Highlights:

- The official Trump price slips 5% to $8.87, despite trading volume soaring 34%.

- The drop comes amid President Trump’s imposed executive tariffs on several trading partners.

- Technical indicators indicate oversold conditions, suggesting a rebound to $9.74 is likely.

The Official Trump price has dropped 5% to $8.87, as the daily trading volume soars 34% to $426 million. TRUMP has dropped 11% over the past week, despite a 2% surge over the past month. Meanwhile, President Donald Trump has recently issued a set of executive orders to raise import taxes by 10 to 41% in retaliation. These tariffs are imposed on various countries, including India (25%), Taiwan (20%), Canada (35%), and Switzerland (39%).

🚨Trump signed executive orders imposing reciprocal tariffs from 10% to 41% on imports from dozens of trading partners—including India (25%), Taiwan (20%), Canada (35%), Brazil (up to 50%), and Switzerland (39%). pic.twitter.com/gxxMS3gkdH

— QuoMarkets (@QuoMarkets) August 1, 2025

This has sparked controversy because it has the potential to cause augmented strain in trade and subsequently impact international supply chains. The latest tariff revision represents a significant jump compared to earlier expectations; the original proposal from Switzerland had been for an increase of 31% to 39%.

Official Trump Price Slumps Below Key Support Zones

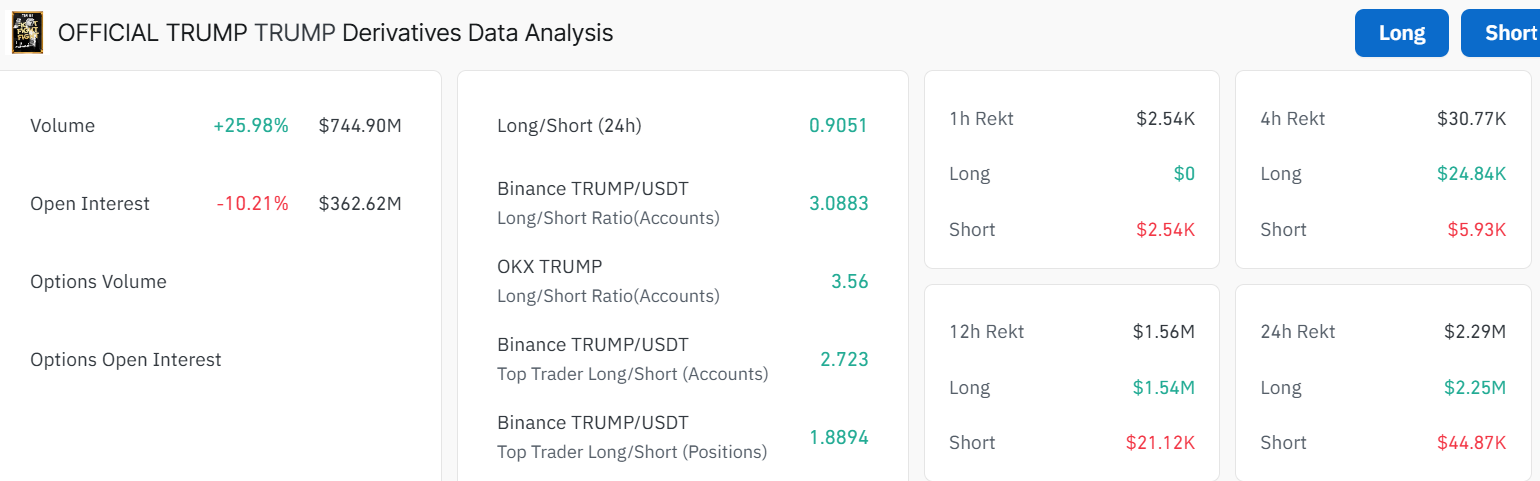

Along with these political events, financial markets have become less stable, and Trump-related derivatives have indeed continued to be traded in large volumes. According to the numbers in the official Trump Derivatives market, the amount of trading increased by 25.98% to $744.90 million. The open interest has dropped by 10.21%, currently standing at $362.62 million, despite an increase in volume. This decline in open interest suggests that traders are becoming more cautious. This is possibly due to the rising uncertainty surrounding the economic impact of these new tariffs.

More interestingly, trading sentiment on markets related to Trump has not been wildly swinging in terms of long-to-short ratios. The ratio and short positions are available on multiple platforms, including Binance and OKX, with a 24-hour ratio of 0.9051. This suggests that traders are taking a slightly more optimistic view of how Trump will perform in the market, but with caution due to the ongoing geopolitical tensions.

A quick look at the 4-hour chart shows a bearish sentiment in the Official Trump price. This is reinforced by the recent plunge of the TRUMP Token below key levels. The 50-day SMA ($9.74) and the 200-day SMA ($9.55) serve as the immediate resistance zones. This shows that the bears are having the upper hand. Moreover, the TRUMP price has slid below the falling triangle pattern, reinforcing the bearish trend.

The Relative Strength Index (RSI) indicates that the market is oversold, as it sits around 29.03. This indicates that the token is oversold, and if the bulls initiate a buy-back strategy, a potential rebound may occur soon. Nevertheless, the MACD (Moving Average Convergence Divergence) lies below the signal line, which supports the bearish sentiment.

Is a Rebound to $9.74 Imminent in TRUMP?

In the short term, the Official Trump price could rebound towards $9.48, a key resistance level. If the volume holds and the bulls show momentum, a close above $9.74 could see the token rally to higher levels, potentially $10.52.

On the flip side, if the bears continue the downside movement, bolstered by the sell signal from the MACD, the next support could be $8.74. A slip below this level will likely trigger further downside towards $8.45. For now, it’s a wait-and-see game. Investors may want to keep an eye on volume and the RSI, as a surge above 50 may signal it’s time to brace for further upside.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.