Highlights:

- Raydium price breaks out bullishly, increasing 27% to trade at 4.81 as trading volume spikes.

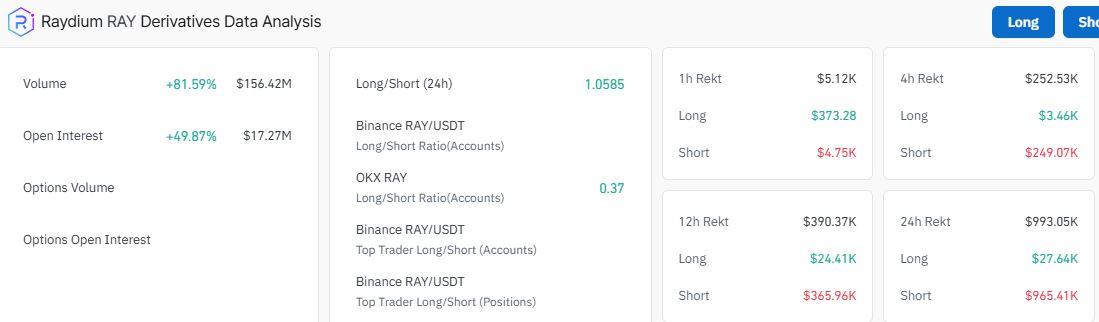

- Coinglass data shows a spike in open interest and volume, signaling a flow of new money.

- Raydium (RAY), the leading decentralized exchange (DEX) on Solana, is making headlines with significant on-chain growth.

The Raydium price has skyrocketed 27% to trade at $4.81 during the European trading hours on Thursday, Nov 7. An 85% jump in daily trading volume accompanied Raydium’s rally, which now stands at more than $270 million, reinforcing the intensity of the demand-side activity.

What’s Behind Raydium’s Price Rally?

This impressive rally in the crypto market was fueled by Donald Trump’s victory in the U.S. elections, sparking optimism. Meanwhile, the meme coin market has also seen explosive growth, with its total market cap soaring 12% to $72 billion in the past 24 hours.

Raydium, the leading decentralized exchange (DEX) on Solana, is making headlines with significant on-chain growth. RAY is known for facilitating meme coin trading on Solana with platforms like Pump.fun and Dexscreener. RAY is now up 50% in a week, 198% in a month, and a whopping 1854% in a year, gaining a spot amongst the top gainers.

$RAY is absolutely killing it!

Aped into this at the beginning of Oct (amongst others) at around $1.6 with my general thesis that Solana DEX coins amongst other areas would balloon. It’s nice when your thesis pays off, and recently they are!💪🏽@RaydiumProtocol#solana #crypto pic.twitter.com/VMyJouWF5Z

— The BlockFather (@robhallam9) November 7, 2024

Moreover, Coinglass data shows bolstered investor confidence in Raydium as the volume and open interest spike. This suggests that new money is flowing into the market, signaling that the bullish momentum may continue.

Raydium Statistical Data

Based on CoinmarketCap data:

- RAY price now – $4.81

- Trading volume (24h) – $272.41 million

- Market cap – $1.26 billion

- Total supply – 555 million

- Circulating supply – 263.85 million

- RAY ranking – #61

The Raydium price has broken out of an ascending parallel channel, recording a 59% increase today. The token has experienced a steady uptrend, flipping the $3.60 resistance into support, hitting the $4.81 mark. The bulls have entirely taken the reigns as they have quashed their seller counterparts in the market.

Raydium Bulls Take the Reigns in the Market

The breakout above $3.60 suggests bullish momentum. If this trend continues, RAY could reach higher targets around $5 or above $6. Zooming out in the daily chart timeframe, the bulls have flipped the key moving averages into immediate support, steadying the uptrend momentum. In this case, the $1.88 and $2.32 act as immediate support levels, leaving the bulls in a resistance-free zone.

On the other hand, RAY’s RSI is currently at 78.95, indicating a major wave of purchases. If the buying appetite persists, RAY might witness another major upside targeting $6. However, if it encounters difficulty rallying toward the $$6 level due to profit-taking and diminishing buying strength, RAY might reverse to chase the $3.60 support.

Moreover, traders are at liberty to hold their long positions in Raydium intact, bolstered by the MACD indicator. The blue MACD has crossed above the orange signal line, calling for traders to consider rallying behind the token.

Raydium Price Outlook

Based on the technical view, the buyers have full control of the RAY market, quashing the seller’s congestion. However, with the RSI sitting in the overbought zone, it might be prudent for traders and investors to carefully watch out for a reversal to avoid a bull trap.

A retracement will likely follow, allowing RAY to sweep through more liquidity as already sidelined investors rush to buy lower-priced Raydium tokens. In such a case, all eyes are on the $3.60 support level, which may absorb the potential selling pressure. On the flip side, a successful consolidation above the current breakout level could pave the way for another leg up, potentially to $5 or above to $6.