Highlights:

- Monero price has surged 3% to $396, as its daily trading volume has spiked by 5%.

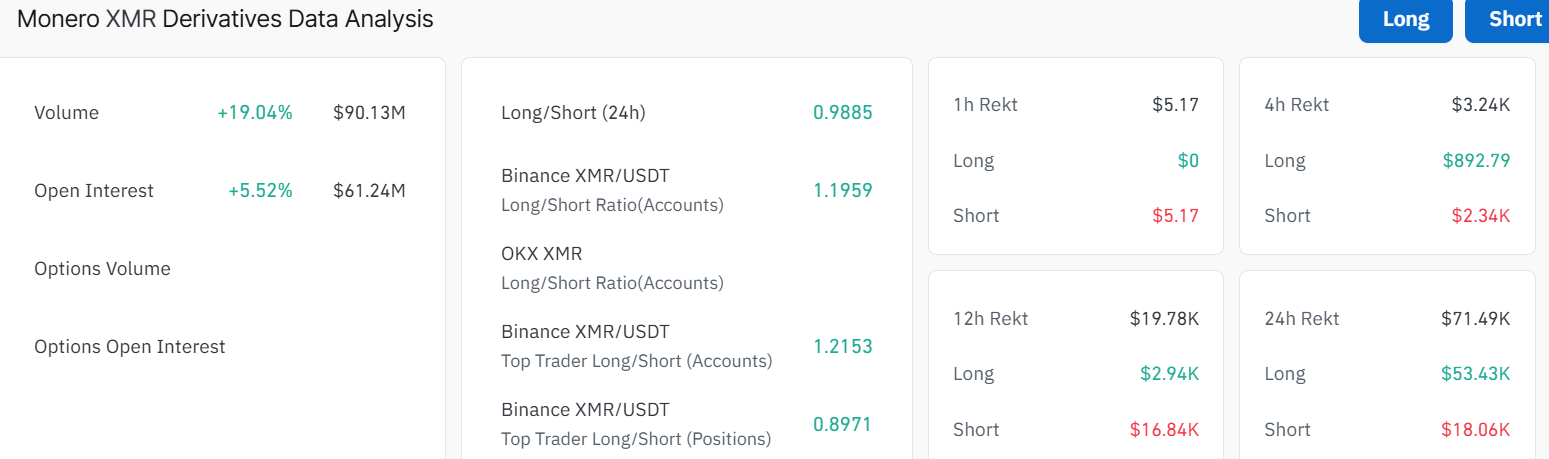

- The XMR derivatives market shows an increase in open interest and volume, indicating renewed confidence in XMR.

- The technical outlook indicates a bullish bias, with buyers targeting the $417 resistance level soon.

The Monero price is showing strength, rising 3% to $396, as its daily trading volume spikes 5%. The privacy coin has rebounded from its recent $335 lows, indicating that a bullish grip is building in the market. Moreover, the XMR derivatives market indicates growing interest as the open interest and volume surge, reinforcing a potential surge above $400.

Currently, the cryptocurrency market remains shaky, with Bitcoin stabilizing above $86,000. The CoinGlass data shows that the Open Interest (OI), which is the notional value of all open futures contracts, is currently at $61.24 million, marking a 5% surge.

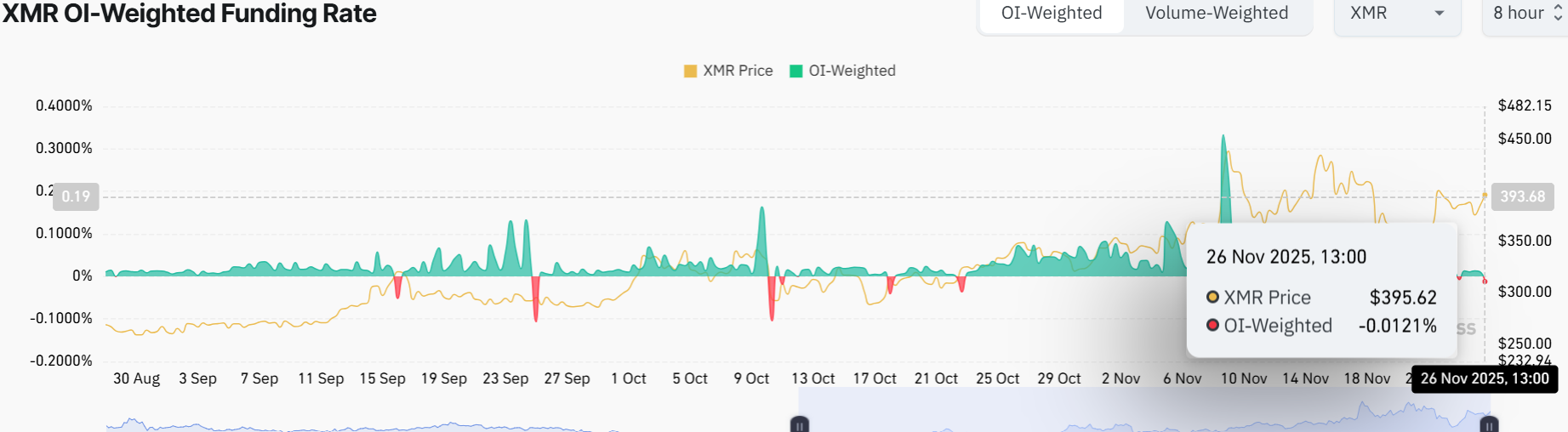

This indicates that traders are in a positive mood and are hopeful for a recovery in the Monero price. Notably, the volume has risen 19% to $90.13 million, indicating intense trading activity among traders. However, the OI-weighted funding rate is at a negative value of -0.0121%. This means that buyers still mind short-term positions. Furthermore, this may lead to the XMR price entering a consolidation phase before a potential rise.

XMR Price Poised for a Rally to $417

The Monero price is holding steady near the $400 mark, at $396, staying above the important support level at $348. This area is where the 50-day simple moving average (SMA) sits, making it a key level for traders. The coin is also well above the long-term 200-day SMA at $318, which supports the notion that the market remains bullish.

Examining the price chart, XMR has been forming higher highs and higher lows. This means the price continues to form new peaks and rebounds, indicating that buyers are in control and the uptrend remains strong.

A “Golden Cross” happened when the 50-day SMA crossed above the 200-day SMA. This is often viewed as a positive sign for further gains. The $348 and $318 levels help protect the downside, giving space for small dips without panicking the market. Right now, the nearest resistance is at $417. If the XMR price breaks above this level, it could quickly move up towards $440 or even $470 if enough buyers enter the market.

Technical indicators agree with this positive view. The Relative Strength Index (RSI) is at 57.66. This indicates that the price is trending upward but is not yet too high to warrant concern about a potential pullback. Each time the price dips close to $335-$348, new buyers appear, and the Monero price quickly rebounds. This indicates that buyers are closely monitoring this area and are confident that the trend will remain strong.

If current momentum holds, XMR could break above $400 and keep climbing towards $417. However, if the price falls below $348, it may head down to retest lower support levels.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.