Highlights:

- SEC ends investigation into Paxos BUSD with no enforcement action.

- Court ruling favoring Binance influenced SEC’s decision on BUSD.

- Paxos’ stablecoins are backed by US dollar reserves, ensuring customer asset safety.

The US Securities and Exchange Commission (SEC) has concluded its investigation into Paxos Trust Company regarding its Binance USD (BUSD) stablecoin. The SEC has decided not to pursue any enforcement action against Paxos, providing much-needed clarity and relief for the company and the broader stablecoin market.

“Paxos prevails in SEC investigation of BUSD stablecoin” 👏

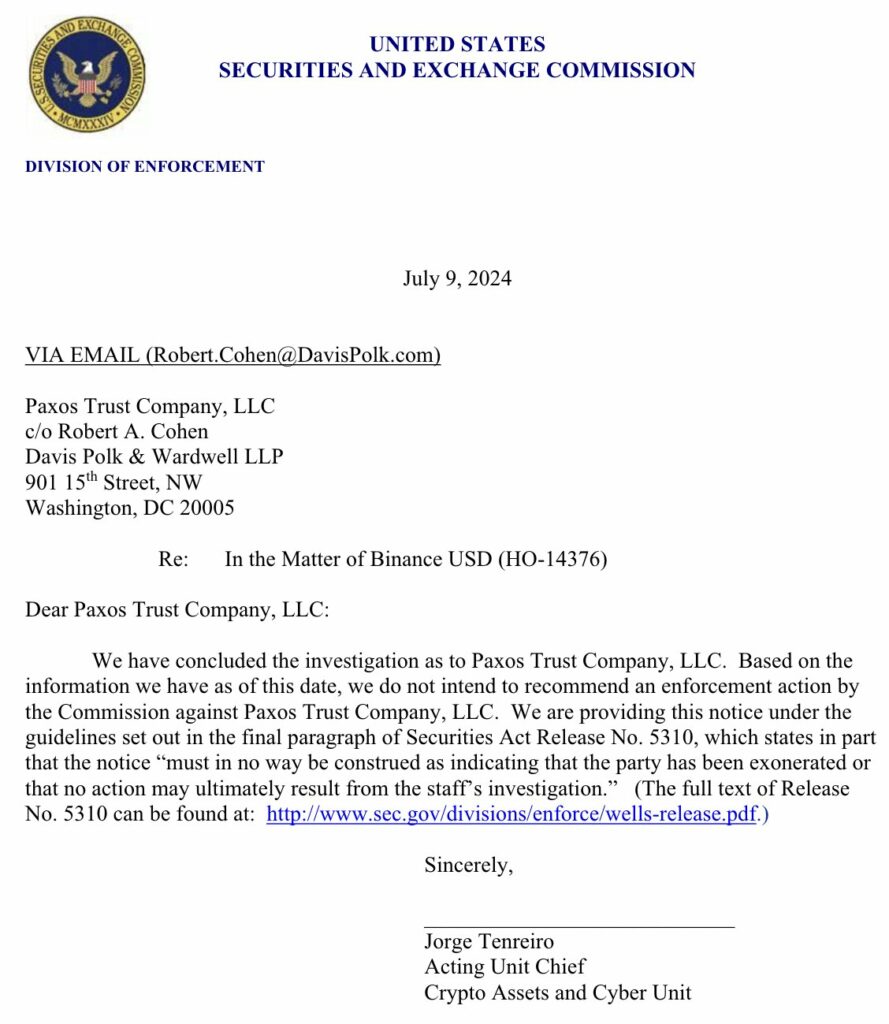

On Tuesday, we received a formal termination notice from the SEC stating that it will not recommend enforcement action against Paxos Trust Company in the investigation of Binance USD (BUSD).

View the letter and our… pic.twitter.com/8kjysfsPg3

— Paxos (@Paxos) July 11, 2024

SEC Concludes Paxos Probe Without Charges

Jorge Tenreiro, the acting chief of the SEC’s crypto assets and cyber unit, stated that the SEC informed Paxos on July 9. Moreover, it would not recommend enforcement action. This decision follows over a year of scrutiny after Paxos received a Wells notice from the SEC in February 2023. The notice suggested that the SEC might take action, alleging that BUSD was an unregistered security.

Paxos has consistently maintained that BUSD is not a security under federal law. Additionally, BUSD is a dollar-backed stablecoin issued in partnership with Binance. The SEC’s decision to end the investigation without charges aligns with a recent federal court ruling. On June 28, a judge ruled that BUSD sales were not a securities offering. Consequently, this led to the dismissal of related charges against Binance.

In a victory for the industry, a US federal court dismissed several #SEC claims against #Binance, ruling that:

1) Crypto tokens are not securities,

2) BNB sales on secondary exchanges were not adequately alleged to be securities,

3) BUSD is not a security.Read more ⤵️…

— Binance (@binance) July 2, 2024

Legal Win Boosts Stablecoin Clarity

The SEC’s decision to drop the case against Paxos has broader implications for the stablecoin market. Walter Hessert, head of strategy at Paxos, expressed relief over the resolution, stating,

The termination of this investigation formally is an enormous relief for us. It’s what we expected all along, and it should hopefully create more certainty in the market among what we see as a growing number of large enterprises.

This conclusion is seen as a victory for Paxos and the cryptocurrency industry. Consequently, it offers regulatory clarity that could foster further stablecoin adoption. The stablecoin market has grown significantly, with traditional finance firms like PayPal and VanEck entering the space. The SEC’s decision could pave the way for more robust regulatory frameworks, ensuring stablecoin security and consumer protection.

The SEC’s investigation had created uncertainty, impacting Paxos’ ability to secure new agreements and partnerships. Despite these challenges, Paxos continued to advocate for the legitimacy and safety of its USD-backed stablecoins. In addition, the company’s stablecoins are backed 1:1 with dollar-denominated reserves, fully segregated, and held in bankruptcy-remote accounts.

SEC’s Impact on BUSD

In three years, BUSD had surged to a $23 billion market cap thanks to its vital role in the Binance ecosystem. However, BUSD’s market cap plummeted to under $100 million after the SEC’s intervention. The SEC’s actions against BUSD and its issuer, Paxos, have sparked significant outrage within the crypto community.

Prominent figures are calling for accountability. Ran Neuner, the founder of Crypto Banter, voiced his frustration: “HOW IS THIS OK????… The SEC literally destroyed a business that had over $20bn in TVL and was making over $1bn by forcing the issuer to shut it down, to only then drop the case after it was dead!!!!!!”

The end of the SEC’s investigation into Paxos marks a key moment for the cryptocurrency industry. It underscores the need for clear regulatory guidelines and offers a blueprint for future stablecoin issuers. Paxos’ success in navigating this regulatory challenge reinforces its position as a leading blockchain and tokenization infrastructure player.