Highlights:

- Bitcoin fell below $90k as Trump confirmed that 25% tariffs proceed.

- Crypto Fear and Greed Index hit 21, with $937.7 million in outflows from Bitcoin funds.

- Teng calls the crypto dip short-term, citing Fed policies and ongoing strong institutional interest.

The crypto market dropped sharply yesterday, with Bitcoin slipping under $86,500 for the first time since November. As of writing, Bitcoin was hovering around $88,386, marking a 0.89% decline in just 24 hours. The drop came after Trump, at a Feb. 24 news conference with French President Emmanuel Macron, confirmed his 25% tariffs on Canada and Mexico will move forward as planned. He had earlier agreed to delay them for 30 days this month.

The tariffs could raise inflation and slow economic growth, which may pressure the Federal Reserve. The Fed plans to cut rates only when inflation nears 2%, but recent data shows inflation moving away from that target.

Rising inflation and delayed rate cuts can boost the U.S. dollar and push Bitcoin down. Rate cuts usually boost crypto as lower traditional asset returns push investors toward riskier options like cryptocurrencies.

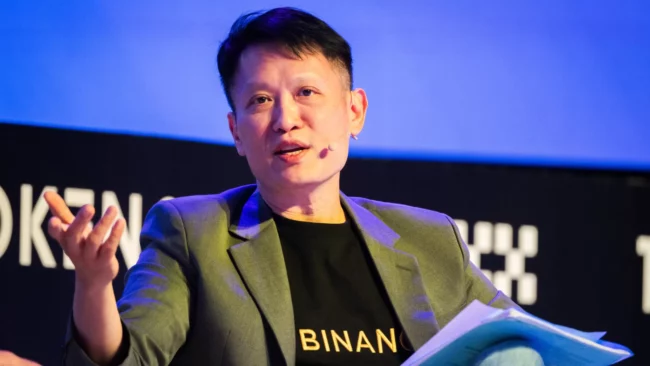

On Feb. 26, the Crypto Fear & Greed Index scored 21 out of 100, reflecting “Extreme Fear.” This marks a 28-point decline over the past two days, dropping from a “Neutral” score of 49 on Feb. 24. Reflecting this sentiment, Farside Investors data shows 11 spot Bitcoin funds faced net outflows of $937.7 million yesterday. Investors are concerned, but Binance CEO downplays fears of a prolonged slump.

Binance CEO Sees Crypto Market Drop as Short-Term

Richard Teng, CEO of crypto exchange Binance, said the recent drop in crypto’s total market cap is a tactical retreat, not a trend reversal. In a Feb. 25 post, Teng said crypto markets, like traditional assets, react to macro changes but remain resilient. “It’s important to view this as a tactical retreat, not a reversal,” he added.

He mentioned the 2022 slump when Bitcoin briefly dipped under $20,000 during Fed rate hikes but later rebounded. Teng said the current drop is like past short-term moves, not a sign of weakness. He highlighted that institutional interest keeps growing with strong ETF inflows and frequent new applications.

Here's my thoughts on the recent market turbulence: It's important to view this as a tactical retreat, not a reversal.

Crypto has been here before and bounced back even stronger. Here's why we should stay optimistic. ⤵️

A thread 🧵

— Richard Teng (@_RichardTeng) February 25, 2025

US spot BTC ETFs have accumulated a total net inflow of $38.08 billion since their launch in January last year. Since Gary Gensler stepped down as SEC Chair on Jan. 20, US asset managers filed for several ETFs tied to cryptocurrencies, including XRP, Cardano, Solana, and Dogecoin. Binance also sees a steady rise in new users, which is showing continued adoption.

Fed’s Rate Cut Stance Influences Market

Teng linked the recent drop to macro factors, mainly the Fed’s careful approach to rate cuts.

He stated:

“It’s important to note that the Fed’s pause is temporary. The recent dip stems largely from the Fed’s cautious approach to rate cuts. While a March cut looks less likely now, it’s crucial to remember that monetary policy is data-driven.”

He said this shift has caused short-term market changes, but the overall direction depends on data. Tend emphasized that falling inflation or a weaker labor market could push the Fed to adjust its policy, possibly boosting the market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.