Highlights:

- The PancakeSwap price has slipped over 8% in a week, to trade at $1.25 today.

- The derivatives data show weakening retail demand, as the open interest declines.

- Technical outlook shows an intense bearish grip, as CAKE could drop to $1.18 lows.

At the time of writing, on Friday, PancakeSwap (CAKE) is trading below $1.25, which is a continuation of the losses that have been over 8% so far this week. Moreover, the crypto market shows weakening momentum, as BTC price is hovering around $66,000, and ETH is struggling below $2000. Further bearing of the bearish view is the weakening of the derivatives market, where the bears are targeting the $1.18 lows.

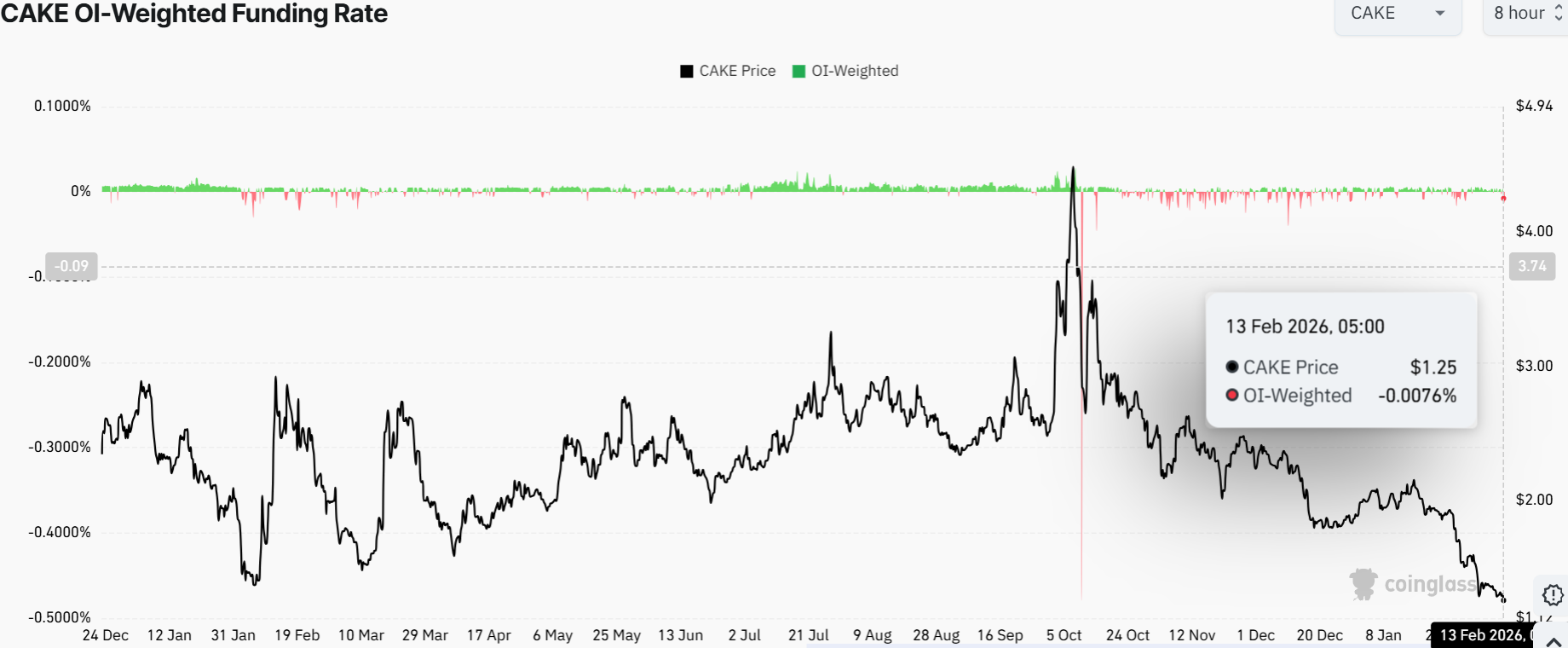

PancakeSwap derivatives data also indicates a bearish direction. According to the Coinglass OI-Weighted Funding rate data, there are more traders who bet the price of CAKE will continue to slide as compared to those who are expecting the price to increase.

