Highlights:

- Polymarket is seeking $50M in funding and is considering launching a token for event outcome validation.

- The platform saw over 75,000 new users in August, driven by a surge in 2024 U.S. presidential election betting.

- Regulatory scrutiny from the CFTC poses challenges over potential derivatives trading activities.

Blockchain-based prediction platform Polymarket seeks $50M in new funding. The platform experiences a surge in user activity tied to the 2024 U.S. presidential election. The New York-based startup is also considering launching its own token. The token would enhance the verification of real-world event outcomes on its platform.

Polymarket is seeking $50 million in fresh funding, according to The Information. It is also considering issuing its own token. Investors in the proposed round would receive warrants entitling them to buy the tokens should Polymarket go ahead with the issuance plan. Polymarket…

— Wu Blockchain (@WuBlockchain) September 24, 2024

Potential Token Launch for Event Verification

According to a report by The Information, the proposed $50 million funding round is expected to provide investors with warrants. These warrants allow them to purchase tokens if Polymarket moves forward with the token issuance. The potential token would enable users to validate event outcomes, enhancing existing mechanisms for resolving markets.

Currently, Polymarket relies on the UMA Protocol as its oracle service for event outcome verification. It remains unclear whether the new token would supplement or replace UMA’s role. However, Polymarket describes itself as “oracle agnostic” in its documentation. This indicates flexibility in its approach to data verification.

Election Betting Drives User Growth

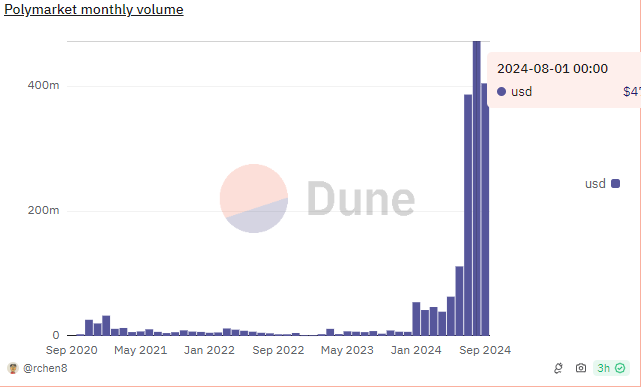

The Polymarket has witnessed significant growth. It has become a hub for political betting ahead of the upcoming presidential race. In August alone, the platform added approximately 75,000 new accounts. This reflects a growing interest in political prediction markets. Traders have staked nearly $1 billion on the U.S. presidential election, making it the most popular topic.

Monthly trading volume on Polymarket reached an all-time high of $472 million in August. The platform allows users to bet on various real-world events. These range from sports matches to geopolitical tensions. Bets are settled in USDC, a stablecoin pegged to the U.S. dollar. Users interact with smart contracts on the Polygon blockchain.

Regulatory Scrutiny Presents Challenges

As Polymarket seeks $50 million in funding and expands its operations, it faces increasing regulatory scrutiny. The U.S. Commodity Futures Trading Commission (CFTC) warned Polymarket this month. The agency cautioned about offering derivatives contracts to U.S. customers without proper registration. CFTC Chairman Rostin Behnam indicated that enforcement actions could be taken against offshore platforms providing such services to U.S. users.

Polymarket currently blocks users with U.S. IP addresses to comply with regulatory requirements. Reports suggest that some U.S. traders have bypassed these restrictions using virtual private networks (VPNs). Additionally, the introduction of a token could subject Polymarket to further regulatory oversight, especially if the token is classified as a security.

Background and Previous Funding

Earlier this year, Polymarket raised $70 million across two funding rounds. General Catalyst led a $25 million round. A $45 million Series B round was led by Peter Thiel’s Founders Fund. Now, Polymarket seeks $50 million in funding to further expand its platform.

Excited to share that @Polymarket has raised $70m:

A $45m Series B led by Founders Fund and insiders 1confirmation and ParaFi + @VitalikButerin, & Dragonfly

And a $25m Series A led by General Catalyst + Polychain, @jgebbia, & more

— Shayne Coplan (@shayne_coplan) May 14, 2024

Investors in the new funding round have not been disclosed, and it is unclear whether they will receive equity or solely token warrants. The platform’s valuation also remains undisclosed. The strong financial backing reflects investor confidence in Polymarket’s innovative approach and growth potential. This positions it as a prominent player in the prediction market space.