Highlights:

- North Carolina proposes HB 92, allowing up to 10% investment in Bitcoin reserves.

- Speaker Hall says Bitcoin adoption strengthens state funds and supports Trump’s Bitcoin vision.

- Blockchain Association sees North Carolina’s bill as a serious plan, not just messaging.

On Feb. 10, North Carolina House Speaker Destin Hall introduced HB 92, a Strategic Bitcoin Reserve bill allowing the state treasurer to invest up to 10% in Bitcoin (BTC) and other qualifying digital assets. However, one requirement is that the digital assets must be exchange-traded products. They must maintain an average market capitalization of at least $750 billion over the past 12 months.

Currently, only Bitcoin exchange-traded products meet this criteria. If approved, it would allow Bitcoin investments for state-managed funds, including public employee pensions, veterans’ home trust funds, and insurance reserves.

North Carolina Takes Bold Step Toward Bitcoin Leadership with New Investment Bill

HB 92 is co-sponsored by Representatives Mark Brody and Steve Ross, both strong supporters of Bitcoin adoption. Its introduction highlights the growing bipartisan interest in incorporating digital assets into state financial reserves.

Hall stated:

“Investing in digital assets like Bitcoin not only has the potential to generate positive yields for our state investment fund but also positions North Carolina as a leader in technological adoption and innovation.”

In a post on X, he said the move supports President Trump’s vision for a national Bitcoin reserve and helps North Carolina lead at the state level. Bill co-sponsor Mike Schietzelt emphasized that blockchain, decentralized finance, and other crypto innovations “will shape our future in many new ways.” He stated that North Carolina is well-positioned to take advantage of these emerging opportunities.

Dan Spuller, Head of Industry Affairs at the Blockchain Association, provided guidance to state officials on the bill. In a post on X, he stressed, “This won’t just be a ‘messaging bill’—it’s a plan in motion.”

He also pointed out that while many states have introduced similar bills, most have failed to advance. However, he believes North Carolina’s initiative stands a stronger chance of success due to Speaker Hall’s active leadership.

As promised, North Carolina’s Strategic Bitcoin Reserve legislation was introduced today.

This is a big deal. Let me explain:

📜 HB 92 bill was personally introduced by House Speaker @DestinHall—one of NC’s most powerful leaders. Top of the food chain.

It will directly… pic.twitter.com/QtS6Kj8CKu

— Dan Spuller (@DanSpuller) February 10, 2025

Strategic Bitcoin Reserves Gain Momentum Across U.S. States

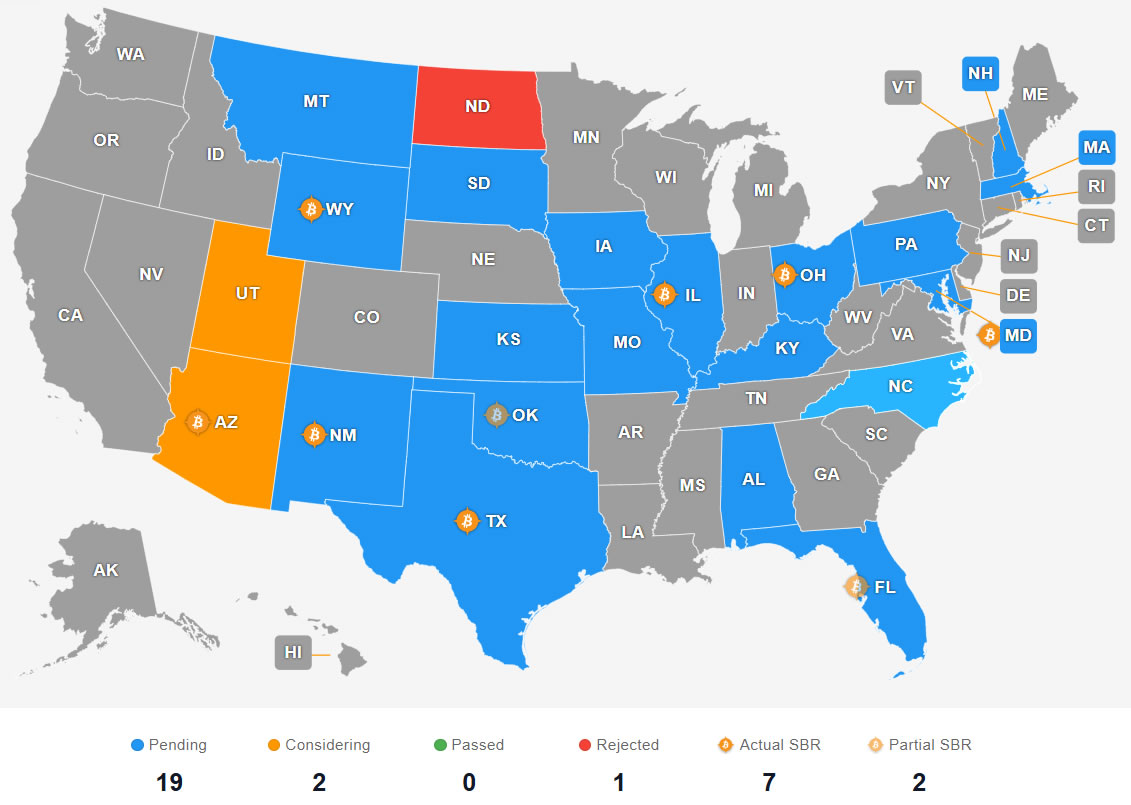

North Carolina has become the 20th US state to propose legislation for a Bitcoin reserve. Just last week, lawmakers in Montana and Florida introduced similar bills, reflecting a growing trend among states integrating digital assets into their financial systems. North Dakota, on the other hand, has declined a proposal for crypto investments.

The concept of a U.S. Bitcoin reserve is gaining traction, especially with President Donald Trump’s views on digital assets. Industry figures like VanEck Chief Matthew Sigel said adopting a Bitcoin reserve strategy could help strengthen the U.S. economy.

Betting odds show a 51% chance that Trump will create a National Bitcoin Reserve this year, and journalists are calling for comment.

My thoughts: Why is it a good idea? A Bitcoin reserve can send a symbolic message of leadership and innovation while providing a financial hedge… pic.twitter.com/5X3oqBKpsj

— matthew sigel, recovering CFA (@matthew_sigel) February 7, 2025

Lawmakers and bill sponsors gave several reasons for investing in crypto assets. They mentioned concerns over U.S. dollar inflation and devaluation, as well as the potential for higher returns on state funds, including pensions for teachers and state employees, insurance funds, and veterans’ funds.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.