Highlights:

- Saylor predicts IBIT will become the world’s largest ETF within ten years.

- IBIT surpassed $53 billion in assets, making it the largest Bitcoin ETF.

- Bitcoin’s rising demand is fueled by inflation concerns and global market instability.

At the Bitcoin Standard Corporation’s Investor Day in New York City on April 24, Michael Saylor, the Executive Chairman of Strategy Inc. addressed a full room of corporate leaders and institutional investors. He confidently stated that BlackRock’s Bitcoin Exchange-Traded Fund (ETF), known as IBIT, will become the world’s largest ETF within the next ten years. His prediction seemed valid because Blackrock is deeply involved in Bitcoin.

🚨NEW: @saylor predicts that @BlackRock’s $IBIT will be “the biggest ETF in the world in ten years.” pic.twitter.com/cyDDFf47FV

— Eleanor Terrett (@EleanorTerrett) April 24, 2025

BlackRock’s IBIT Becomes the Largest Bitcoin ETF

Michael Saylor stressed that IBIT could eventually become the largest ETF worldwide. Since its launch on January 11 last year, it has attracted over $54 billion in net assets. It was noted that the fund reached $10 billion within seven weeks, making it the fastest-growing ETF to date. On April 22, the ETF posted a one-year return of 37.31%.

This growth has made IBIT the largest Bitcoin ETF. It has surpassed Invesco QQQ Trust Series and Fidelity’s Wise Origin Bitcoin Fund, which manage $18.3 billion and $19.681 billion, respectively. In the broader market, spot Bitcoin ETFs now control over 1 million units, valued at more than $95 billion. IBIT holds nearly 48.7% of the U.S. spot Bitcoin ETF market. The pace of this growth is remarkable. Gold ETFs took two decades to reach $128 billion, while Bitcoin ETFs have surpassed $95 billion in just one year.

Saylor called BTC the new cornerstone for corporate treasury strategy. He pointed out that companies are realizing cash is weak and unstable over time. In his view, Bitcoin is “better than cash” and acts as future-proof money, protecting firms from inflation. He added that interest in Bitcoin-based financial tools, such as ETFs, is expected to grow.

IBIT Struggles to Catch Up with Vanguard ETF

Vanguard’s S&P 500 ETF (VOO), with $559 billion in assets under management (AUM), currently leads the global ETF market. Since its inception in September 2010, VOO has become a key choice for long-term equity investors.

On the other hand, BlackRock’s IBIT, a spot Bitcoin ETF launched just over a year ago, has rapidly climbed to become the 34th-largest ETF globally. With $54 billion in AUM, IBIT is about one-tenth the size of VOO. Despite its short history, IBIT has broken multiple records for ETF launches and is drawing significant institutional interest.

In response to Saylor’s prediction, Bloomberg’s Eric Balchunas shared his thoughts on X. He remarked that IBIT’s debut year performed beyond initial forecasts. However, he pointed out the significant difference in size between IBIT and VOO, noting that VOO holds ten times more assets and receives five times the daily inflows.

Balchunas said IBIT would need to attract $1 billion to $4 billion daily to catch up with VOO. This would require rare market conditions, including a potential stagnation in U.S. equities and a major increase in BTC’s value and adoption.

I would never say never re $IBIT bc it broke every conceivable record it’s rookie year but.. King VOO is curr 10x bigger and hauls in 5x more cash every day = would take a flat or negative decade for US stocks while btc moons. https://t.co/2htftYoVyD

— Eric Balchunas (@EricBalchunas) April 24, 2025

Bitcoin Price Movement

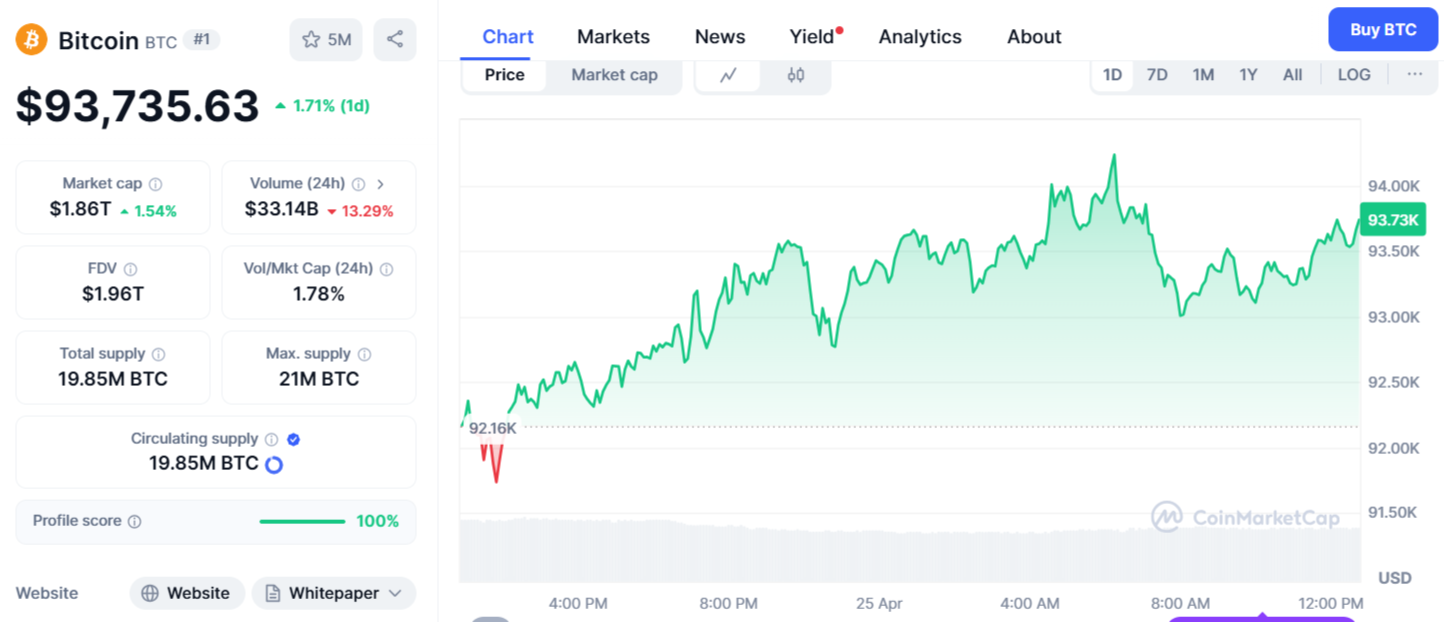

According to CoinMarketCap, Bitcoin is currently priced at $93,735, reflecting a 1.71% increase over the last 24 hours. The cryptocurrency has recently surpassed Silver and Amazon, securing its position as the sixth most valuable asset worldwide. Rising inflation worries and global uncertainty are driving interest in Bitcoin. Many investors now see it as a safe haven and a reliable long-term asset.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.