Highlights:

- Ripple acquires Palisade to boost its custody solutions and other platform operations.

- With the acquisition, Ripple will support more use cases for businesses that prioritize speed and flexibility in handling high-volume transactions.

- Ripple hopes to become the platform of choice for companies seeking to manage digital assets more securely.

San Francisco-based cross-border payment firm Ripple has expanded its digital asset services with the acquisition of Palisade, a firm that builds wallets and custody systems for cryptocurrencies. The company announced this acquisition through a press release on November 3, stating that it is aimed at making Ripple the platform of choice for businesses, fintechs, and large institutions seeking to store, move, and manage digital assets safely.

Before the acquisition, Ripple already offered its custody service to banks and fintechs holding cryptocurrencies, stablecoins, or tokenized real-world assets. With the Palisade purchase, Ripple will support more use cases, especially for businesses that prioritize speed and flexibility in handling high-volume transactions.

Institutional-grade asset custody just got supercharged.

We're acquiring @palisadeinc: https://t.co/2536rNIuWv

Palisade offers a fast and scalable wallet solution, ideal for on/off ramps and global corporate payments – this integration accelerates value transfer across Ripple…

— Ripple (@Ripple) November 3, 2025

The acquisition follows Ripple’s recent launch of its institutional prime brokerage for XRP and RLUSD in the United States. According to Crypto2Community, this new offering enhances over-the-counter (OTC) spot trading for Ripple’s XRP and RLUSD stablecoin. Notably, the company initially sealed a $1.25 billion acquisition of Hidden Road before unveiling Ripple Prime.

Palisade’s Model Sets to Boost Transactions Across Ripple’s Platform

Palisade offers a “wallet-as-a-service” model, enabling companies to create and manage wallets at scale. It is designed for rapid transactions across on- and off-ramps, including other related crypto operations. Ripple described Palisade’s model as aligning with its goal of moving value in real-time for traditional and crypto-native firms.

Reacting to the purchase, Monica Long, Ripple’s President, described secure digital asset storage as the foundation of blockchain adoption for companies. According to her, companies are following banks to embrace crypto.

Long Stated:

Corporations are poised to drive the next wave of crypto adoption. Just as we have seen banks go from observing to actively building in crypto, corporates are now entering the market, and they need trusted, licensed partners with out-of-the-box capabilities.”

She also highlighted Ripple’s upgraded focus on long-term asset security and lightweight, instant wallet creation. Together, Ripple and Palisade will enhance long-term safekeeping, instant global transfers, and treasury management.

@palisadeinc has been acquired by @Ripple 🎉

Our wallet-as-a-service platform will help power Ripple's next-gen custody and payments infrastructure, bringing our technology to businesses worldwide. Same team, now at enterprise scale.

This is just the beginning 🚀 pic.twitter.com/G1en6AySYz

— Palisade (@palisadeinc) November 3, 2025

Palisade will Bring Modern Infrastructure to Ripple

Major banks, including Absa Bank, BBVA, DBS, and Société Générale, have already adopted Ripple’s custody. The platform functions like a digital vault, with immutable transaction records and built-in compliance approvals. This enables customers to manage multiple asset vaults and track everything from a single dashboard.

Palisade brings multi-party computation (MPC), zero-trust security, multi-chain support, and DeFi integration to the Ripple platform. MPC divides wallet keys into separate parts for safer management. The zero-trust security approach ensures that every user and device is verified before gaining access to the platform.

The upgraded platform will also support fast wallet provisioning, allowing businesses to create and manage many wallets. Additionally, multi-chain support lets firms manage assets across blockchains, while DeFi tools enable lending, staking, and yield farming.

