Highlights:

- ProShares receives SEC approval to launch three XRP futures ETFs on April 30.

- SEC delays decision on spot XRP ETFs, approval likely within this year.

- CME Group to launch XRP futures contracts on May 19, offering both micro and standard sizes.

United States Securities and Exchange Commission (SEC) has approved ProShares, a leading issuer of leveraged and inverse ETFs, to launch three XRP futures-based exchange-traded funds (ETFs). The SEC filing states that the new ETFs tracking XRP’s price will launch on April 30. These include the UltraShort XRP ETF targeting -2x daily performance, the Ultra XRP ETF designed for about 2x daily returns, and the Short XRP ETF, which allows investors to benefit from price drops.

The U.S. SEC has approved ProShares Trust to launch multiple XRP-related futures ETFs, but not XRP spot ETFs, with an effective date of April 30, 2025. The approved products include ProShares UltraShort XRP ETF, ProShares Ultra XRP ETF and ProShares Short XRP ETF, which are…

— Wu Blockchain (@WuBlockchain) April 27, 2025

These ETFs will be the second, third, and fourth XRP-related ETFs to launch in the U.S. market. The first XRP futures ETF by Teucrium began trading at the NYSE on April 8 and received a strong response. Teucrium launched its 2x Long Daily XRP ETF in response to increasing investor interest in XRP. This interest was driven by the impact of Donald Trump’s election win. This sparked favorable regulatory changes for the crypto industry, including the legal outcome between Ripple Labs and the SEC. A futures-based ETF follows the price of XRP futures contracts, in contrast to a spot ETF.

ProShares’ application for spot XRP ETFs is still under SEC review. Meanwhile, the first spot XRP ETF by Hashdex began trading in Brazil earlier this week. Nevertheless, the launch of these XRP futures ETFs remains significant. These products provide a regulated method for gaining exposure to XRP’s price fluctuations, potentially attracting institutional investors.

SEC Delays Decision on Spot XRP ETFs, but Approval Likely This Year

The SEC has delayed its decision on multiple spot XRP ETF proposals, including those from Bitwise, WisdomTree, and Grayscale. Such delays are typical in the SEC’s process for reviewing crypto ETFs. It is not exclusive to XRP-related products. Applications for other altcoin-linked ETFs, including those for Solana (SOL), Dogecoin (DOGE), and Litecoin (LTC), are also awaiting approval.

ETF experts are hopeful that the SEC will approve spot crypto ETFs within this year, with Litecoin ETFs potentially leading the way. Analysts have also become more confident about the approval of XRP ETFs, especially after Paul Atkins was appointed SEC Chairman.

CME Group to Introduce XRP Futures

Earlier this week, CME Group, a leading derivatives exchange operator, announced to launch of XRP futures on May 19. The exchange will provide micro contracts for 2,500 XRP and larger ones for 50,000 XRP. These contracts will be cash-settled, using the CME CF XRP-Dollar Reference Rate calculated daily at 4:00 p.m. If approved, XRP will become the fourth cryptocurrency available for futures trading on CME, alongside BTC, ETH, and SOL.

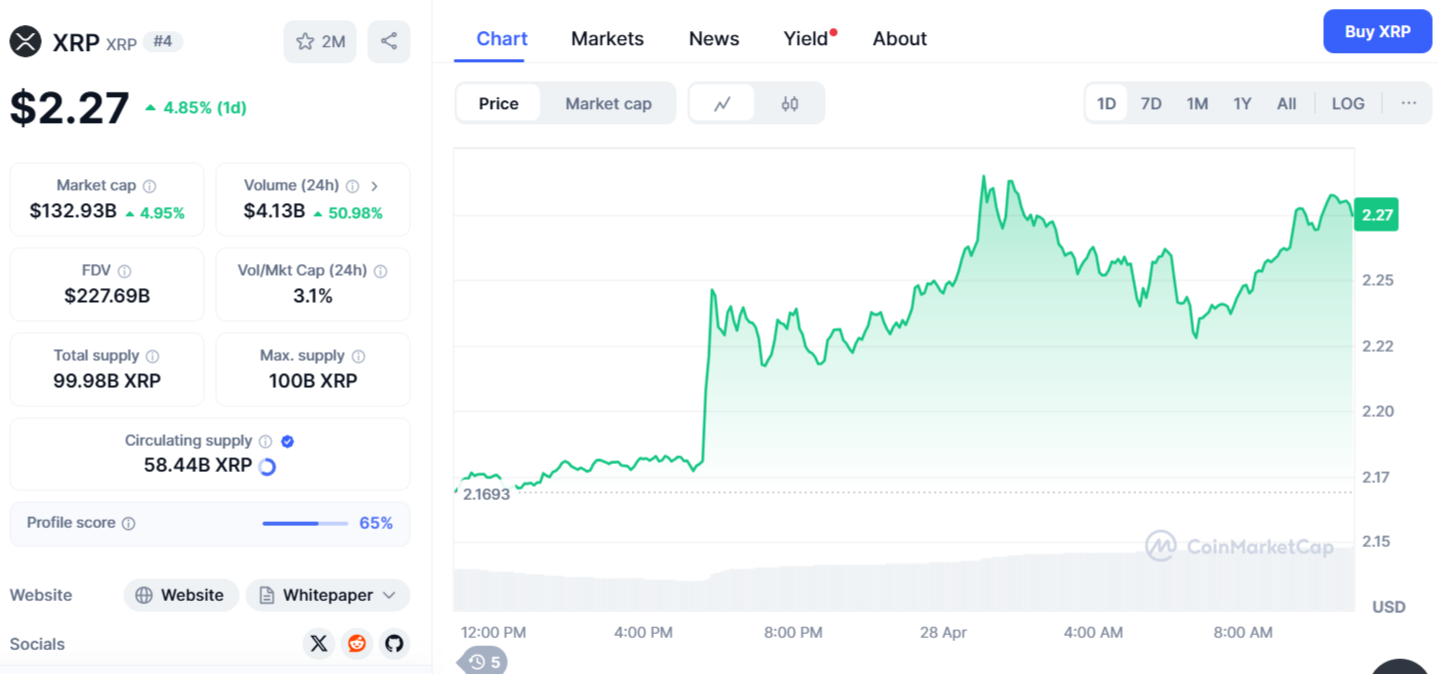

Market data currently shows XRP trading at $2.27, marking a 4.85% increase in the last 24 hours, according to CoinMarketCap. The inclusion of XRP is not coincidental. With a market cap exceeding $132.93 billion, it is now the fourth-largest cryptocurrency.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.