Highlights:

- The price of Quant has surged over 40% in a month, to the $106 mark.

- Quant CEO has unveiled the launch of OverLedger Fusion, which allows faster and scalable transactions.

- CoinGlass data shows increased interest in the QNT token, which could push it towards the $150 mark.

The Quant price has surged 10%, breaking the $105 key resistance mark to $106 in the past 24 hours. Its trading volume has notably gone ballistic by 298% to $52M, indicating intense market activity. QNT is now boasting a 12% surge in the past week and 44% in a month, indicating an intense bullish grip.

What’s Behind Quant Price Surge?

Quant CEO, Gilbert Verdian, recently revealed the launch of Overledger Fusion. It is an advanced Layer 2.5 network that brings new advantages to public blockchains for institutions, companies, and users in the DeFi space. By using multi-ledger roll-up technology with Overledger Fusion, institutional blockchain usage is supported by solving problems related to scalability, privacy, compliance, and security.

— Gilbert Verdian (@gverdian) May 26, 2025

With its secure multi-chain solution, Overledger Fusion allows faster and more scalable transactions among many Layer 1 blockchains and stays in line with regulators’ rules. Powering the Quantum ecosystem is the network’s native token, Quant (QNT), which has seen strong evidence of bullish momentum lately.

Quant Price Technical Outlook

Recently, QNT has experienced a strong upside, jumping by 10%, and overcoming resistance levels. The regular price chart outlines a cup and handle structure which typically means the price is likely to rise further. Even though QNT is getting close to being overbought on the RSI, the token is still moving strongly. Besides, the MACD indicator signals bullishness because it has crossed over and is indicating that bulls remain active. With the momentum here, QNT may surpass $150 in price in the coming days.

Various essential technical indicators support the expectation of QNT prices growing higher. The Quant price is comfortably above both its 50-day and 200-day moving averages at $82.6 and $94.4, respectively. According to the chart, there is a healthy consolidation happening before we can expect a rise in the Quant price. RSI is close to oversold, yet has some space to reach a higher point, and the MACD’s positive histogram suggests that momentum is rising. All these signals suggest that QNT may continue to surge before the token hits the overbought region.

Derivatives Market Highlights Rising Volume and Interest

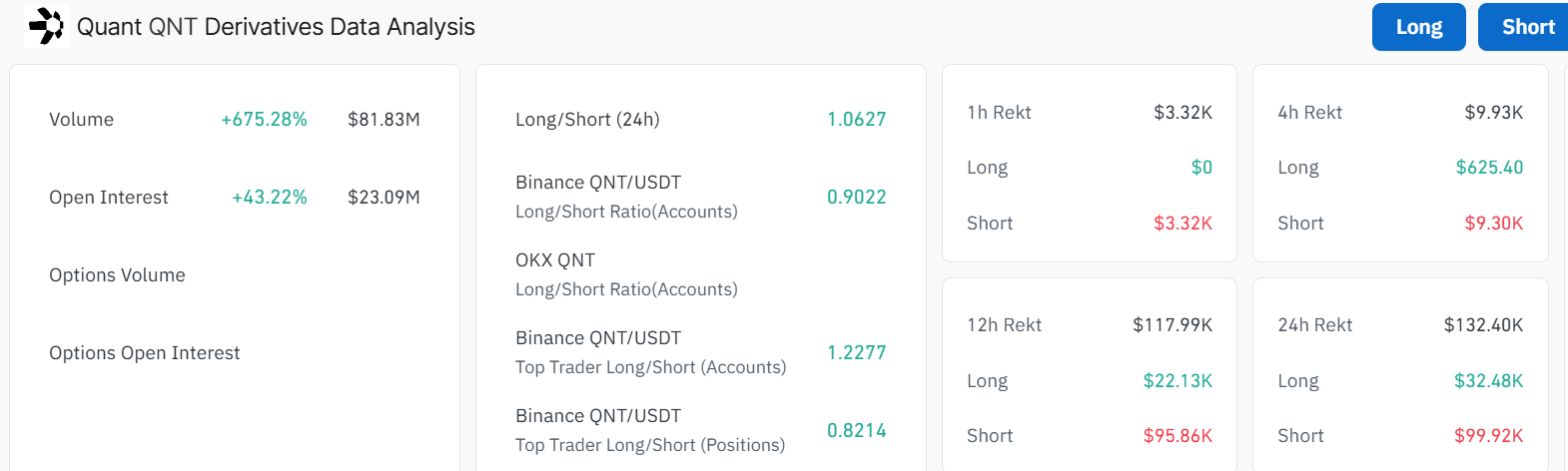

In addition, the derivatives data support the optimistic view for Quant. Trading and interest in the QNT market have increased greatly, leading to volume rising a staggering 675%, reaching $81.8 million.

Traders on both sides have shown more commitment through the rise in open interest by 43%. The small difference between long and short positions means that traders feel that prices will continue rising. What stands out is that most activity by top traders on Binance indicates a stronger belief in sustaining long trades.

Meanwhile, if Quant bulls maintain the positive momentum, the token could surge further. In such a case, the bulls could target $112, $127, and $150 resistance marks. However, if the token hits overbought, the Quant price may retrace towards key support zones. In such a scenario, the $100, $94, and $89 support areas will be in line to absorb the potential selling pressure. In the meantime, with the $105 resistance broken, the surging volume would sustain the upward movement, reaching the $150 mark in the future days.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.