Highlights:

- Ripple gets DFSA license to expand crypto services in Dubai’s DIFC.

- Garlinghouse says the UAE benefits from strong crypto regulations and innovation.

- XRP rises 5% as Ripple’s lawsuit settlement talks continue.

On March 13, blockchain payment provider Ripple announced that it secured a license approval from the Dubai Financial Services Authority (DFSA). This will allow the firm to offer regulated crypto payments and services within the Dubai International Finance Centre (DIFC), a UAE free-economic zone with its own regulatory framework and tax policies.

The announcement came six months after Ripple got initial approval for the DFSA license. On October 1, the company said it was working to get full approval to expand its digital asset services in the UAE. Ripple has become the first blockchain payments company to get a DFSA license. It will help Ripple grow in the Middle East crypto market.

Ripple has secured regulatory approval from the Dubai Financial Services Authority (DFSA), making us the first blockchain payments provider licensed in the DIFC. https://t.co/6oHWtnjODr

This milestone unlocks fully regulated cross-border crypto payments in the UAE, bringing…

— Ripple (@Ripple) March 13, 2025

Garlinghouse Highlights UAE’s Role in Crypto and Blockchain Innovation

Brad Garlinghouse, CEO of Ripple, shared his views on the industry’s growth. He highlighted that the crypto sector is expanding rapidly due to clearer regulations and increasing institutional interest. He also pointed out that the UAE, with its strong support for tech and crypto innovation, is in a great position to gain from these advancements.

Ripple has operated in the UAE since 2020, with its regional headquarters in the DIFC. About 20% of its global customers are based in the Middle East. With a global trade sector exceeding $400 billion, the UAE presents a huge opportunity for blockchain payments.

Ripple stated that 64% of finance leaders in the Middle East and Africa see faster payments as blockchain’s biggest benefit. DIFC Authority CEO Arif Amiri welcomed Ripple’s growth, saying Dubai fully supports blockchain innovation.

Reece Merrick, Ripple’s managing director for the Middle East and Africa, spoke about the DFSA license. He said it will help Ripple support businesses that need faster and more transparent payments.

Merrick stated:

“Securing this DFSA license is a major milestone that will enable us to better serve the growing demand for faster, cheaper and more transparent cross-border transactions in one of the world’s largest cross-border payments hubs.”

As of March 13, Ripple has obtained over 60 licenses worldwide, including in Singapore, Ireland, and several U.S. states. The company also introduced RLUSD, a stablecoin that has reached a market cap of over $130 million since December.

SEC Preparing to End Lawsuit Against Ripple

UAE DFSA license approval comes as talks continue about a possible lawsuit settlement. Fox Business journalist Eleanor Terrett reported that the delay is due to Ripple’s legal team working to secure better terms in the agreement. The journalist said the talks focus on the August court ruling. This ruling fined Ripple $125 million. It also banned the company from selling XRP to institutional investors.

🚨SCOOP: Two well-placed sources tell me that the @SECGov vs. @Ripple case is in the process of wrapping up and could be over soon.

My understanding is that the delay in reaching an agreement is due to Ripple's legal team negotiating more favorable terms regarding the August…

— Eleanor Terrett (@EleanorTerrett) March 12, 2025

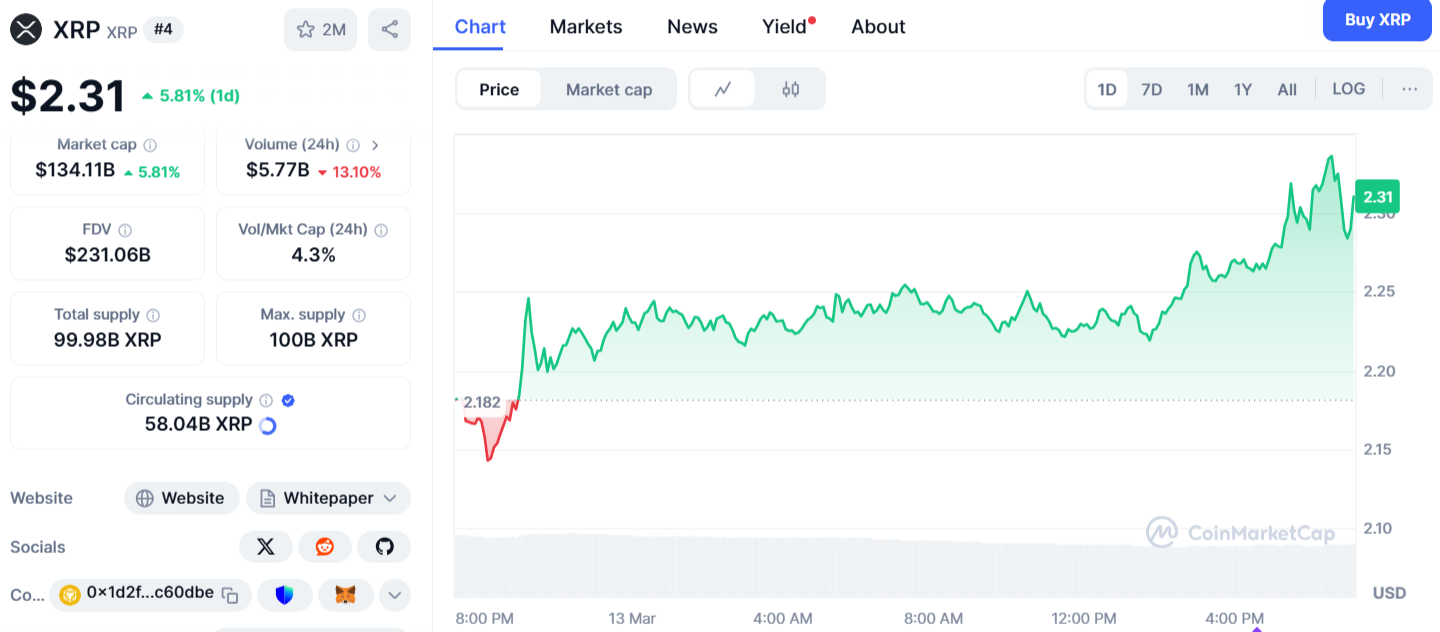

XRP is now up 5.81%, trading at $2.31. A Ripple lawsuit settlement could push XRP beyond $3 quickly. It may also pave the way for the approval of a spot XRP ETF.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.