Highlights:

- The price of Pepe has soared 5% to $0.000014 in the past 24 hours after US President Donald Trump’s Truth Social post.

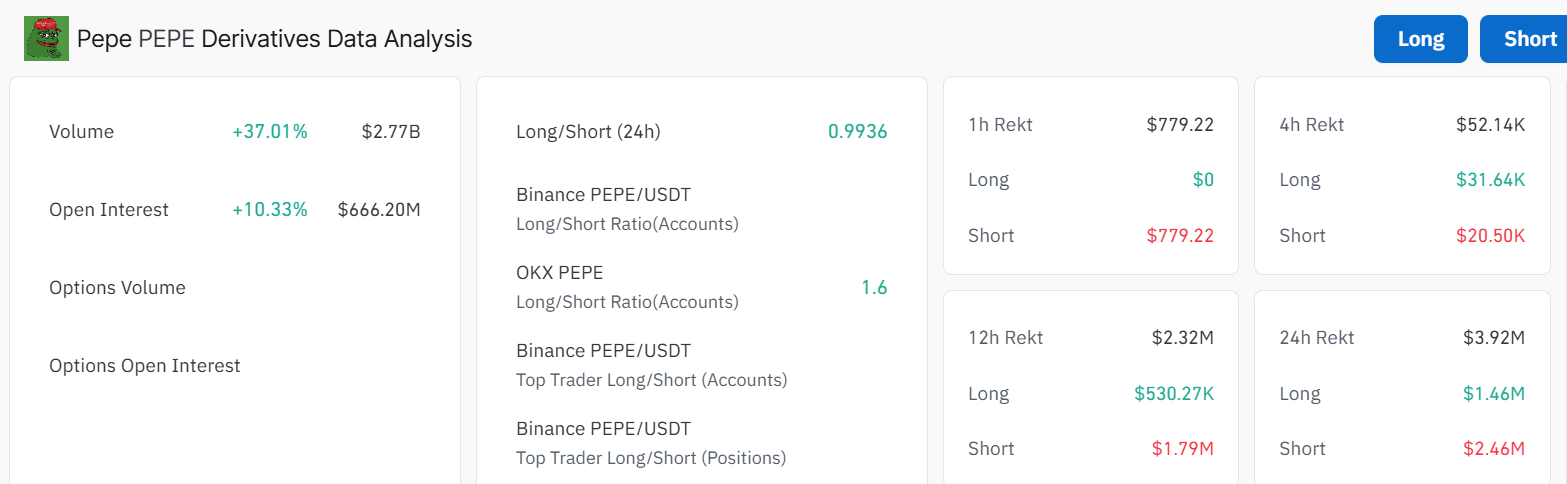

- The derivatives market shows strong trader activity with a 37% volume increase and a balanced long-short ratio.

- The Pepe technical indicators point to a potential upside towards $0.00002.

Recently, the Pepe price saw a sharp rise, turning it into one of the hottest meme coins on the crypto market. This comes as US President Donald Trump posted a picture on his Truth Social featuring the frog-themed meme coin. This has sparked excitement in the crypto community, causing Pepe’s price to rally about 5% to $0.000014.

Nothing Can Stop What Is Coming pic.twitter.com/lrPorKJCiO

— Pepe (@pepecoineth) May 29, 2025

As a result, the meme coin began to trend, and trading volumes soared to $1.63 billion each day. The surge in its price recently is because traders see a rising demand and are hoping to profit quickly.

Pepe Price Technical Outlook

Positive features can be seen in Pepe Coin based on its technical data. The meme coin’s recent rise from a consolidation pattern puts it above the 50-day moving average at $0.00001044 and the 200-day MA at $0.000013. This shows that the bulls are in full control and could soar higher if they break above the consolidation channel.

Additionally, the RSI at 63 indicates that strong buying is there, with the price having good potential to rise further. The uptrend could last because the MACD shows buyers own the market, and the indicator sits in positive territory. However, the momentum indicator calls for caution as it has flipped below the signal line, indicating a potential sell signal.

Derivatives Market Data Indicates Robust Trader Engagement

As Pepe Coin prices rise, a busy derivatives market demonstrates increased investments both from retail investors and from institutions. Open interest and volume in Pepe derivatives saw rises of 10% and 37%, respectively. This points to greater participation and reliability in the market.

Cryptocurrency prices on Binance are still balanced, with the current ratio suggesting that the bulls and bears are only slightly out of step. Yet, on this exchange, the odds point toward bullish trading, with traders holding higher numbers of long positions. Due to how volatile and speculative memecoins are, the trading of derivatives can result in sudden price changes in any direction.

Pepe price rise shows memecoins are still an important part of the crypto market. Although online interest can quickly push prices up, investors must remember the risk of big price fluctuations. Based on its technical indicators, this coin may rise further, but strong speculation in memecoins means their prices can move in any direction very fast.

More derivatives are traded, and the resulting open interest means that the market is maturing and more advanced trades are being used. Because the long-short ratio is balanced, it looks like traders are keeping a close eye on what might happen with the token. Anyone interested in Pepe Coin needs to watch out for risk due to the swift changes in these assets’ prices.

What’s Next for PEPE?

Based on the overall outlook, the Pepe Bulls have the upper hand in the market. Meanwhile, if the buying interest soars and the support levels stay intact, the frog-themed meme coin could surge. This could propel Pepe price to $0.000016, $0.000019, and $0.00002 resistance zones in the short term.

On the downside, if the bears capitalize on the sell signal portrayed by the MACD indicator, the Pepe price will drop. In such a case, the $0.000013, $0.000012, and $0.000010 support zones will be in line to absorb the potential selling pressure. Meanwhile, as more people, including the US president, pay attention to Pepe Coin, it serves to highlight how memecoins can encourage excitement and the big price jumps in the crypto world.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.