Highlights:

- The United States SEC has acknowledged the recipient of Canary Capital’s XRP ETF filing.

- In a new filing, the regulatory body called for public opinions from market participants.

- The window for comments on the XRP ETF application will last for 21 days.

According to a February 19 filing, the United States Securities and Exchange Commission (SEC) has acknowledged the spot Exchange Traded Fund (ETF) proposal from CBOE BZX Exchange on behalf of Canary Capital. The regulatory body acknowledgment comes a few days after CBOE BZX submitted 19b-4 applications on behalf of four firms, including Bitwise Invest, Canary Capital, 21Shares, and WisdomTree.

The SEC recognition of Canary Capital’s XRP ETF filing implies that the ETF proposal has made considerable progress and could be on the verge of impending approval. It is worth noting that the SEC called for comments regarding the XRP ETF from market participants in the filing. The window for public opinion will last for 21 days. It would start counting after the SEC publishes the application in the Federal Register.

🚨 BREAKING NEWS:

THE SEC HAS ACKNOWLEDGED THE FILING FOR CANARY CAPITAL‘S SPOT #XRP ETF! 🙌🏼 pic.twitter.com/OOsS1Ijtmn

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) February 19, 2025

As expected, the news about the progress that could result in an eventual XRP ETF approval has sparked excitement among market observers, particularly XRP enthusiasts. The crypto community seemed more interested in the price impacts of a potential ETF approval on XRP. Like Bitcoin and Ethereum ETFs in 2024, many market experts have speculated that the ETF approval could become a turning point that would birth XRP’s meteoric price ascent.

SEC ETFs Acknowledgements Soar Following Leadership Overhaul

Over the past few weeks, the SEC has acknowledged 19b-4 filings from several issuers, underscoring more intentional efforts to encourage crypto participation in the United States. Notably, the SEC leadership overhaul and the Crypto Task Force establishment have undoubtedly played significant roles in hastening the previously bureaucratic procedures.

For context, despite several applications, the SEC, under the leadership of Gensler, only approved BTC and ETH ETFs in 2024. In fact, the regulatory watchdog frustrated some issuers’ efforts when it revealed that it would not proceed with the approval processes for two Solana (SOL) ETF applicants in December 2024. Aside from outrightly refusing to engage with the SOL ETF issuers, the SEC stated it would not entertain further proposals.

However, within just a few days of Mark Uyeda’s appointment, the SEC has already recognized several ETFs. Only XRP has scored six acknowledgments from the regulatory watchdog concerning ETF filings from Grayscale, 21SHARES, Bitwise, CoinShares, WisdomTree, and most recently, Canary Capital.

🚨 🚨 BREAKING NEWS:

The US SEC acknowledged the filing for Canary Capital spot XRP ETF. 📃 🪙 💰 🇺🇸

This is the sixth XRP ETF acknowledged after Grayscale, 21SHARES, Bitwise, CoinShares, WisdomTree.

BOOOOOM! 🔥 #XRP #RLUSD #XRPETF 💎 💎 💎 💎 💎 💎 💎 💎 💎 💎 pic.twitter.com/6UxTjNYTRj

— Kenny Nguyen (@mrnguyen007) February 20, 2025

Apart from XRP, other cryptocurrencies are also experiencing similar ETF application recognitions from the regulatory watchdog. For context, CryptoCommunity reported in an old publication that Litecoin (LTC) ETF approval is edging closer following the SEC’s approval of its ETF filing from Canary Capital. Another news article captured another filing from the SEC indicating that the regulatory agency has acknowledged the recipient of Grayscale’s Dogecoin (DOGE) ETF 19b-4 application.

