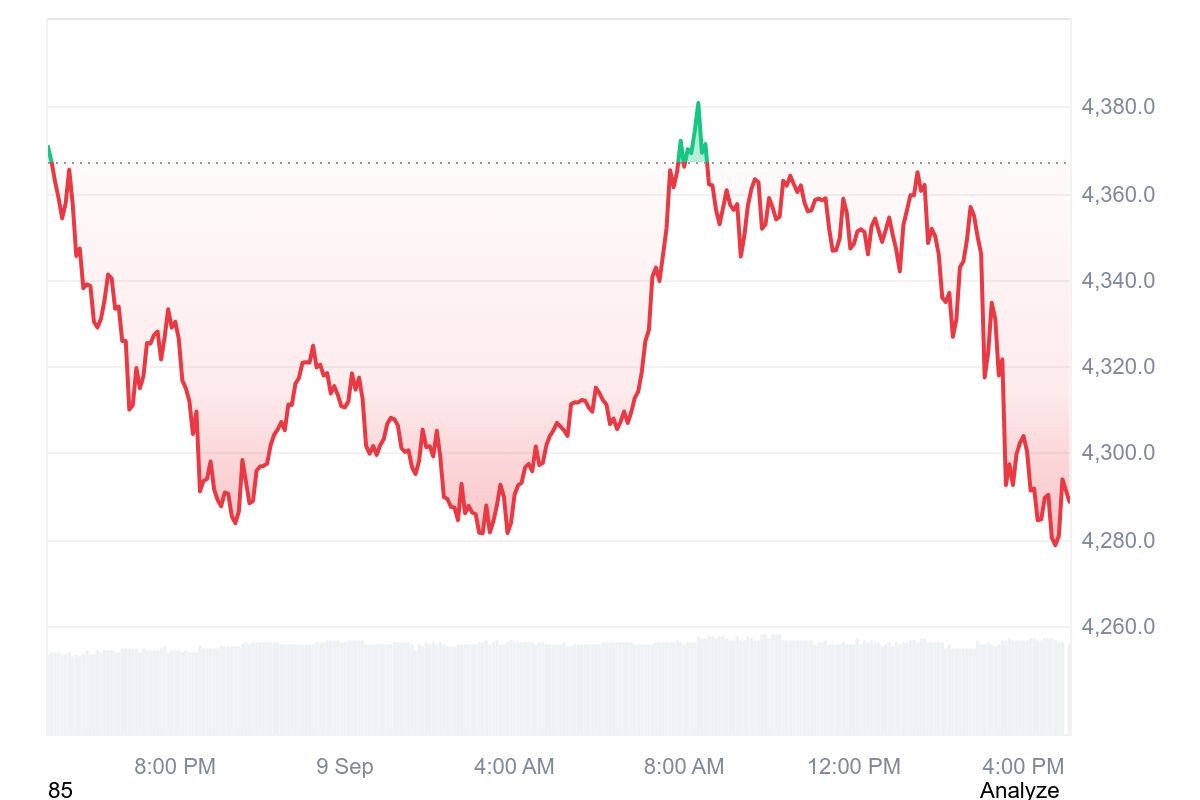

At the time of writing, ETH’s price is down 1.9% in the past 24 hours. It is changing hands at $4,288.90, with price extremes fluctuating between $4,279.58 and $4,378.82. Ethereum’s long-term data, including its 7-day-to-date and 14-day-to-date variables, showed declines of about 1.9% and 3.8%, respectively. However, its month-to-date and year-to-date data spiked 2.8% and 84.8%, respectively.

Coincodex’s data showed Ethereum’s 24-hour trading volume ranked second at $37.95 billion. Its supply inflation is low at 0.32%, with a 13.43% dominance, while its volatility is medium at 3.43%. Sentiment and “Fear and Greed Index” reflected neutral.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.