Highlights:

- The Monero price has decreased by 5% to exchange hands at $454 today.

- The derivatives data show mixed sentiment, as the open interest slips while the funding rate flips positive.

- The technical outlook shows a potential bullish reversal, as XMR eyes the $481 barrier.

The price of Monero (XMR) has fallen by 4%, exchanging hands at $ 454 today. Despite the huge withdrawals in XMR derivatives, the privacy coin maintains the positive funding rates, which is an indicator of the bullish interest among the traders. The technical outlook of Monero shows mixed signals as XMR eyes the $481 barrier, with support holding.

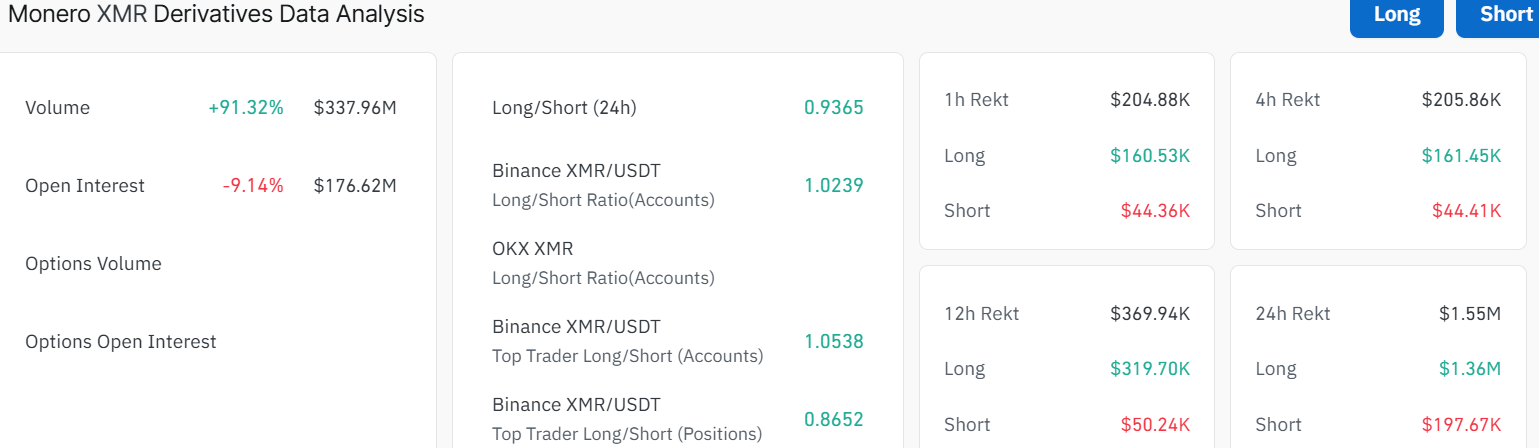

The retail strength of Monero sends mixed signals, as it shows good rates of funding despite XMR futures Open Interest (OI) decreasing and huge long liquidations. According to CoinGlass, the XMR OI has reduced by 9.14% in the past 24 hours, to $176.62 million. This indicates that the value of the outstanding contracts has decreased.

In line with the outflow, the long liquidations of $1.36 million during the past 24 hours are higher than the short liquidations of $197K, indicating a bullish positional wipeout. The 0.0122% funding rate, however, shows that there is a spike in the bullish interest among traders who will be ready to pay a premium to occupy the long positions. A long-term cumulative bullish positional accumulation would make the risks of massive long liquidations more likely in case of a return to the bearish trend.

XMR Eyes the $481 Barrier as Support Holds

The XMR price is currently showing early signs of a bullish reversal after weeks of decline within a clearly defined bearish channel. The token is currently exchanging hands at around $454, a sligh 4% slip in the past 24 hours. On the daily chart, Monero price has been moving inside a downward-sloping channel since mid-January, where sellers maintained control and pushed prices lower from around $799 high to recent levels at $454.

The chart highlights a key support zone between $415, which previously acted as a strong demand area. This zone has again proven effective in holding back further declines, giving bulls a foundation to build momentum for a potential upside.

Meanwhile, the recent flip in the funding rate in the derivatives data could trigger a potential shift in market sentiment. If the recent price level holds and the bulls reclaim the $481 barrier, XMR could target a move toward the upper resistance near $619, marking a bullish reversal pattern.

From a technical perspective, the Relative Strength Index (RSI) has plunged below the yellow band at 48.51 to 42.17. Its position below the 50-mean level indicates some potential downside if the bulls fail to rally above the neutral zone.

A confirmed breakout above the channel resistance and sustained movement above $481 could trigger a new rally toward $619. However, if the price falls back below the $415 support, the bearish trend may mount. This could see further downside towards the $400 zone or even $360, which aligns with the 200-day SMA. Traders should watch these levels closely for confirmation of the next major move.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.