Highlights:

- The price of Raydium surges 10% to $2.30, with daily volume up 673% to $419M after Upbit listing.

- Whale deposits 906,788 RAY ($2.26M) into Binance post-pump, raising concerns of a sell-off.

- Technical indicators show bullish momentum, with the bulls eyeing the $2.71 resistance.

Raydium price has spiked 10% to the $2.30 mark, as its daily trading volume soars 673% to $419M in the past 24 hours. This comes following the Upbit listing of two new pairs on RAY/KRW and RAY/USDT. This exchange listing will expose RAY to a wider market, thereby increasing its liquidity and accessibility to the Korean Won (KRW) and USDT markets.

레이디움(RAY) KRW, USDT 마켓 거래지원 안내

✅ 지원 마켓 : KRW, USDT 마켓

📅 거래지원 개시 시점: 2025-06-19 12:00 KST 예정🔗 공지 바로가기:https://t.co/jXeEDyP9zl#Upbit #RAY@RaydiumProtocol pic.twitter.com/kONvy7dNwA

— Upbit Korea (@Official_Upbit) June 19, 2025

Besides the listing, there was a whale that led to the price spike. Whale after the price pump deposited an enormous amount of 906,788 RAY tokens, which are estimated to be worth around the value of $2.26 million at Binance.

The price of $RAY surged by nearly 25% due to its listing on Upbit.

Whale 256Eh2 deposited 906,788 $RAY($2.26M) into #Binance after the pump, possibly to sell.https://t.co/F6UVfMuEVk pic.twitter.com/x03YR48yfl

— Lookonchain (@lookonchain) June 19, 2025

This huge amount has raised eyebrows on the possibility that the whale may sell out the tokens, which could likely affect their price actions on the market. The presence of whales, as in this case, may significantly influence token pricing, serving as a catalyst for both short-term volatility and long-term crucial market sentiment.

Raydium Price Breaks out of a Falling Wedge

A quick look at the RAY/USD 1-day chart shows a growing sign of bullish sentiment, as the bulls attempt to dominate the market. Meanwhile, the Raydium price is still struggling below key moving averages, as they act as immediate resistance zones. Furthermore, the bulls must overcome the $2.71 resistance zone to validate a short-term rally in the market.

On the other hand, the technical indicators are showing growing bullish sentiment. To start with, the Relative Strength Index (RSI) is currently at 46.87, and that means that the token is neither oversold nor overbought. That will be neutral reading, indicating that the price has sufficient scope to move upwards without being overbought. Additionally, the MACD line is currently showing bullish momentum, as it has fallen above the signal line. This prompts traders to buy more RAY tokens, potentially driving further upward movement.

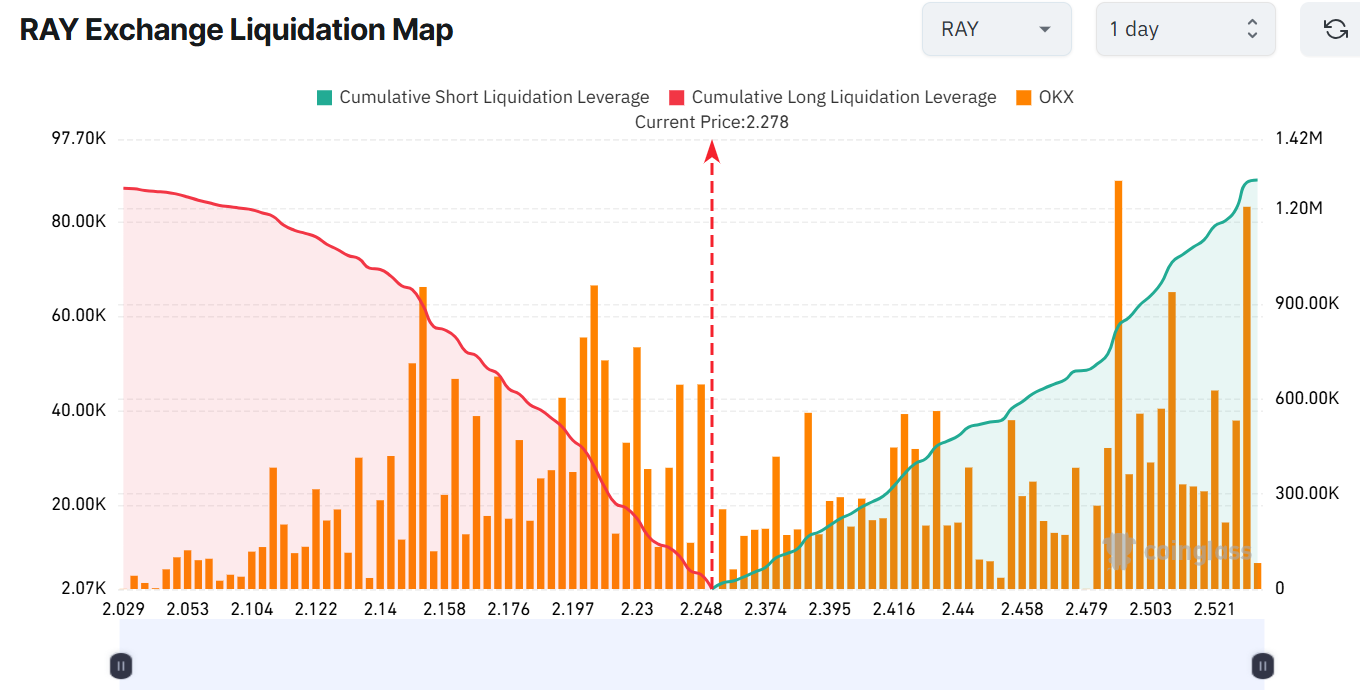

On the other hand, the Coinglass liquidation map of RAY shows almost an equilibrium accumulation of long liquidation leverage ($1.26 million) and shorts ($1.29 million) in the last 24 hours. This balance suggests that the market is neutral, as both the bulls and bears are struggling to gain control.

RAY Poised for a Potential Upside

Following the recent listing, the Raydium price could rally to the upside, potentially reaching the $2.71 resistance level. Further, today’s spike may draw more FOMO from traders, igniting more upside in the Raydium price. If the bulls capitalize on the buy signal from the MACD and the rising RSI, the Raydium price could surge towards $2.71. A break above this level will open a door for the upside towards the $2.74, $3 mark.

On the downside, if the bears step in and whales trigger a sell-off, RAY may drop towards the $2 support area. Meanwhile, the Raydium price may experience short-term volatility due to its listing on the Upbit exchange and increased whale activity.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.