Highlights:

- South Korea’s crypto investors surpassed 15.59 million, accounting for over 30% of the population.

- Bitcoin prices surged, boosting total crypto holdings to 102.6 trillion KRW in November.

- The average daily trading volume of crypto exchanges reached 14.9 trillion KRW in November.

Data from the Bank of Korea revealed a rise in cryptocurrency investors in South Korea. By the end of November, the number of domestic crypto asset investors surpassed 15.59 million, making up over 30% of the country’s 51.23 million population. This represents a significant increase of 610,000 new investors from October’s total of 14.98 million. Data from South Korea’s top five exchanges—Upbit, Coinone, Korbit, Bithumb, and GOPAX—shows this increase. The growth follows rising optimism in the virtual asset market after the U.S. presidential election.

According to data from the Bank of Korea, as of the end of November, the total number of cryptocurrency investors in South Korea exceeded 15.59 million for the first time, accounting for more than 30% of the country's population, with total assets of US$79 billion and average…

— Wu Blockchain (@WuBlockchain) December 25, 2024

Surge in Crypto Investors and Market Growth in South Korea

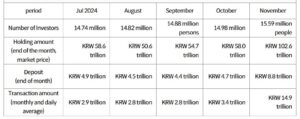

November saw the highest increase in crypto investors in South Korea. However, in the preceding months, the number of investors grew steadily by around 100,000 people each month. In July, there were approximately 14.74 million domestic asset investors. This number rose to 14.82 million in August, 14.88 million in September, and 14.98 million by the end of October.

The sharp increase in investors in November aligns with a notable rise in Bitcoin prices. Bitcoin surged from around 100 million KRW at the end of October to over 135 million KRW by late November. Additionally, the influx of domestic investors and the rise in Bitcoin prices helped boost the total crypto holdings to 102.6 trillion KRW (approximately $70 billion) in November. This is a significant increase compared to 58 trillion KRW (about $40 billion) in October.

At the end of November, deposits in exchanges that had not yet been invested totaled 8.8 trillion Korean won. The average daily trading volume of domestic virtual asset exchanges also surpassed the combined trading volumes of South Korea’s Kospi and Kosdaq stock exchanges. It reached 14.9 trillion won in November. In the months before November, however, the average daily transaction volumes fluctuated between 2 and 3 trillion KRW. October recorded a daily trading volume of only 3.4 trillion KRW.

Rep. Lim Gwang-hyun of the Democratic Party of Korea, a member of the National Assembly Planning and Finance Committee, commented on the expanding virtual asset market. He said, “The virtual asset transaction volume is rapidly increasing to a level comparable to that of the stock market.”

South Korea Enforces Virtual Asset Protection Act and Releases First Crypto Data

On July 19, the Virtual Asset User Protection Act, introduced by South Korea’s Financial Services Commission (FSC), came into effect. The regulations mandate insurance to protect users’ crypto assets from hacking and malicious attacks.

Providers must also keep customers’ crypto assets separate from the exchange’s assets. Additionally, banks must securely hold customer deposits. Virtual asset service providers (VASPs) must maintain due diligence to prevent money laundering. They must also report any suspicious transactions to the regulator.

SOUTH KOREA'S NEW CRYPTO REGULATORY LAW NOW IN EFFECT: FACTS…

– South Korea’s Virtual Asset User Protection Act (VAUPA) officially took effect on July 19, 2024, marking a crucial milestone in the regulation of the country’s expanding cryptocurrency market.

Here’s a breakdown… https://t.co/sy06gK7ayB pic.twitter.com/YPNGgAgU7W

— BSCN (@BSCNews) July 19, 2024

According to Yonhap, the data was collected and released in response to the country’s new regulations on crypto exchanges. This marked the first time statistical data related to crypto assets had been made publicly available.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.