The rate has become negative on Friday and is at -0.0076%, which was close to the point of departing the end of January price dips. The negative ratio implies that shorts are covering longs, which indicates that there is a negative attitude towards the PancakeSwap price.

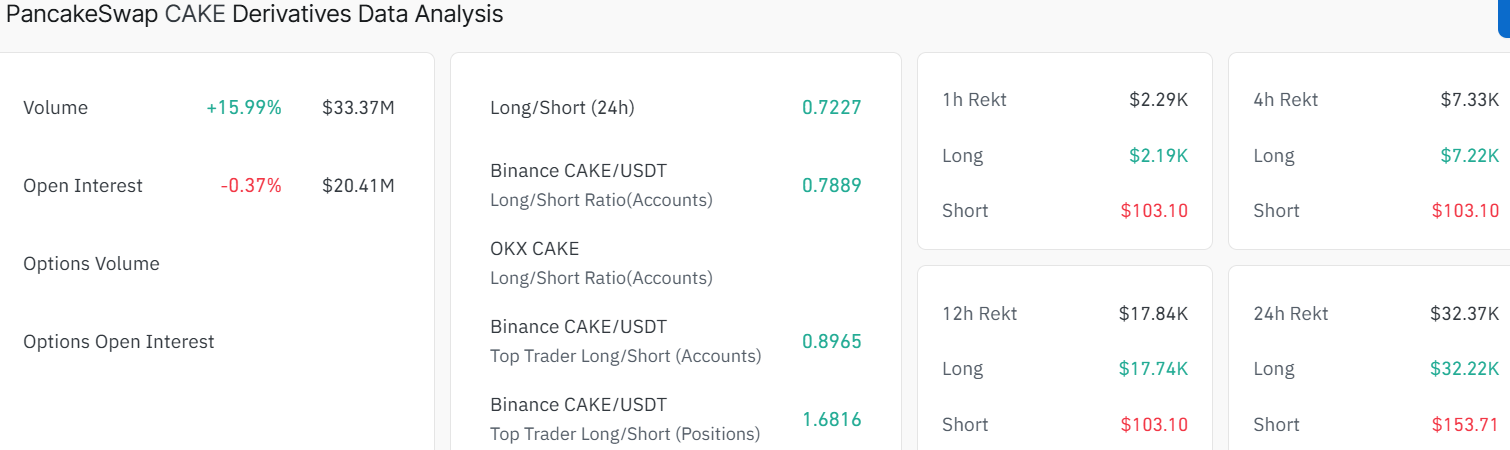

Moreover, the futures Open Interest (OI) of CAKE has plummeted to $20.41 million on Friday. The last time being at those levels was mid-March 2025. It has been steadily declining since the January 6 peak of $43.57 million. This decline in OI keeps investors out and gives a negative forecast. However, the volume is surging, currently up 15% to $33.37 million, indicating heightened market activity. Despite the mixed sentiment, CAKE bulls need to show momentum to regain control in the market.

PancakeSwap Price Eyes $1.18 Lows as Bearishness Rises

The PancakeSwap price has been in a prolonged downtrend, within a falling parallel channel, currently exchanging hands at $1.25 in the last 24 hours. The coin is below its important 200-day simple moving average (SMA) at $2.38, which acts as a strong long-term resistance. The 50-day SMA at $1.79 serves as the immediate resistance, meaning CAKE needs to clear this zone to regain upward momentum.

Looking at the chart, the CAKE price is trading at $1.25 near its recent lows at $1.18. The price currently sits close to the $1.25 zone, as the bears show intense grip. Moreover, the technical indicators reflect oversold market conditions. The Relative Strength Index (RSI) is 24.27, suggesting no strong momentum. The MACD is below the signal line, signalling heightened selling appetite in the CAKE market.

Meanwhile, if CAKE breaks above the 50-day SMA at $1.79, the next resistance zone lies between $2.10 and $2.38. Surpassing this could trigger renewed buying interest and a test of higher levels near the $2.62.

However, with the tumbling crypto market and weak technicals, the PancakeSwap price could drop further. If resistance levels prove too strong, CAKE might revisit lower supports near $1.18, recent lows, risking further short-term selling. In the meantime, the technical indicators suggest a wait-and-see market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.