Highlights:

- The price of Ondo has slid almost 1% to $0.82, with a 14% decrease in daily trading volume.

- Ondo Global Markets aims to make US securities, worth over $90T, globally available, boosting asset liquidity.

Ondo’s RSI at 38.42 and MACD below the signal line indicate weak bullish sentiment and further downside risk.

The Ondo price has slipped almost 1% to exchange hands at $0.82, as the crypto market struggles to regain momentum. Its daily trading volume has notably dropped 14%, indicating a fall in market activity. ONDO is now down about 10% in the past week, signalling some bearish momentum.

However, Ondo Finance has launched Ondo Global Markets to make US securities as useful as stablecoins have proved to be for the US dollar. Making US Treasuries and equities, over $28T and $62T together, globally available, Ondo intends to boost the fluidity and usefulness of these assets online. Can these recent developments trigger a bullish reversal in the Ondo market?

Stablecoins made the US dollar globally accessible, instantly tradable and fully composable.

Ondo Global Markets will unlock the same upgrades for US securities.

US Treasuries and equities represent $28T and $62T in market value, respectively.

Learn more about Ondo Global…

— Ondo Finance (@OndoFinance) June 4, 2025

Ondo Price Trades within a Descending Triangle Pattern

In technical analysis, a descending triangle is thought of as a sign of a bearish continuation. In ONDO’s situation, the price keeps showing a chart pattern with lower highs and a flat support line at $0.82. The situation points to more selling since every rally is weaker than the last one. Most of the time, the breakdown happens when the price closes below the support level.

Both the 50-day MA and the 200-day MA at $0.92 and $1.15 cushion the bulls against further upside, tilting the odds towards the bears. Moreover, if the bearish outlook sustains, the Ondo price could drop further.

A closer look at the technical indicators, at a level of 38.42, the RSI is showing that the market is not oversold, and the bullish sentiment is low. Notably, the MACD momentum indicator has plunged below the signal line, reinforcing the bearish grip. In the meantime, the bulls need to gain strength and break above resistance zones for a splendid bullish outlook.

Price Breakdown Scenarios and Key Support Levels

To confirm a bearish trend, ONDO has to finish its daily trading below $0.83 on support. As a result, there could be more sales, and the first goal for the price is $0.70. Moving down in price, the following critical support is $0.60, which is also the previous low, and an increased fall in price could extend the falling trend. Still, if the price can keep support at $0.82 and remain above the 50-day SMA of $0.93, the bearish movement might end.

On the other hand, if the price moves above the trendline and the 50-day SMA, it could mark the start of a reversal that might push the Ondo price to $1.15. At that point, the following resistances are seen at $1.36 and $1.54, depending on developing momentum.

Volume and Open Interest Analysis: Market Sentiment Overview

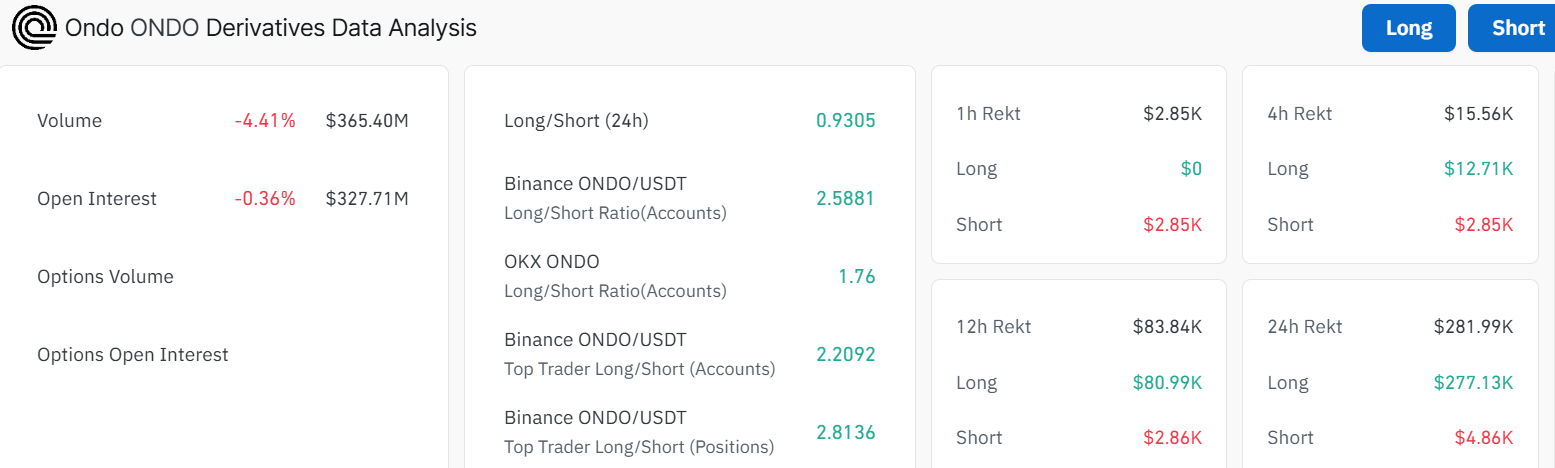

Trading volume in the derivatives market of ONDO is slightly lower, down by 4.41% to $365.40 million. On the other hand, open interest has gone down a little by 0.36%. Such declines are a sign that traders are unsure, since neither side has taken too much risk yet.

Nevertheless, according to Binance, most traders are holding onto long positions, as seen from the long-to-short ratio of 2.58. It proves that people in the market are ready or expect prices to go up again. Given the high level of uncertainty in the ONDO market, traders are advised to stay careful and notice any movements in the price, mainly when support and resistance barriers appear.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.