Highlights:

- Japan’s Remixpoint has bought ¥200 million ($1.4 million) worth of Bitcoin tokens.

- The investment increased the company’s Bitcoin holdings to about 1,051.56 BTC.

- Remixpoint said it realized the funds for the purchase from one of its most recent stock acquisition rights exercises.

Japanese-based energy management solutions and digital assets investment firm Remixpoint has disclosed another Bitcoin (BTC) purchase. The company announced the new acquisition in its updated financial document on June 16, 2025. According to the publication, Remixpoint added 13.296 BTC, valued at about ¥200 million ($1.4 million) on June 13.

Japan’s Remixpoint acquires another 13.3 $BTC for $1.4M

Japanese energy consulting firm @remixpoint_x announced in a June 16 press release published on its website that it has acquired an additional 13.3 Bitcoin (BTC) for 200 million yen ($1.4 million). This latest purchase…

— CoinNess Global (@CoinnessGL) June 16, 2025

The Japanese firm reported that it paid an average of ¥15.04 million ($104,294.88) per token. This purchase increased the company’s total BTC holdings to 1,051.56 BTC, valued at ¥16.03 billion ($111.22 million) with unrealized gains of ¥1.64 billion ($11.38 million).

Remixpoint added:

“This Bitcoin purchase was funded using a portion of the proceeds from the exercise of rights conducted on the afternoon of June 12, 2025.”

BTC追加購入のお知らせ

ビットコイン保有枚数

1051BTChttps://t.co/LREHQc8gCu— リミックスポイント公式Xアカウント (@remixpoint_x) June 16, 2025

Meanwhile, today’s announcement comes a few days after the Japanese crypto investment firm announced the acquisition of about 56.8 BTC, increasing its BTC holdings to about 1,038.266 BTC. Remixpoint noted that this purchase aided the company in exceeding its 1,000 BTC target.

Despite surpassing its goal, the Japanese firm has not relented in its BTC acquisitions, implying strong faith in Bitcoin as a sustainable investment option. Beyond the acquisition, the company completed one of its stock acquisition rights exercises on June 12.

The company reported:

“Planned amount raised: 5,625 million yen. Completed amount raised: 5,976 million yen (106%). It was all completed quickly.”

権利行使完了のお知らせ(新株予約権)

調達予定額5,625百万円

調達完了額5,976百万円(106%)

迅速に全て完了致しました。https://t.co/Odwmm5rFmX— リミックスポイント公式Xアカウント (@remixpoint_x) June 13, 2025

Remixpoint Other Crypto Holdings

Unlike some other investment firms focusing only on BTC, Remixpoint boasts a diversified crypto portfolio worth ¥17.11 billion ($118.76 million). The assets in the company’s portfolio include Ethereum (ETH), Solana (SOL), Ripple’s XRP, and Dogecoin (DOGE).

Per the publicized filing, Remixpoint owns 901.45 ETH worth ¥331 million ($2.3 million), 13,920 SOL, valued at about ¥305 million ($2.12 million), 1.19 billion XRP worth ¥373 million ($2.59 million), and 2.8 million DOGE, valued at about ¥2.1 million ($14,576.10). While BTC generated most of Remixpoint’s unrealized gains, every other asset in the company’s portfolio contributed only 6% of the entire ¥1.76 billion ($12.22 million) profit. The company noted that the unrealized profits would impact next year’s earnings, set to end in March 2026.

Bitcoin Interest Continues to Rise Among Institutions and Individuals

Earlier today, Simon Gerovich, the Chief Executive Officer (CEO) of another Japanese-based Bitcoin investment firm, Metaplanet, announced that the company has finally reached its long-term target. In an X post, the CEO reported that Metaplanet added 1,112 BTC worth $117.2 million to its massive BTC stores, increasing its holdings to the long-anticipated 10,000 BTC tokens.

Meanwhile, CoinShares has published last week’s digital assets inflows, showing marked rebound inflows from BTC. Last week, BTC drove digital assets’ $1.9 billion net inflows with its $1.3 billion net profits. CoinShares added, “Short-bitcoin products also recorded modest inflows of $3.7 million, though total AuM remains low at $96 million.”

