Highlights:

- The Near Protocol price has rebounded above key support zones, currently trading at $2.65.

- On-chain metrics show a rising TVL with a positive funding rate, suggesting a bullish sentiment.

- The technical outlook is bullish, with bulls targeting the $3.00-$3.07 range soon.

The NEAR Protocol price has rebounded above the key support zone, currently trading at $2.65. This indicates that the bulls are ready to recover after a slight downside over the past few days. However, the daily trading volume is still in the red, down 27%, indicating a drop in trading activity. Moreover, rising TVL and strong funding rates signal a more bullish market mood. This further suggests that the NEAR price is poised for a recovery soon.

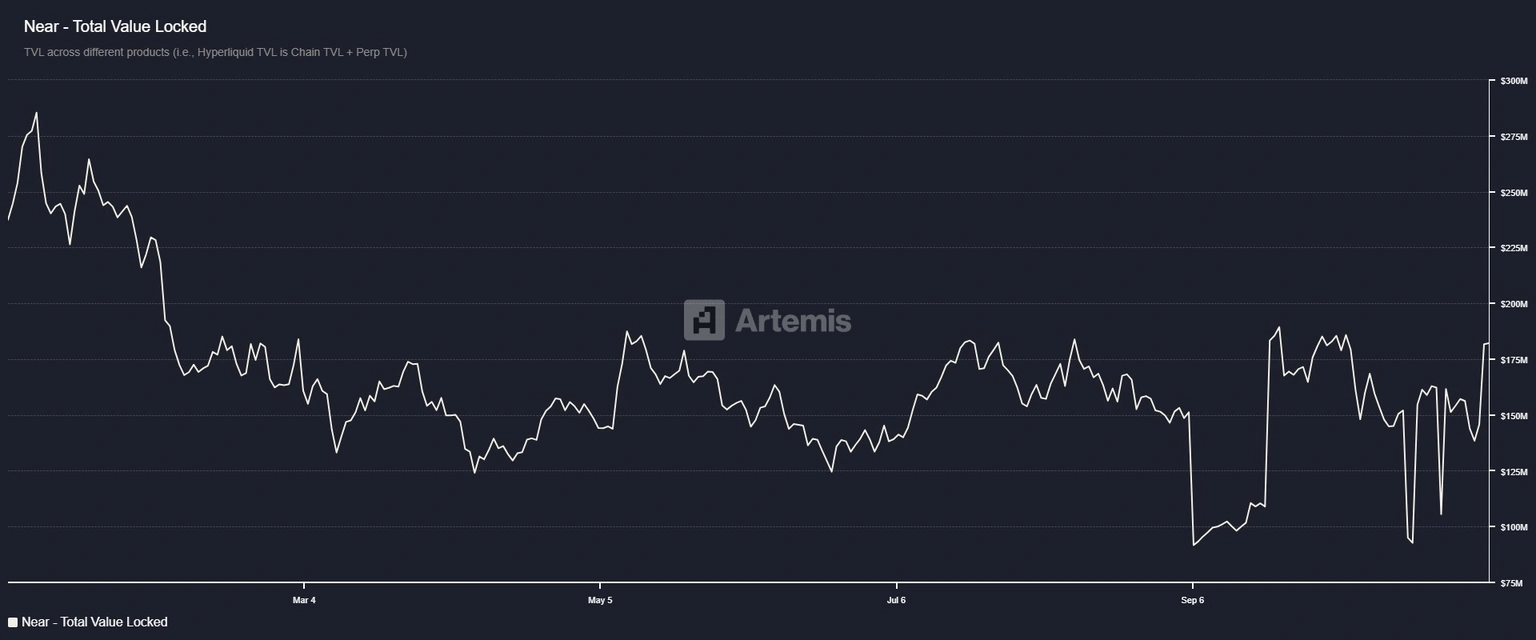

According to Artemis Terminal data, NEAR TVL rose to $182.1 million on Wednesday, up from $105.5 million on October 29, and has continued to rise to today. The increase in TVL is also a positive sign of increased activity and interest in the NEAR Protocol ecosystem. This suggests more users are depositing or using assets on NEAR-based protocols.

