Highlights:

- The Official Trump price has dropped 4% to $10.89, as trading volume has decreased by 26%.

- Trump Media has acquired $2 billion in BTC for its treasury.

- TRUMP derivatives market shows a drop in volume and open interest, indicating reduced market activity.

The official Trump price has decreased by 4.25% to $10.85 over the past 24 hours. Its daily trading volume has notably dropped 26% to $955 million, indicating a decline in market activity. Despite the decrease, TRUMP is now 17% up over the past week and 27% over the past month, showing growing hype.

Meanwhile, the Trump Media is said to have acquired $2 billion worth of Bitcoin to set up its treasury. The action was posted as a viral tweet on 21 July 2025, creating commotion in the cryptocurrency markets. According to Trump Media’s official announcement, it plans to keep stacking sats and convert options into spot BTC.

ALERT 🚨 : Trump Media buys $2 billion worth of Bitcoin for its treasury. pic.twitter.com/fVsPbNyE2q

— Ant (@KingAnt777) July 21, 2025

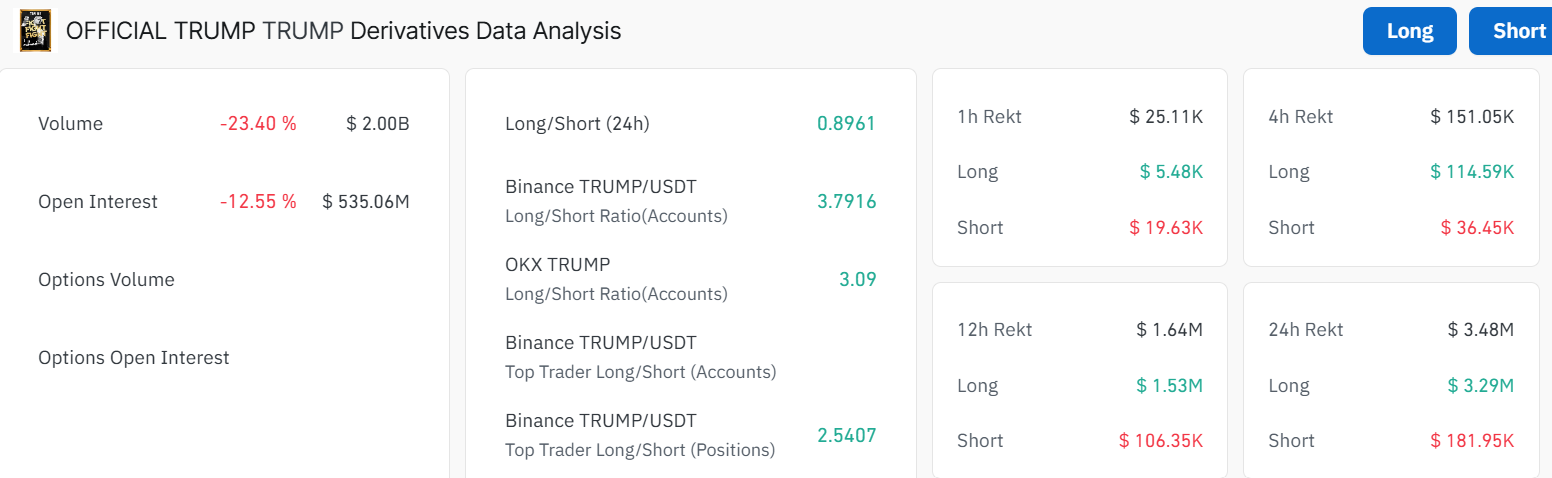

On the other hand, the TRUMP derivatives market, according to on-chain metrics, shows a drop in market activity. The volume of TRUMP tokens has decreased by 23.40% to $2.00 billion, whereas the open interest has fallen by 12.55% to $535.06 million.

The imbalance suggests that traders may have adjusted their positions in the short term. Nevertheless, the analysis by key exchanges shows a different picture, as Binance reveals a long/short ratio of 3.79, indicating robust positions on the long side. However, the total long-to-short ratio sits at 0.8961, signalling that the bears are showing strength.

Official Trump Price Poised for Further Upside

A quick look at the 4-hour chart, the official Trump price is trading well within the confines of a rising parallel channel. Having reached a low of approximately $9.02 in mid-July, the token has risen to $10.89, marking a gain of about 20%. Considering that the present price is trading above the 50-day MA at $10.14, the bulls seem to be in control.

On the other hand, the Relative Strength Index (RSI) of 55.16 indicates that there is still some more upside to run before being overbought. Moreover, its position above the 50-mean level shows that there is more room for the upside, giving he bulls the upper hand. In the meantime, the MACD line (0.2143) is trailing below the orange signal (0.2613), indicating a sell signal in the market.

Is It Time to Buy Trump?

Looking ahead, the $2B Bitcoin buy signals bullish intent, despite the 4% slide, which suggests profit-taking or FUD entering the market. If the Official Trump price breaks and holds above $11.33, there could be a bounce back to $12-$17, testing the recent high.

A breakout above $17, accompanied by surging volume, could signal a rebound to the previous all-time high (ATH) of $77. However, if the price fails to reclaim the $11.33 resistance, traders will want to watch out for a further drop to $10.14, coinciding with the 50-day MA.

Meanwhile, in the short term, traders could expect volatility. The rising parallel channel pattern suggests a shift. Moreover, Trump Media’s Bitcoin move could shift sentiment quickly. In the long term, if the BTC move sparks a rally, the official Trump price might ride the wave past $17 by August. Traders will want to keep an eye on that RSI, as overbought conditions could cause a short-term pullback.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.