Highlights:

- The Polygon price is up 5% today to exchange hands at $0.15.

- Polygon has acquired Coinme and Sequence for over $250 million, regulating on-chain money movement in 48 states.

- The positive market outlook signals a potential surge, as POL eyes $0.19 if key support holds.

Polygon (POL) is up 5% today, trading at $0.15. On Tuesday, the Ethereum (ETH) scaling ecosystem acquired Coinme and Sequence for more than $250 million, bringing it one step closer to operating as a US-regulated blockchain payments company. On-chain records indicate that large-wallet investors are increasing exposure to POL, suggesting new demand.

On Tuesday, Polygon said it would pay more than $250 million after acquiring Coinme, a Bitcoin ATM kiosk service provider, and Sequence, a crypto wallet infrastructure provider. This is an evolution in Polygon’s Open Money Stack roadmap, a cross-border stablecoin payment infrastructure.

BREAKING: Polygon to become U.S. regulated payments platform

We’re acquiring Coinme and Sequence to move all money onchain.

→ Regulated money movement in 48 states

→ Fiat on/off ramps

→ 50,000 fiat-to-crypto locations in the U.S.

→ Easy onboarding with wallet infra

→… pic.twitter.com/lwvLheEc3P— Polygon | POL (@0xPolygon) January 13, 2026

The recent acquisition provides regulated on-chain money movement access in 48 money-transmitter-licensed states. It also provides licensed wallet infrastructure, 50,000 point-of-sale locations in the US, and on- and off-ramps for fiat-to-crypto movement.

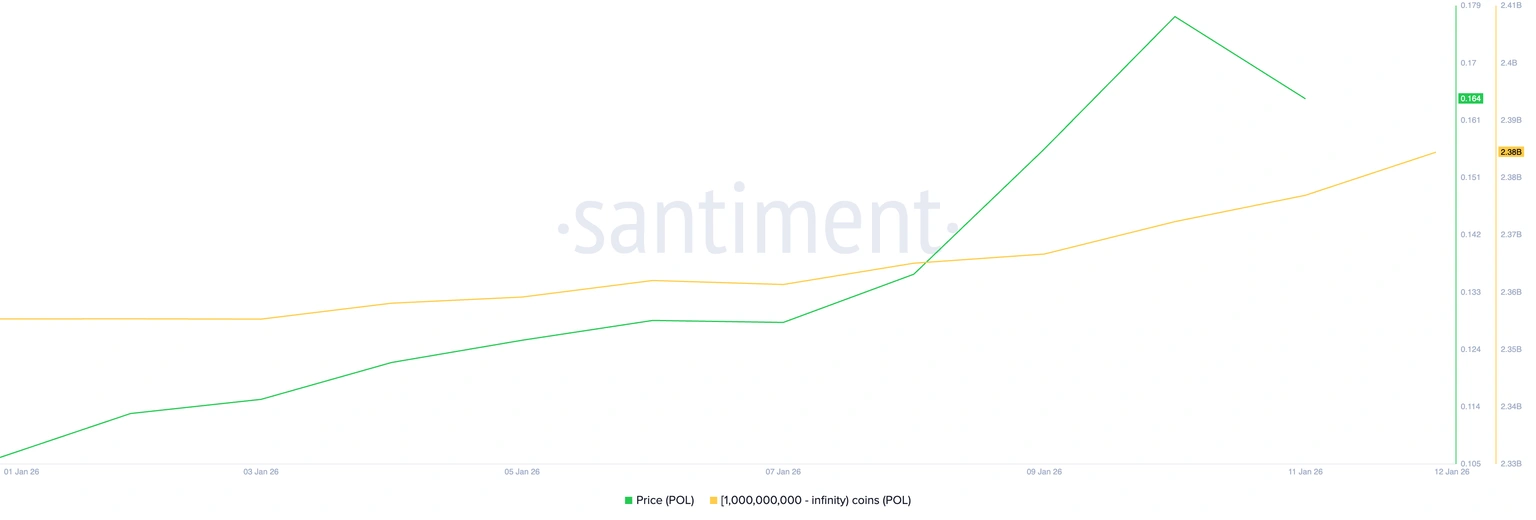

Additionally, the Santiment data indicates consistent whale demand, with whales accumulating more holdings. There are over 1 billion POL holding whales, holding a total of 2.38 billion tokens, which is higher than the 2.35 billion on January 1. This further indicates renewed interest this year, which may drive a surge in the Polygon price.

POL Eyes $0.19 Zone as Bullish Momentum Builds

The Polyon price has rebounded from the $0.12 support level and is testing $0.15. From November through most of January, POL has been consolidating between $0.10 and $0.14. This provided strong support, with buyers stepping in whenever the price dropped. The breakout above $0.15 has triggered fresh momentum, which could see POL eye $0.19, the next key resistance zone.

The chart shows that $0.19 is a key resistance level. Sellers are active at this point, and the price has not closed above it yet. On the other hand, if it bears prove too strong at this level, the price may fall back to the support zone near $0.14–$0.12.

The Relative Strength Index (RSI) is currently around 65.01, indicating the bulls are showing intense buying pressure. This means the token still has room to rise before hitting the overbought conditions.

If the RSI eases while the price remains above support, the POL token may be setting up for another rally. A breakout above the resistance could open the way toward $0.24 or beyond. At the moment, the structure appears to be a classic breakout pattern. The consolidation established a strong base, and the recent rise shows clear buying pressure. Now, the market is watching whether the Polygon price can build enough strength to push past $0.19.

For traders, the key levels are clear. The $0.12 level is strong support, and $0.19 is major resistance. A breakout above $0.19 could signal the start of a stronger uptrend, while a rejection may bring the token back into a sideways range. In short, the Polygon price has moved from months of stagnation into a decisive breakout, but it still needs to clear resistance to confirm a longer-term bullish trend.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.