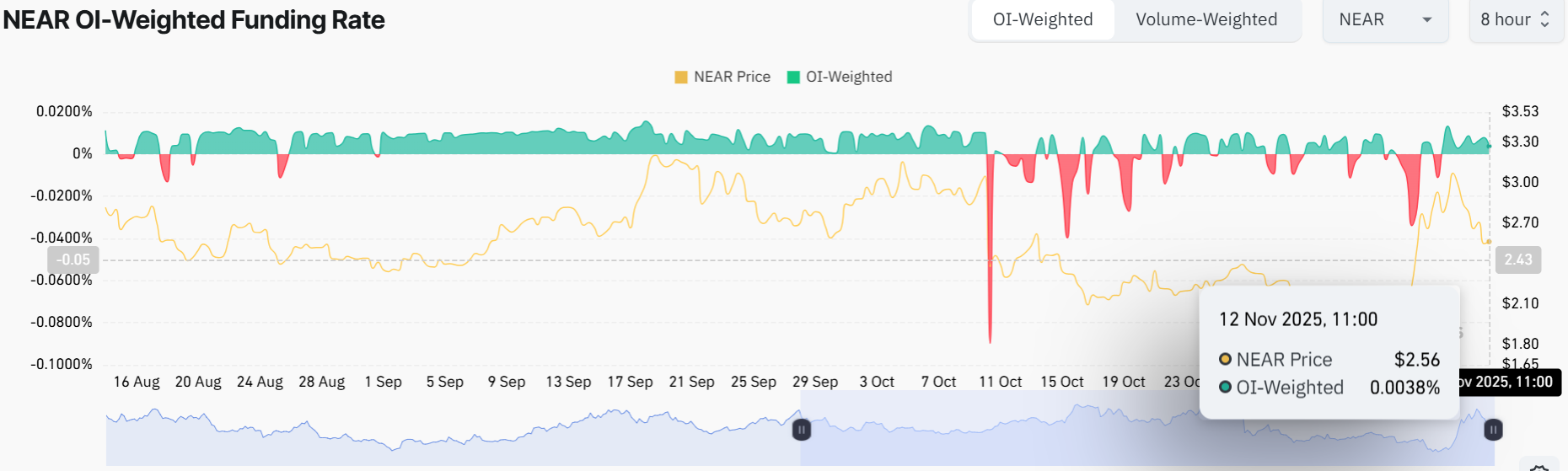

On the other hand, the derivatives market seems poised for a recovery rally, with the Coinglass OI-Weighted Funding Rate data showing a positive trend. This indicates that traders who bet the price of NEAR Protocol will drop further hold fewer positions than those who bet it will rise. The metric reversed to a positive rate, and on Wednesday, it was 0.0038%, indicating that longs are paying shorts, a bullish signal.

Near Protocol Price Could Rally Towards $3 If Support Zones Hold

The NEAR/USD chart shows the asset trading at $2.65, a slight rebound above the $2.55 support zone. The 50 Simple Moving Average (SMA) on the 1-day chart sits at $2.50, and the 200 SMA at $2.55, both of which act as solid support levels.

The Near Protocol price is trading above both SMAs, signaling bullish momentum. Moreover, the recent breakout above the wedge pattern reinforces the bullish market picture. The Relative Strength Index (RSI) at 55.45 is also showing signs of recovery, suggesting an upside bias. Moreover, its position above the 50 mean level tilts the odds in favor of the bulls.

Looking ahead, the chart suggests the Near Protocol price has not peaked yet. The subsequent breakout above the wedge pattern indicates the price is poised to surge further. Risk-takers can buy in now with a tight stop-loss below $2.55 (recent support). But if the price starts to come down, investors should wait for a dip into the $2.50 safety net to reduce risk.

Conversely, if the support zones hold up with positive technical indicators, Near Protocol’s price could continue its rebound. In that case, the $3.00-$3.07 will be the next key target. In a highly bullish case, the bulls may reclaim the $3.38 high. Long-term bulls should continue holding, but short-term traders might want to lock in gains around the $2.70 or $3.00 psychological resistance levels.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.