The Notcoin price has declined by 1.36% in the past 24 hours, dropping to $0.0084 as the cryptocurrency market rises by 0.74% today. NOT is also down by 4% in the past week and 28% in the last 30 days. Moreover, the viral Telegram tap-to-earn mining project is down 42% in a year. Worsening the outlook, its 24-hour trading volume has plunged 13% to $111 million, indicating a recent fall in market activity.

About three months ago, Notcoin (NOT) reached an all-time high of $0.028. This surge occurred a few weeks after the viral Telegram tap-to-earn mining project distributed numerous tokens to its users in the community. However, NOT’s price has plummeted by about 70%, largely due to early profit-taking and the recent issues surrounding Telegram founder Pavel Durov.

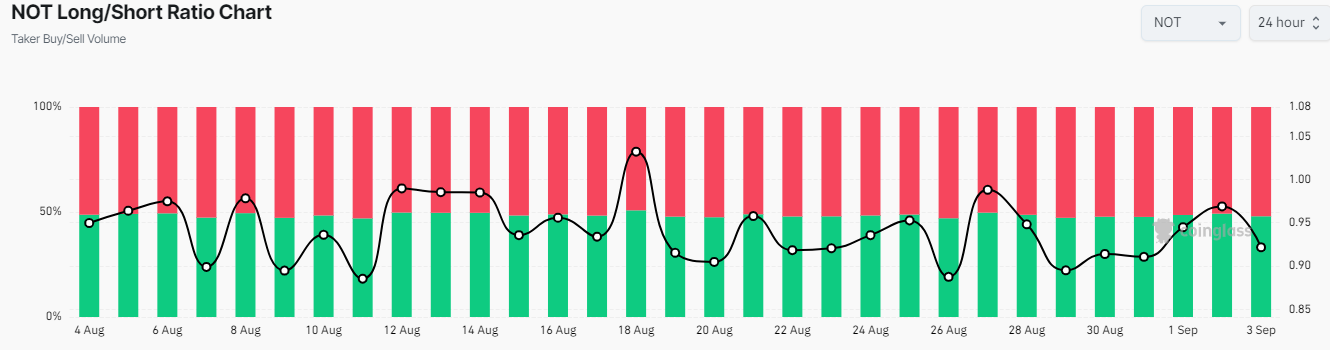

Data from Coinglass shows that the Notcoin price is on the borderline of reinforcing its leg up if the bulls gain momentum in the market. Notcoin’s Long/Short Ratio has plunged to 0.92, slightly below 1. This ratio is a barometer of investor expectations.

This means that if the reading rises above 1, the average open position is bullish, while a reading below the value suggests a bearish stance.

Notcoin Statistical Data

Based on CoinmarketCap data:

- NOT price now – $0.0084

- NOT trading volume – $111 million

- NOT market cap – $850 million

- NOT total supply – 102 billion

- NOT circulating supply – 102 billion

- NOT ranking – #70

NOT Price Plunges 28% in a Month, Can September Provide Recovery Space?

The viral Telegram tap-to-earn mining project, Notcoin, plunged a whopping 28% in the past 30 days to around $0.0078. However, the token is showing signs of recovery as it signals broader market stabilization around $0.0084. Notcoin seems to be exiting the downtrend in the descending triangle, potentially triggering a rally in the coming days.

The technical outlook throws mixed reactions in the NOT market, however, the odds favour the upside. The bulls are gaining stamina as they aim to flip the 50-day Simple Moving Average at $0.0085 resistance into support. If the bulls play their cards well, a breach and break above the $0.0104 resistance level will trigger an uptrend in the NOT market. Meanwhile, the bulls must first bring down the critical keys at $0.0085 and $0.0104 to trigger an upward movement.

On the other hand, the Relative Strength Index has hurtled from the 30-oversold zone, currently at 49. If the buyers keep adding to their positions, the RSI could jump above the 50-mean level, potentially to the 70-overbought region. Moreover, there is significant room to the upside before NOT is considered overbought.

Furthermore, the Moving Average Convergence Divergence (MACD) is calling for traders and investors to rally behind NOT. This is reinforced by the MACD indicator (blue) crossing above the signal line (orange) in the NOT market. This shifts the market’s momentum from bearish to bullish. As the momentum indicator gradually ascends above the mean line (0.00) into the positive region, the path with the least resistance stays on the upside.

Notcoin Price Outlook

In the 4-hour chart above, the odds tilt in favor of the buyers. If the bulls capitalize on the MACD, which calls for traders to rally behind NOT, the price of Notcoin could surge. The break and close above the $0.0085 resistance level could reignite bullish momentum, with the next target set at $0.0104.

Conversely, the Notcoin market portrays some bearish prospects in the market. NOT price trades below the 50-day and 200-day SMAs, reinforcing the bearish sentiment. If Notcoin fails to hold above the $0.0081 support, the next key level to watch is $0.0077.