Highlights:

- The price of Sei surges 8% to $0.20 in 24 hours, as daily trading volume is up 78%.

- Wyoming Stable Token Commission selects Sei for WYST stablecoin.

- Traders show bullish sentiment, aiming for a breakout above $0.21.

As of 20 June, the Sei price has shown a splendid bullish outlook, surging 8% to the $0.20 mark in the past 24 hours. Its daily trading volume has notably soared 78%, upholding intense market activities. This comes as the Wyoming Stable Token Commission has chosen the Sei Network to be one of the possible blockchains to utilize the new proposed WYST stablecoin. This is a major step forward in Sei since the project becomes a contender in the state-backed stablecoin powering the state of Wyoming.

Sei Network has been selected by the Wyoming Stable Token Commission as a candidate blockchain for WYST 🇺🇸

WYST is the first fiat-backed stablecoin issued by a U.S State and will be deployed using @LayerZero_Core.

The updated candidate list is publicly accessible on The… pic.twitter.com/a2PV26bHyR

— Sei 🔴 (@SeiNetwork) June 19, 2025

Wyoming is leading the pack in the area of blockchain, with the state choosing Sei Network as a candidate blockchain for WYST. The choice of Sei as the blockchain is to provide a high-performance, scalable, and efficient network for digital assets.

Sei Price Struggles Near Key Resistance

Sei price is moving in an upward direction, as the bulls aim for a breakout above the falling wedge pattern. Despite the 8% surge in the past 24 hours, the bulls still need to overcome the $0.21 resistance mark for a potential upside move. The daily chart outlook showcases a bullish sentiment, with the bulls attempting to take total reins.

The Relative Strength Index (RSI) is 54.98, which indicates that Sei is in a neutral state. However, its position above the 50-mean level shows that the bulls have the upper hand. Moreover, there is still more room for the upside before the RSI spills into the 70-overbought territory.

Furthermore, the Moving Average Convergence Divergence (MACD) indicator is also moving in the positive direction and supports the bullish sentiments towards Sei on a short-term basis. Traders are at liberty to buy more SEI tokens, unless the momentum indicator changes.

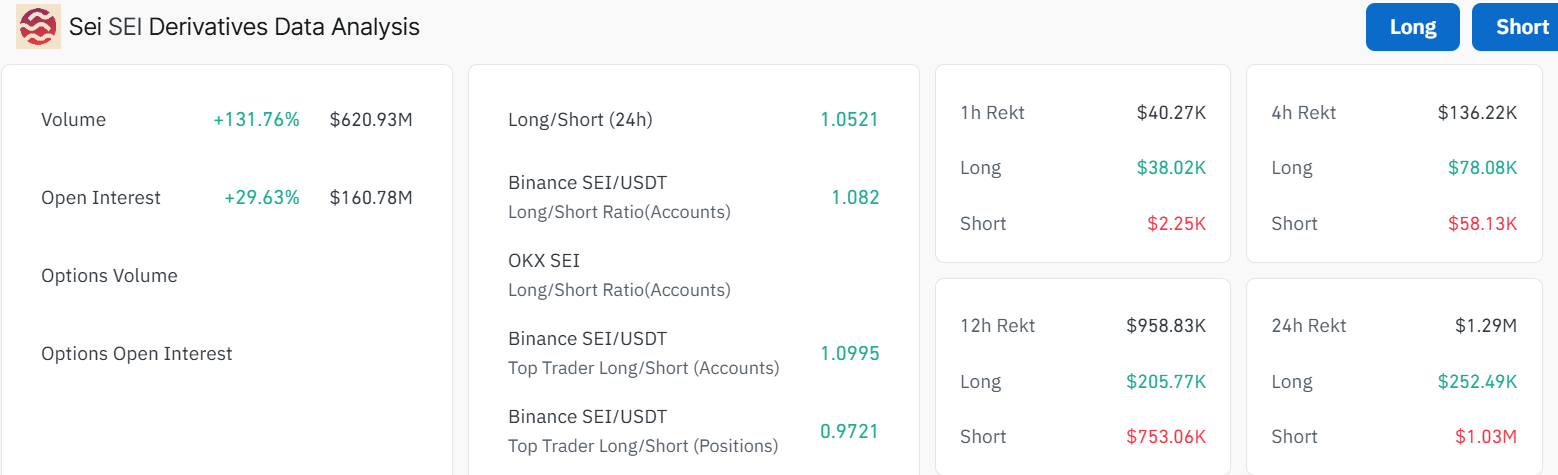

The volume of trade and open interest in Sei are also bullish, reinforcing the positive outlook and a potential breakout. Sei is currently drawing a lot of marketplay with an increment of 137% recorded in volume of $620 million. Since the open interest surged 29%, traders are even placing bets on a further increase in the Sei price.

On the other hand, the optimistic outlook is justified by the long/short ratio equal to 1.0521. This means that a larger number of traders occupy long positions because they are anticipating an additional price rise.

Sei Bulls Aim for a Breakout to $0.25 in the Short Term

Zooming out on the Sei price analysis, the bulls are showing strength, as they aim for a breakout above the falling wedge pattern. In the meantime, the bulls need to overcome the $0.21 barrier to continue with the upside movement. A close above this area will open the doors towards $0.23 and $0.25 in the short term. However, if the bulls maintain the breakout momentum, they could target $0.8 – $1 in the medium term.

On the flip side, if the $0.21 resistance proves too strong, the $0.19 safety net will act as the immediate support. If this level gives way, more downside could be expected towards $0.17, $0.16, and $0.15 support areas, before the bulls regroup for another rally.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.