Highlights:

- Mt. Gox Moves 140,000 Bitcoin Worth $9 Billion

- Large Bitcoin Transfers Cause Market Volatility and Anxiety

- Repayment Plans for Creditors Influence Market Sentiment

Mt. Gox, the Bitcoin exchange that collapsed in 2014, has re-emerged into the spotlight with significant Bitcoin transactions. The exchange moved approximately 140,000 Bitcoin valued at nearly $9 billion to various wallets, profoundly influencing the cryptocurrency market dynamics. This activity occurred just as Mt. Gox plans to repay its creditors, signaling potential shifts in market sentiment and the broader digital currency landscape.

Mt. Gox’s Large Bitcoin Transfers Shake Market

On July 16, Mt. Gox executed a series of large-scale Bitcoin transfers that have significantly impacted the cryptocurrency market. Initially, 44,527 BTC were transferred to a known Mt. Gox cold wallet. Subsequently, two separate transactions moved nearly 96,000 BTC to unknown addresses. This series of movements totaled over $6 billion worth of Bitcoin transferred within just two hours.

The unknown address “BHDct9b” received a substantial transfer of 42,587 BTC valued at approximately $2.69 billion. Additionally, 4,641.24 BTC worth $293.94 million were sent to the Mt. Gox: Cold Wallet (1Jbez). Despite the large receipt, the “BHDct9b” address has not initiated any further transfers, contributing to market anxiety and a decrease in Bitcoin’s value.

#PeckShieldAlert #Mt.Gox labeled address has transferred a total of ~95.86K $BTC (worth ~$6B) to 2 new addresses 18vjnB…ct9b & 3JQieE…yFrE pic.twitter.com/v7O8Qfk6D6

— PeckShieldAlert (@PeckShieldAlert) July 16, 2024

These transactions are part of a broader narrative surrounding Mt. Gox’s ongoing rehabilitation efforts. On July 5, Mt. Gox announced plans to start repaying its creditors’ Bitcoin and Bitcoin Cash debts through designated cryptocurrency exchanges, as per the rehabilitation plan approved by the creditors.

Mt. Gox Transfers Stir Market, Spur Speculation

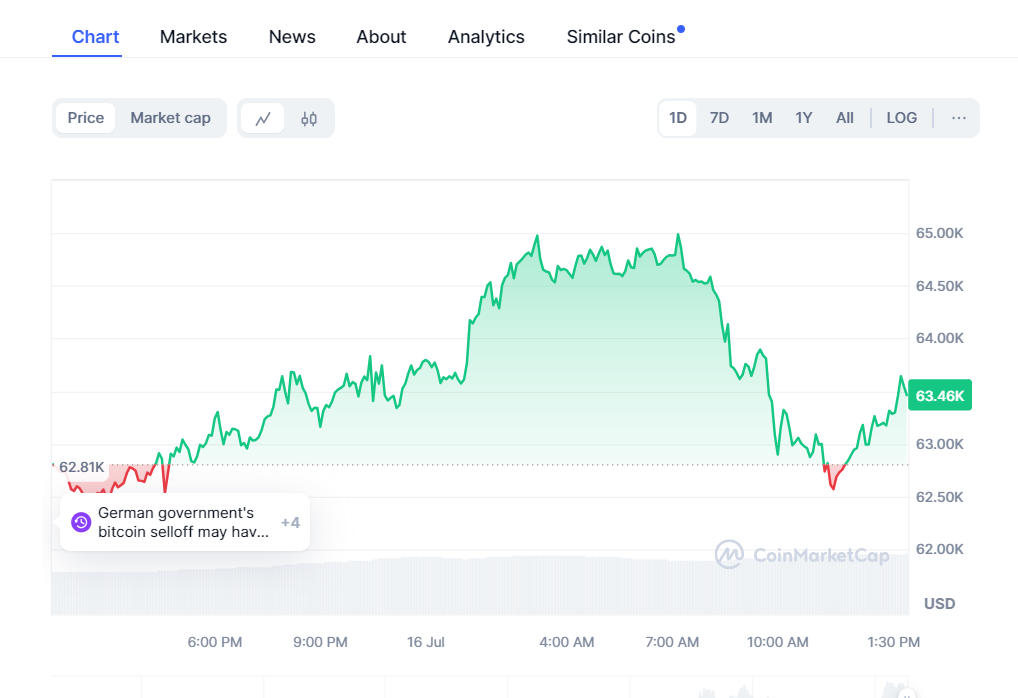

Bitcoin experienced significant volatility in the last 24 hours, opening around $62,800, reaching a high of $65,000, and then sharply falling to approximately $63,000. It modestly recovered to close at $63,540, marking a 1.33% increase for the day. Bitcoin’s market dominance dipped to 53.82% during this period, suggesting a shift towards altcoins. The market capitalization was around $1.25 trillion, with a trading volume of $39.44 billion.

The recent mobilization of funds by Mt. Gox raises questions about the timing and nature of these repayments. Speculations about the motives behind these transfers range from internal reorganization to the imminent distribution of assets to creditors. The latter is supported by the promise that the remaining rehabilitation creditors would receive their funds “promptly” after certain conditions are met.

Broader Market Reactions and Future Outlook

The recent movement of Mt. Gox’s Bitcoin holdings and the resulting market fluctuations underscore cryptocurrency markets’ sensitivity to significant transactions. While the primary focus remains on Mt. Gox’s repayment initiatives, the broader implications for market stability and investor sentiment are also substantial.

The cryptocurrency community stays alert as Mt. Gox progresses through its intricate recovery process. The actions of the once-dominant exchange still have the power to sway market prices and investor confidence. The coming months will be crucial in determining how these large-scale transactions will affect the broader digital asset market and the long-term recovery of funds for those impacted by the Mt. Gox collapse.