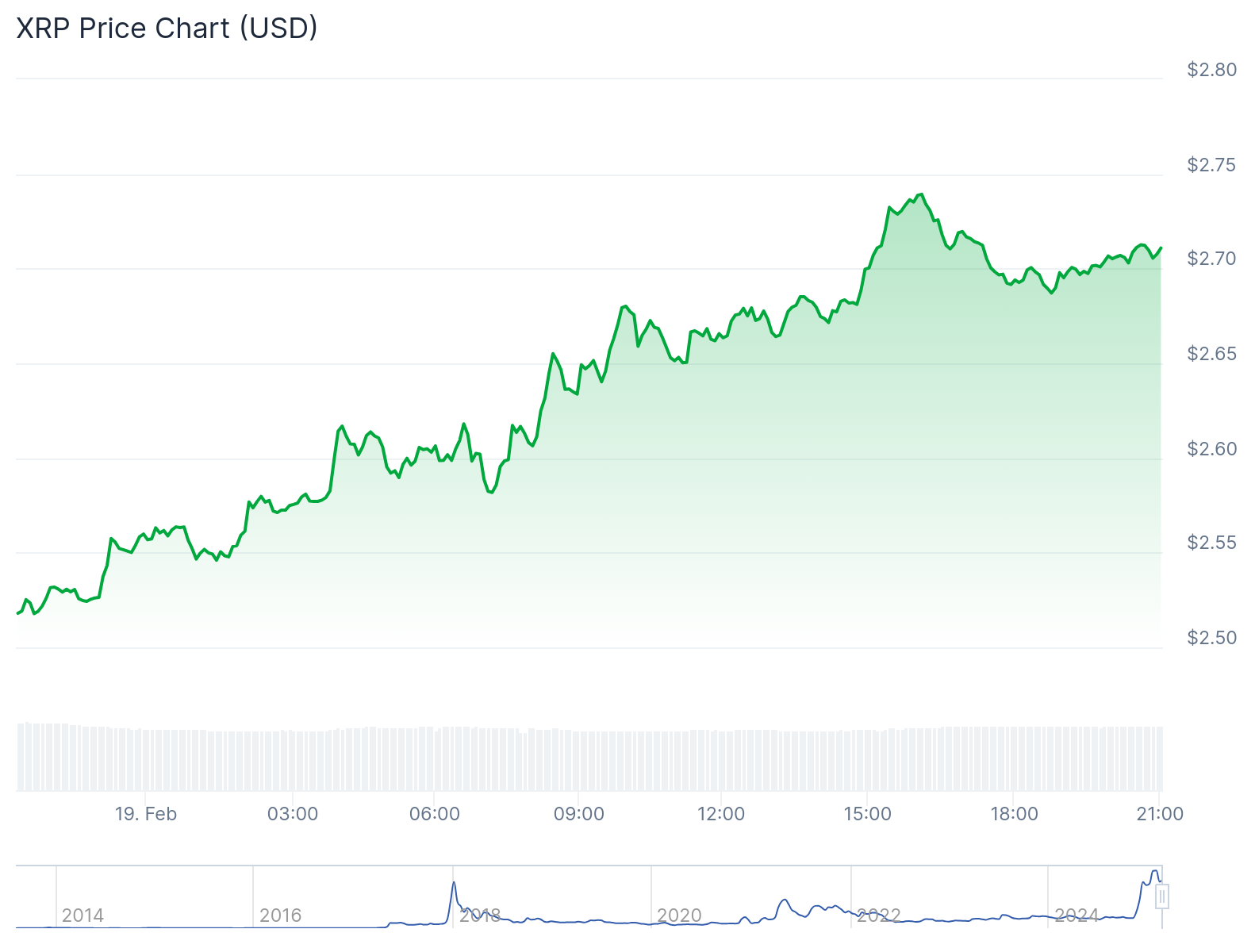

XRP’s Price Reaction

Ordinarily, market participants would anticipate that the new development would spur a surge in XRP’s price actions. Such was the case with XRP, as it recorded a 7.6% surge in its daily price change metric. At the time of writing, XRP is changing hands at approximately $2.71.

Within a 24-hour interval, XRP’s price has fluctuated between $2.52 and $2.74, underscoring a positive reaction in the short interval. Other relevant statistics revealed that XRP has a $156.6 billion market capitalization, while its 24-hour trading volume is $4.55 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.