Highlights:

- Boiron predicts BTC could reach $250k, citing scarcity and growing demand.

- Hackers stole $1.5 billion from Bybit, causing Bitcoin and Ethereum prices to dip.

- Analysts remain bullish, with Scaramucci projecting Bitcoin could reach $200,000 this year.

In a roundtable interview with Rob Nelson, Marc Boiron, CEO of Polygon Labs, predicts that Bitcoin’s price could reach $250,000. He described Bitcoin as the easiest financial asset to understand, though many people fail to grasp this concept. Boiron emphasized that the cryptocurrency’s scarcity and rising demand will drive its price upward.

Boiron considers Bitcoin among the safest investment options in today’s financial landscape. He noted that although traders often focus on short-term volatility, Bitcoin’s fixed supply of 21 million coins supports long-term value growth as adoption rises. “You have this asset with a fixed supply, and all you need to determine is whether demand for this asset will increase or not. It’s literally that simple,” Boiron stated.

Boiron sees less downside risk for Bitcoin price despite its notorious volatility. He believes current market conditions offer more stability. The Polygon Labs executive emphasized that clearer regulations could lower the risks tied to Bitcoin investments. He said well-defined government policies in the digital asset space may enhance confidence among institutional investors.

Crypto Prices Dip After $1.5 Billion Bybit Hack

Crypto prices fell on Friday after hackers stole nearly $1.5 billion from the Bybit exchange. Security analysts attribute the attack to North Korea’s Lazarus group. They expressed deep concern over the group’s sophisticated methods, especially given it was the largest hack in crypto history.

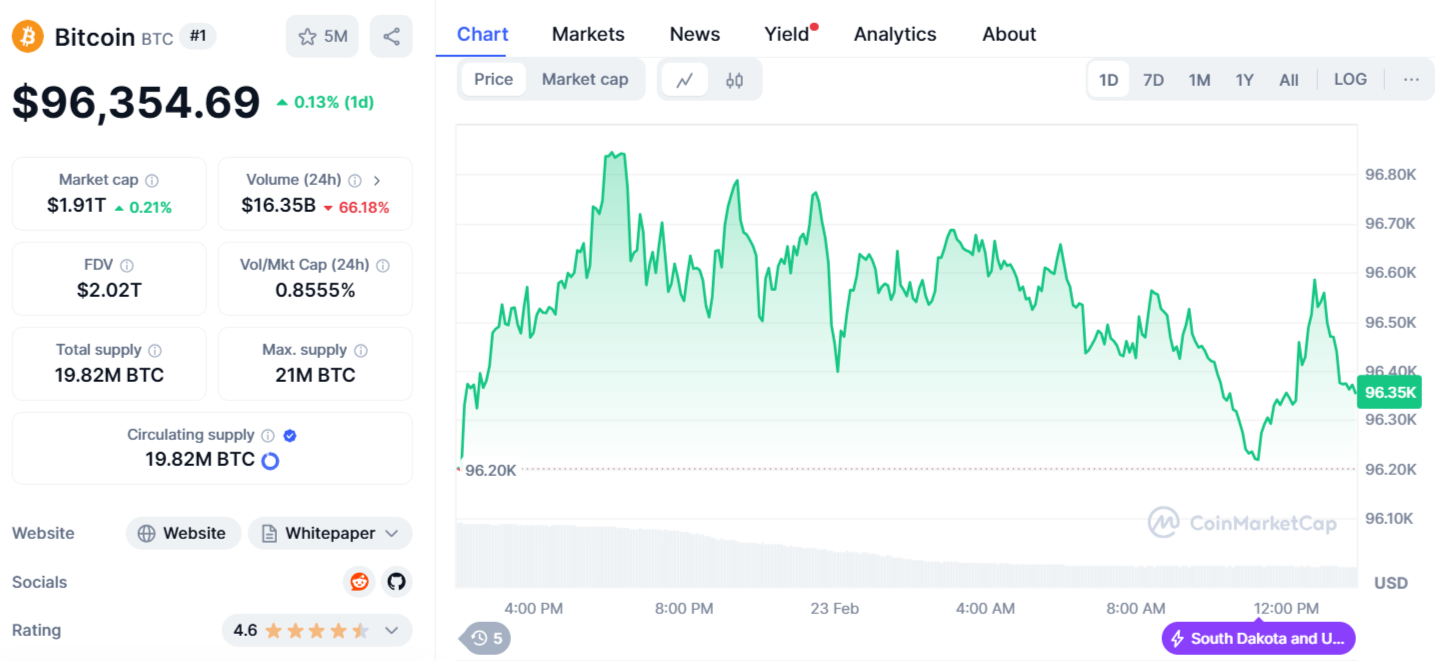

Bitcoin price slipped below $97,000, retreating from recent highs near $100,000. It is now trading at $96,354, marking a 0.13% increase over the past 24 hours. Ethereum also faced downward pressure, dropping nearly 4% on Friday to under $2,700. However, it has since rebounded by 4.72% in the last 24 hours, climbing to $2,823.

On Friday, Coinglass reported that liquidations exceeded $500 million. Despite these short-term dips, Boiron and other industry leaders remain positive about Bitcoin’s future. They believe its limited supply and rising institutional interest will continue to drive long-term price growth.

Analysts Remain Bullish on Bitcoin

It turns out that the CEO of Polygon Labs is not the only bullish on BTC. Other financial firms have also presented optimistic projections. CEO of ARK Investment Management, Cathie Wood, said BTC’s recent stabilization around the $100,000 mark is a healthy development. She anticipates a significant price increase in the future, driven by early-stage institutional adoption and evolving regulatory landscapes.

Moreover, SkyBridge Capital founder Anthony Scaramucci anticipates Bitcoin price could hit $200,000 this year with a $4 trillion market cap, similar to Apple and Nvidia. He cites potential U.S. Bitcoin reserves and growing institutional adoption as key drivers. He believes Bitcoin’s market cap could reach $15–20 trillion, like gold’s global value. Achieving this would make Bitcoin a mainstream financial asset, especially popular among younger investors.

Anthony Scaramucci was a hot Wall Street manager last year thanks to crypto. Now he sees bitcoin hitting $200,000 — this year. https://t.co/Hp6wjUmUt3

— MarketWatch (@MarketWatch) February 18, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.