Highlights:

- Bitcoin plunged 10% in the past 24 hours, while Ether tumbled 20%.

- Over $825 million in crypto positions liquidated in the past 24 hours.

- The crypto market crash results from global sell-offs, geopolitical tensions, and uncertain US politics.

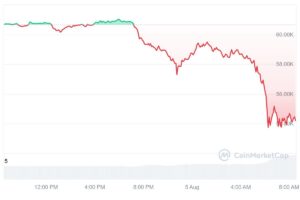

On August 5, the price of Bitcoin (BTC) fell to $52,500, marking a sudden 10% drop from $58,350 in less than two hours. Since then, BTC has partially recovered and was trading at $54,196 at the time of writing.

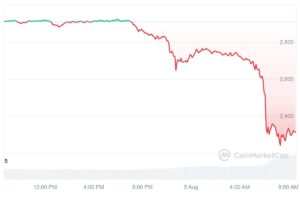

The last time Bitcoin plunged below $53,000 was on February 26 of this year, following a price rally sparked by the approval of spot Bitcoin exchange-traded funds (ETFs) in the United States. Ethereum (ETH) also dropped to its lowest level since February, losing 10.48% to trade at $2,313 at the time of writing.

Other highly traded cryptocurrencies, such as SOL, XRP, DOGE, and BNB, also saw significant drops today. Currently, the entire crypto market cap stands at $1.88 trillion, reflecting a 12.68% decrease over the past 24 hours.

More than $825M Liquidated in the Past 24 Hours

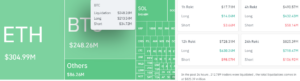

According to data from Coinglass, over $825 million worth of leveraged positions have been liquidated on centralized crypto exchanges (CEXs) in the last 24 hours. More than $718 million in longs and $106 million in short positions have been liquidated. This widespread liquidation activity has affected 212,789 traders. Most liquidations happened on Binance and OKX, with $320 million and $251 million, respectively.

Bitcoin saw liquidations totalling $248 million, with $213 million from long positions and $34 million from short positions. The second-largest crypto, Ethereum, recorded liquidations amounting to $305 million, comprising over $269 million from long positions and $36 million from short positions. Solana’s SOL fell 11.26% to trade at $129, while Dogecoin dropped over 14.80%. Dogecoin and Solana saw the liquidation of $10 million and $40 million, respectively, in the past 24 hours.

Key Reasons Behind Crypto Market Crash

Bitcoin plunging alongside other altcoins indicates a significant market correction or sell-off, potentially triggered by broader economic factors.

The Bank of Japan’s unexpected interest rate hike last week to 0.25% from 0%–0.1% strengthened the yen and led to a drop in Japanese stocks. The Nikkei index dropped 15% over three days and is now 20% below its mid-July peak, according to Bloomberg. This volatility has also impacted global markets, with the US Nasdaq falling more than 5% in the last two trading sessions of the previous week.

Japan’s markets led losses in the region as the Nikkei 225 and Topix dropped as much as 7% in volatile trading. Monday’s decline follows Friday’s rout. On Friday in the U.S., stocks fell sharply as a much weaker-than-anticipated jobs report for July ignited worries that the… pic.twitter.com/ZqiWBJYKl4

— Wu Blockchain (@WuBlockchain) August 5, 2024

Many observers on X linked the drop to Israel’s preparations for potential attacks from Iran and Hezbollah, with warnings of possible assaults starting as early as Monday.

Everyone is panick selling everything like it's the end of the world. Well it's not!#Bitcoin and the #crypto are down so bad like traditional stock market because people are so afraid of the #Israel – #Iran play. pic.twitter.com/47A3ZvoC3Q

— Block🔗c hained 🐻 (@HoMainman45244) August 5, 2024

Also over the weekend, Jump Crypto, the cryptocurrency division of Jump Trading, began transferring hundreds of millions of dollars in crypto assets, including ether and USDT. This led to speculation that the firm might be liquidating its holdings in response to an ongoing investigation by the US Commodity Futures Trading Commission.

Meanwhile, the approaching US presidential election is adding to uncertainty for crypto investors, as US Vice President Kamala Harris started seeing growing approval. Polymarket’s election poll shows Harris a 45% chance of winning, up from 30% when Biden endorsed her. Although Trump strongly supports crypto, Harris does not match his level of support. However, her campaign recently added David Plouffe, a former Binance advisor, to boost crypto outreach.

This recent downturn is the largest 72-hour loss in over a year, wiping out between $200 and $500 billion from the total crypto market capitalization. The situation remains dynamic, with investors and analysts closely watching the market fluctuations and their potential impact on the global economy.