Highlights:

- The United States SEC has acknowledged Grayscale’s Spot Cardano ETF filing.

- Admitting the recipient of the ETF application implies that an eventual rejection of approval is edging closer.

- Market participants speculated that the ETF approval will be bullish for ADA.

According to a February 24 filing, the United States Securities and Exchange Commission (SEC) has acknowledged Grayscale’s spot Cardano Exchange Traded Fund (ETF) application. As usual, the regulatory watchdog called for public opinions on the ETF from market participants in the latest filing.

The new development comes a few days after Crypto2Community reported that the New York Stock Exchange (NYSE) Arca, a subdivision of the larger NYSE Group, submitted a 19b-4 application requesting a spot Cardano ETF on behalf of Grayscale. It is worth noting that the 19b-4 application was presented to the SEC on February 10, which invariably implies that the regulatory body needed only 14 days to admit the recipient of the filing.

Like several other ETF applications that gained the SEC’s recognition, the new development implies that Cardano’s eventual ETF approval or rejection by the SEC is drawing closer. Based on previous ETF filings from the SEC, the window for public opinions will last for a few days, with 21 days as a maximum upper limit.

The SEC has confirmed that Grayscale has filed for a spot Cardano ETF. Cardano is an open-source, decentralized public blockchain platform that uses the PoS consensus mechanism, founded by Ethereum co-founder Charles Hoskinson. https://t.co/e1XLY9q14J

— Wu Blockchain (@WuBlockchain) February 24, 2025

Latest Development Implications

After the window for public opinions elapses, the next step entails moving the application to the Federal Register, which would mark the beginning of a 240-day countdown that will precede the ETF’s approval or rejection by the SEC. Moreover, Cardano’s 19b-4 application acknowledgment implies that the digital asset has joined cryptocurrencies that would likely score ETF approval in 2025. Other digital assets in this category include XRP, Dogecoin (DOGE), and Litecoin (LTC).

In fact, among the digital assets above, XRP seems to have taken the front foot as it has been confirmed that its application landed in the Federal Register on February 21, marking the beginning of its 240-day timeline. Hence, it suggests that an approval or a rejection would happen on or before October 18.

Grayscale’s Spot Cardano ETF will be ADA’s Positive Turning Point

Designed to expose traders to regulated Cardano investments, the proposed ETF will track the price of ADA and allow investors to trade Grayscale’s Cardano Trust shares. The shares in the Trust will represent equal interests in its ADA holdings.

By embracing ETF investments, traders will circumvent the conventional method of buying and holding digital assets as individual investors. This investment method attracts lesser risks and is gradually becoming a trend, as evidenced by the massive capital inflows recorded by Bitcoin and Ethereum ETFs following their approvals last year.

Meanwhile, market participants perceived a Cardano ETF as a bullish catalyst for Cardano’s native token, ADA. Many have speculated that the ETF will add liquidity, attract institutional investors, and give ADA legal recognition. Overall, the ETF will edge ADA closer to mainstream adoption and guarantee its long-term survival amid stiff competition.

Cardano Record Significant Price Declines Despite Positive News

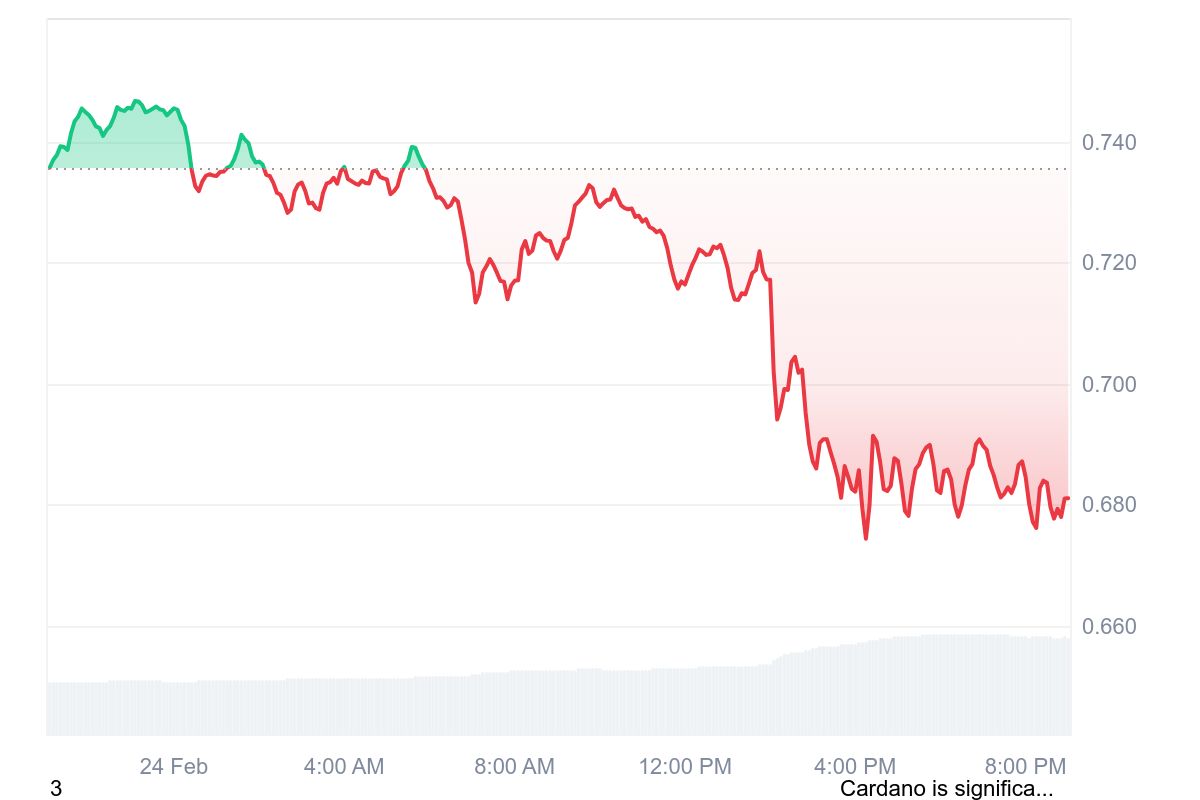

At the time of press, ADA is priced at about $0.68, reflecting a 7.4% decline in the past 24 hours. Within the same timeframe, the digital asset has oscillated between minimum and maximum prices of $0.67 and $0.75, respectively. Aside from its short-period price change variable, other extended periods reflected losses.

For context, ADA’s 7-day-to-date, 14-day-to-date, and month-to-date statistics displayed 15.8%, 13%, and 31.1% declines, respectively. Following the declines, ADA’s market cap dropped to about $24.3 billion. Despite the poor market outlook, ADA’s 24-hour trading volume surged by about 84.23% and has a $1.02 billion valuation.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.