Highlights:

- A recent Binance document has revealed that retail investors are fueling 80% of Bitcoin ETF demand.

- Institutional investors influence record average expansion rates, with advisors contributing the most cash inflows.

- IBIT and FBTC topped the charts for best-performing commodities in the United States ETF market in 2024.

The world’s largest exchange, Binance, has released its investigational findings on spot Exchange Traded Funds (ETFs). The document from the studies contained some interesting disclosures, including how retail investors are fuelling significant portions of Bitcoin (ETF) demand.

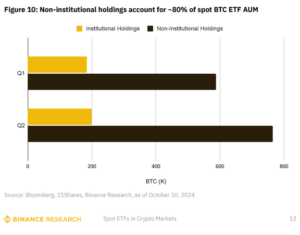

Under buying patterns, the trading platform noted that about 80% of the commodities procurement came from non-institutional investors. Additionally, the trading platform stated that the increment started progressing at roughly 30% since Q1.

In its exact write-up, Binance stated:

“About 80% of bitcoin ETF purchases have likely been coming from self-directed investors who have made their allocation, often through an online brokerage account.”

Per Binance, not every capital inflow recorded in BTC ETFs qualifies as fresh investments. The exchange explained that some of these funds are from traders holding Bitcoin in other wallets and locations, including exchanges or retail brokers.

Binance added that the token shifts stem from investors’ desire to store their BTC holdings in more regulated and convenient locations. Overall, the exchange spotlighted Bitcoin ETFs’ double-faceted functions of attracting new and existing investors.

Why Retailers are Dominating Bitcoin ETFs Market

According to the exchange, Bitcoin has always survived off a massive retailer base. Notedly, Binance’s assertion is evident in IntoTheBlock’s BTC statistical summary. Per the on-chain analytical tracker, Bitcoin’s large holders’ size displayed 12%, implying a whopping 88% accounted for retailers.

Meanwhile, aside from the massive retailers’ pool, Binance mentioned that Bitcoin ETFs are readily available on several retail-accessible platforms. Therefore, they can procure the commodities with little or no stress.

U.S. spot #Bitcoin ETF demand hit a 6-month high, with netflows totaling 64,962 BTC over the last 30 days. https://t.co/Zw3TqYlQLn pic.twitter.com/HOEcR74gZB

— Ki Young Ju (@ki_young_ju) October 25, 2024

Institutional Demand Record Average Expansion Pattern

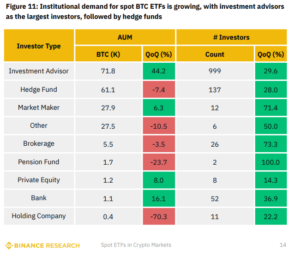

For institutional demand influence on Bitcoin ETFs, Binance noted that the growth trend has been slow relative to retailers. In its documentation, the exchange revealed that institutional contributions have grown by 7.9% since Q1. “A more notable indicator is the rise in institutional investors, with Q2 13F filings showing an increase from the mid-900s to over 1,200. This growth is encouraging and highlights the resilience of institutional interest,” Binance explained.

Furthermore, the world’s largest exchange took an in-depth analysis of institutional investment variables to spotlight the main contributors. According to Binance, asset managers with notable Bitcoin ETF expansion roles include hedge funds, banks, and investment advisors. Among the institutional entities, the trading platform disclosed that the advisors witnessed the highest expansion rate.

In the publicized document, Binance noted that the growth pattern for institutional advisors has soared by 44.2% from its Q1 level with over 71.8K Bitcoin holdings. Highlighting more reasons to ascribe advisors, the fastest growing asset manager category, Binance mentioned that even within BlackRock, the most valuable Bitcoin ETF, advisors’ input remains the highest.

BlackRock and Fidelity Bitcoin Commodities Ranked Among the Best Performing Entities

Having spotlighted Bitcoin ETFs’ impressive feats in roughly ten months of gracing the crypto market, Binance thought it wise to recognize some of the best-performing commodities. Per Binance, BlackRock Bitcoin ETF (IBIT) and Fidelity Bitcoin ETF (FBTC) have stood out with significant cash inflow contributions.

The exchange noted that apart from IBIT registering an unprecedented 71-day cash inflow steak, it also topped the list of best-performing United States ETFs for commodities launched in 2024. Other ETFs topping the list include Fidelity’s FBTC, ARK 21Shares’ ARKB, and Bitwise’s BITB.

BlackRock now owns over 390,000 #Bitcoin.

They are not holding these for short-term gains.

You might get shaken out, chewed up, and spat out before $BTC rises higher

They can afford to hold and wait for decades, while you cannot.

That's exactly what you're seeing now -… pic.twitter.com/rFptLqegoC

— BISS (@bissbtc) October 23, 2024