Highlights:

- The price of Raydium has increased 8% to $3.88 in the last 24 hours.

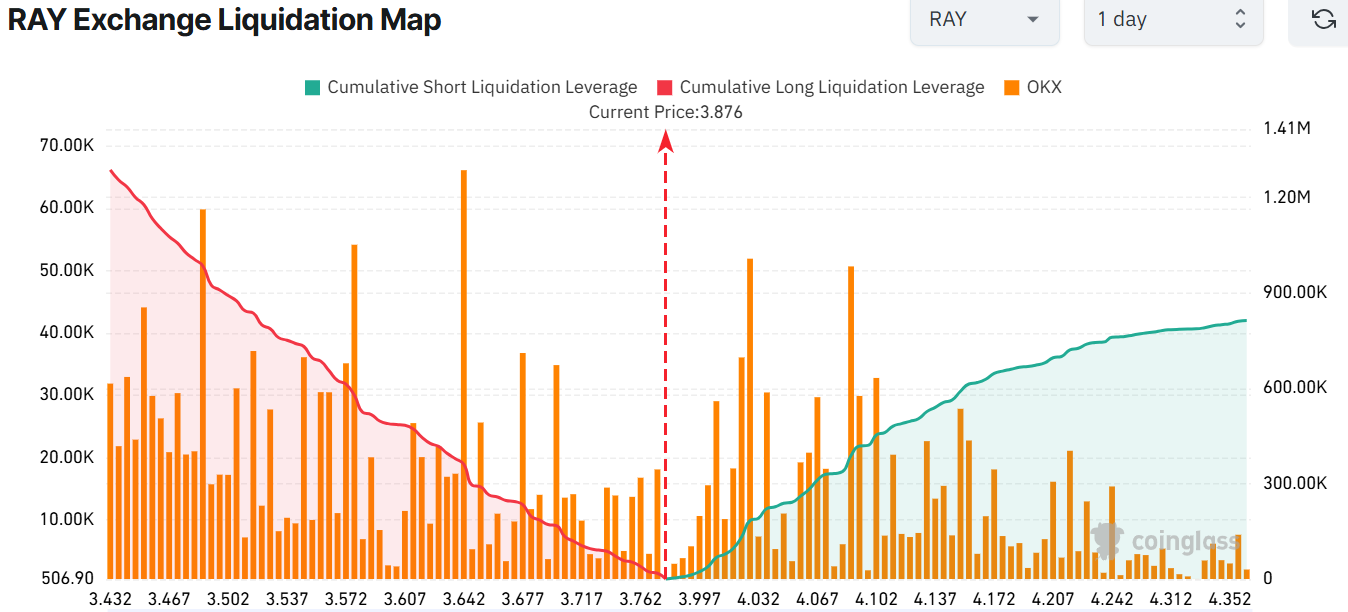

- The liquidation map shows that there are more short liquidations in lower price ranges.

- An analyst predicts that the RAY is set to break out to $4.

The price of Raydium has increased by 8% to $3.88, after hitting an intra-day high of $3.98. Its volume has increased by 107%, with a trading volume of $342 million, placing Raydium among the top gainers of the day.

In the meantime, Raydium Protocol continues to develop in the blockchain industry in the second quarter of 2025, after the opening of its LaunchLab. LaunchLab is offering free token launches on the Solana network, adding competition to other launch platforms. According to Messari data, LaunchLab volume has garnered $1.1 billion, accounting for 21.7% of net revenue in Q2.

State of @RaydiumProtocol Q2

Key Update: Raydium's LaunchLab debut brings free token launches to Solana, flipping competitors and driving significant revenue growth.

QoQ Metrics 📊

• TVL ⬆️ 54.7% to $1.8B

• LaunchLab volume $1.1B, 21.7% of Q2 net revenue

• RAY price ⬆️ 25.3%… pic.twitter.com/F7MK1AYPxc— Messari (@MessariCrypto) August 25, 2025

The price trapped in the Raydium ecosystem increased by 54.7% to reach $1.8 billion. This splendid expansion highlights an increase in engagement and trust in platform users. The increasing popularity of the Raydium platform is a sign of a shift towards more profitable ventures for investors.

Raydium Price Turns Bullish, Targeting $4 in the Short Term

The technical signals are also encouraging regarding the performance of the $RAY token. Short and long liquidations at crucial prices are also significant, as presented by a detailed liquidation map. The market is currently in a strong bullish trend, with the price standing at 3.88.

Nonetheless, a liquidation risk persists. The liquidation map indicates that there is a higher concentration of short liquidations in lower price ranges compared to higher price ranges. This suggests that the market is more likely to exhibit upward movements. The current long liquidation pressure indicates that a continuity of the upward movements could be supported, especially when the price exceeds the $4 level.

A quick look at the Raydium price 4-hour chart shows that it is poised for more upside. RAY has broken out of a tightened triangle with the $3.47(50-day) and $3.19(200-day) SMAs, cushioning against downward movement.

Right now, RAY is bouncing between key support at $3.88 and resistance at $4. If it breaks above that resistance with volume, we could see a legit moonshot. The RSI at 66.40 shows increased buying momentum, but it is not yet overbought. The MACD has crossed to positive territory, flipping above the orange signal line. This calls for more traders and investors to rally behind the RAY token.

Is It Time to Buy RAY?

Looking ahead, in the short term, the Raydium price may test $4 this week if the volume holds. Intense buying momentum could see a potential rally towards $4.13-$4.50 by the end of September.

Raydium $RAY breaks out of a triangle, targets $4! pic.twitter.com/RTnKUFhQET

— Ali (@ali_charts) August 27, 2025

In the long term, if Raydium leverages this launch, RAY could reach $6-$7 by the end of Q3, especially with the RSI showing room to climb. However, traders will want to watch out, as failure to hold at $3.47 (50 SMA) could send the Raydium price dipping to $3.19.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.