Highlights:

- Sam Bankman-Fried says the FTX collapse happened without his approval and claims lawyers rushed the bankruptcy.

- Prosecutors and courts found that customer funds were misused even as Bankman-Fried disputes insolvency.

- His prison statements continue to attract attention and lead to brief moves in the FTT token.

Sam Bankman-Fried, founder of the collapsed crypto exchange FTX, has made a new claim from prison about the collapse of FTX. His verified account circulated a statement this week that explained how the bankruptcy unfolded in November 2022. He said he never approved the Chapter 11 filing. He also said lawyers acted within hours after he stepped aside from management.

JUST IN: SAM BANKMAN-FRIED SAYS "FTX WAS NEVER BANKRUPT. I NEVER FILED FOR IT."#BreakingNews #FTX #SamBankmanFried #Crypto pic.twitter.com/AxH0Q0zfqJ

— Crypto News Hunters 🎯 (@CryptoNewsHntrs) February 10, 2026

Bankman-Fried said the filing occurred after outside advisers took control of the company. He claimed the move removed him from key decisions during the crisis. According to his account, the filing proceeded without his consent. Sam described the timing as abrupt and unnecessary.

He also said FTX did not face insolvency at the time. He claimed internal teams had reviewed company wallets before the filing. According to his statement, those reviews showed assets exceeded liabilities. He said the bankruptcy process itself caused further damage.

Records and Decisions Surrounding the FTX Collapse

Bankman-Fried believes that FTX was under liquidity pressure and not a balance sheet failure. He claimed that customer withdrawals went high in the short term. He argued that the exchange had enough assets at the time. In his version, the conditions were aggravated by panic.

Bankman-Fried commented that FTX.US was independent of the international platform. He alleged that technical inspections revealed that it was not linked to the deficit of the customers. He added that the business could have been left open and sold off.

In a sworn filing dated January 2023, Bankman-Fried recounted discussions with legal advisers. He claimed that he cautioned against bankruptcy filing without further technical verification. He also said that advisors demanded that FTX. The US should be added to the bankruptcy. In his explanation, cash on hand was a factor in that choice.

During the criminal trial, prosecutors contested the claims he made. Investigators testified that FTX combined customer funds with Alameda Research accounts. According to prosecutors, this practice generated an approximate shortfall of $8 billion. Court evidence revealed major financial gaps in the business.

The court concluded that subsequent recoveries of assets did not alter previous behavior. The judges ruled that better solvency following the recovery in the market did not reverse the misappropriation of customer funds. The findings underpinned the guilty verdicts of fraud and conspiracy. The court sentenced Bankman-Fried to 25 years in prison.

The bankruptcy process of FTX has been evolving. The estate has recently abandoned a plan to cap repayments to creditors in 49 countries. The estate included the plan in the Chapter 11 case in Delaware. Claimants raised prolonged objections in court, and the estate withdrew the proposal.

Market and Narrative Effects as Appeals Continue

The conversation started when Bankman-Fried responded to an inquiry from Bitcoin trader Alex Wice. The trader condemned the FTX trial and raised questions about the treatment of evidence. He termed the proceedings as flawed. Bankman-Fried replied that he concurred with practically everything in the criticism.

Agree with almost all of this.

But FTX was never bankrupt. I never filed for it.

The lawyers took over the company and 4 hours later they filed a bogus bankruptcy so they could pilfer it for money. https://t.co/5YjqvPjFT3 pic.twitter.com/L7VWJK4Wny

— SBF (@SBF_FTX) February 10, 2026

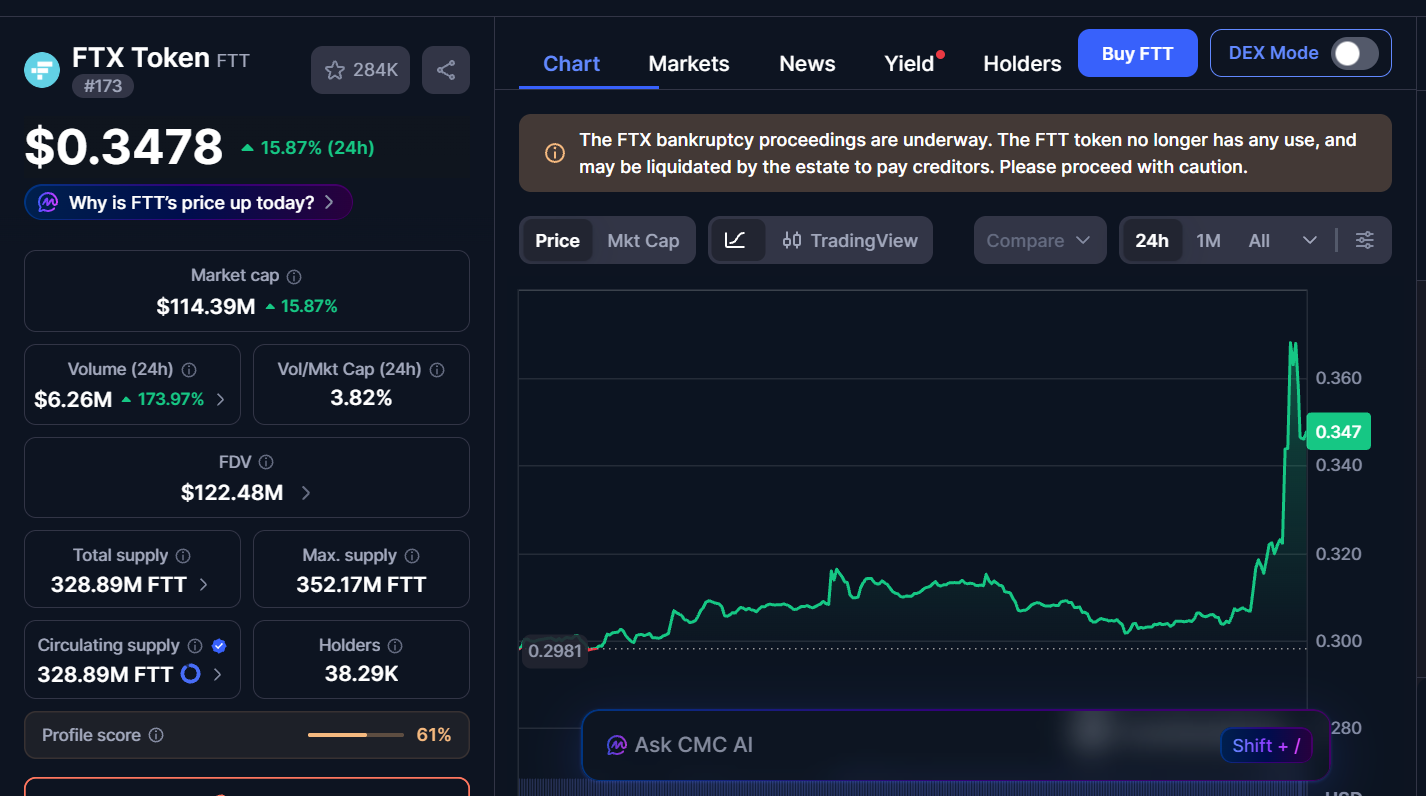

After the exchange, the FTT token recorded a brief speculative movement. The coin is trading at $0.3478, a 15.87% increase in the past day. The trading volume is up 173.97% to $6.26 million, while the market cap stands at $114.39 million.

Bankman-Fried is serving a 25-year prison sentence related to the FTX case in a federal prison. Sam alleged in a past tweet that his 2022 arrest was politically driven. He reported that the pressure on enforcement intensified once he changed his political support to Republicans.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.