Highlights:

- The Monero price has increased 3% to $432, as bullish sentiment builds.

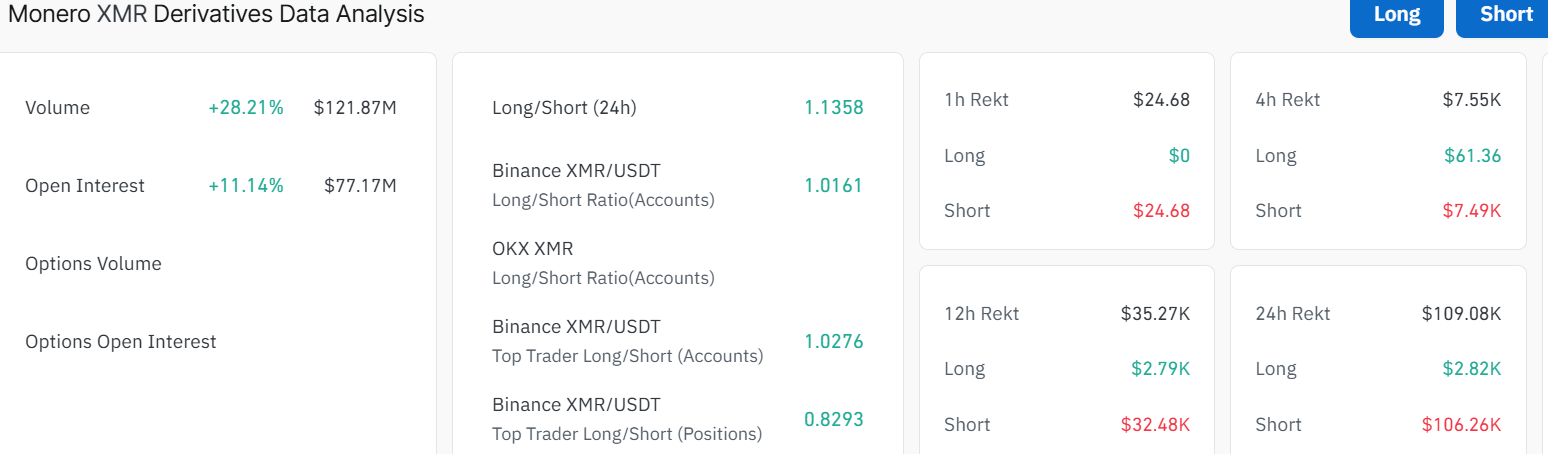

- The derivatives data shows steady bullish bets as XMR’s open interest spikes 11%.

- XMR technical outlook signals a bullish grip, as bulls eye $439 resistance zone.

The Monero (XMR) price is trading at around $432, marking a 3% surge over the past 24 hours. The daily trading volume has increased 1% to $166 million, indicating heightened market activity. Meanwhile, the privacy coin has regained retail interest, as evidenced by the increased Open Interest and long positions. Nevertheless, the technical picture is bullish, reinforced by the golden cross as the Monero bulls target $439 resistance soon.

According to CoinGlass, the XMR futures Open Interest (OI) is currently at $77.17 million, which is an improvement compared to $68.15 million on Tuesday. This growth in OI by 11% indicates an increase in traders’ risk exposure in XMR derivatives, both in long and short positions.

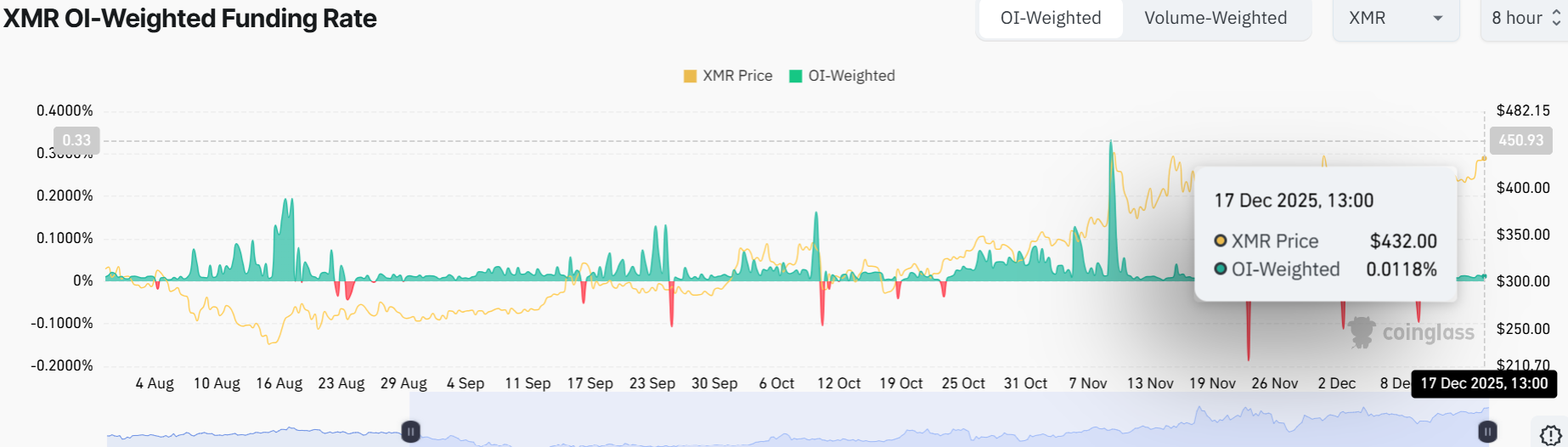

With a tilt to the bullish, the OI-weighted rate of funds to buy is at 0.0118% which means that bulls are paying a premium to hold the long position by buying the funds. Moreover, the long-to-short ratio chart indicates that there is a gradual increase in the long positions, as it sits at 1.1358. Its position above one indicates building bullish sentiment in the Monero price.

Monero Targets $439 Zone Soon

The XMR/USD daily chart shows the asset is bullish. The price action has shown a solid uptrend within a rising parallel channel, as the bulls eye higher levels. Monero’s volume has also soared 1.62%, hitting $166 million, proof that the hype is real. Moreover, the 50-day SMA at $385 has flipped above the 200-day SMA at $323, indicating a golden cross in the market. This shows that the long-term bullish trend is evident in the XMR market.

The Relative Strength Index (RSI) at 62.49 shows intense buying pressure, but the asset hasn’t hit the 70+ territory. This means that XMR still has room to run before a pullback takes place.

The chart shows that the Monero price could move to the immediate resistance zone at $439 soon, if the bullish grip holds. If the momentum keeps up, it could even test the $470 high.

However, a rejection at $439 resistance level could cause a pullback in the XMR token. If the immediate support at $405 holds, it’s a green light to buy the dip. If it breaks, though, the XMR token might slide to $385, aligning with the 50-day SMA.

The Moving Average Convergence Divergence (MACD) is also crossing bullish, with the signal line trending upward, indicating further upside potential. For now, if not already in, traders might want to wait for a break above the $439 zone. It’s not too late to stack Monero bags, but timing is everything. For now, Monero price is bullish, but play smart. Investors may target $439 in the short term and $470 if the bulls remain strong.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.