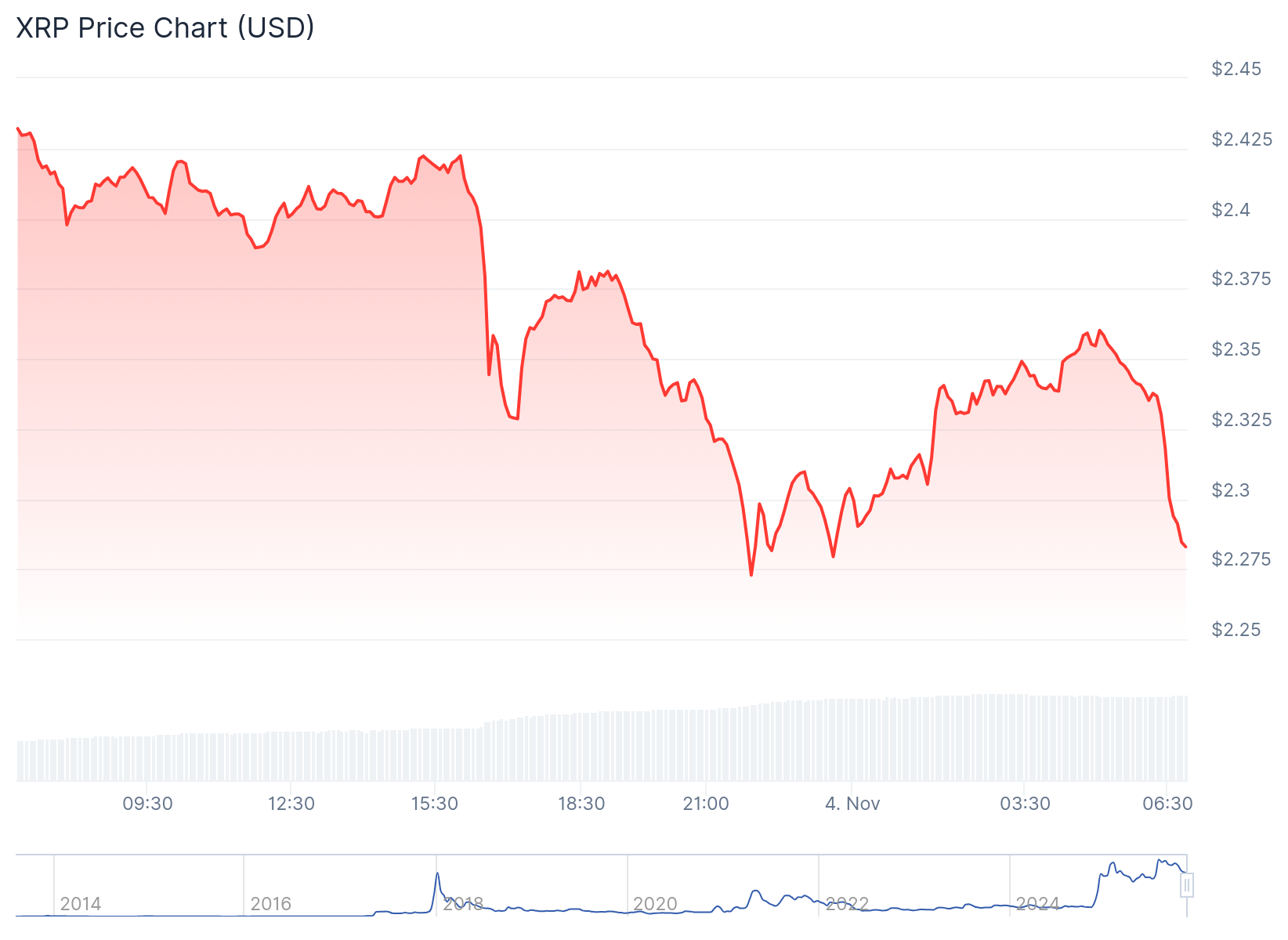

XRP Remains Below $2.5 Desite the Acquisition

At the time of writing, Ripple’s native token, XRP, is priced at $2.32, following a 4.8% decline in the past 24 hours. Despite the price drop, XRP’s 24-hour trading volume surged 104.35%, to reach $6.51 billion. Meanwhile, XRP’s sentiment remains bearish, while supply inflation and volatility are high at 6.26% and 7.35%, respectively.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.