Digital asset investment products saw US$1.9bn in inflows last week, marking the 9th consecutive week and a record YTD total of US$13.2bn. Bitcoin rebounded with US$1.3bn in inflows, while Ethereum saw US$583m inflows, its strongest since February. https://t.co/mz9A80gw4z

— Wu Blockchain (@WuBlockchain) June 16, 2025

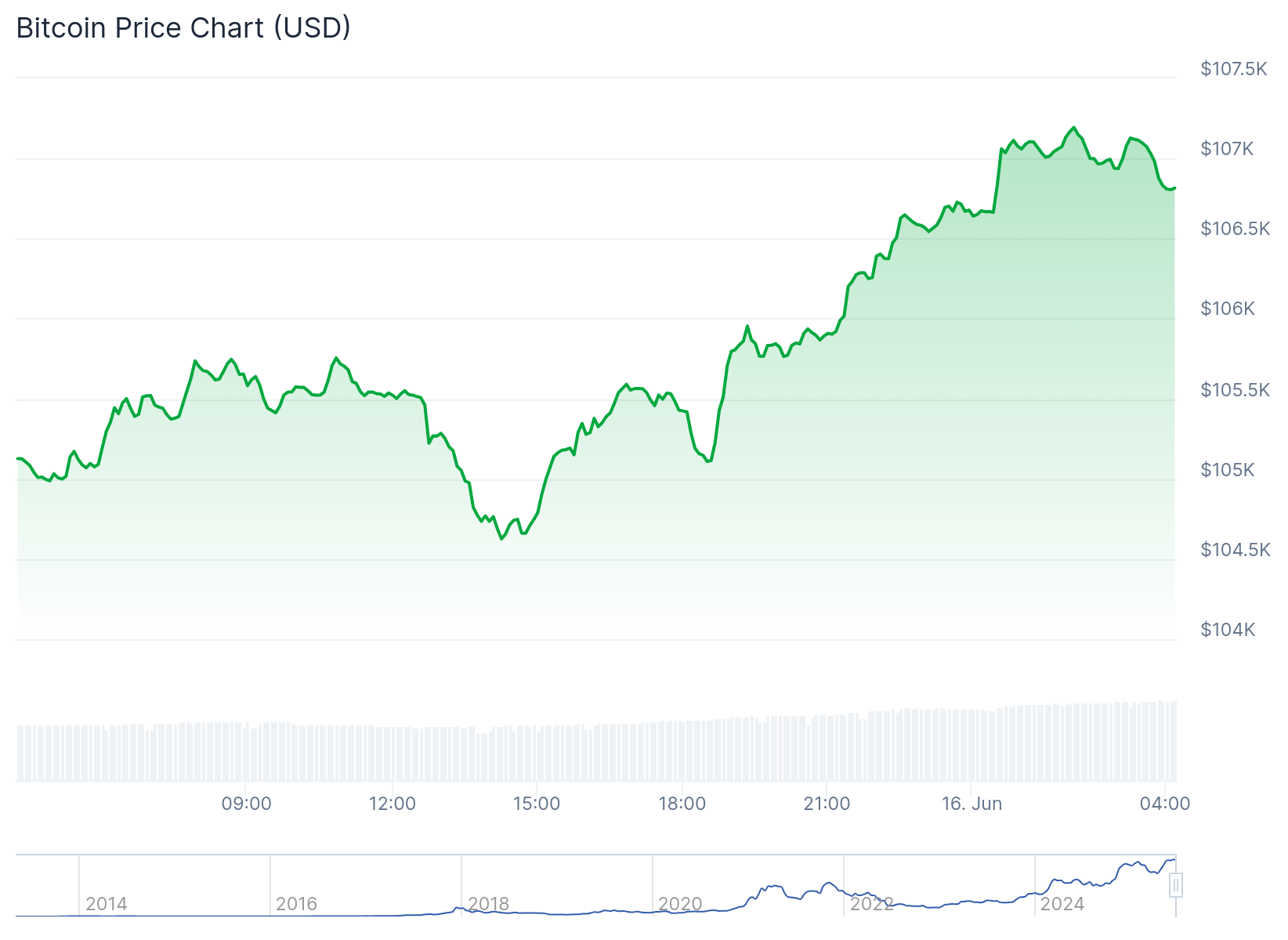

Bitcoin Price Appreciates Slightly

At the time of writing, Bitcoin’s price is up 1.6%, trading at about $106,800 and fluctuating between $104,627 and $107,194. BTC’s 7-day-to-date price change variable showed slight declines of about 0.4%, with price extremes oscillating between $103,639 and $110,266. This price range underscores BTC’s volatility within a short interval. However, BTC’s longer-term price change variable showed increments. For context, the token is 3.8% up month-to-date and 60.2% up year-to-date.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.