Highlights:

- The Monero price is showing a strong bullish trend, soaring 1% to $453 over the past 24 hours.

- The derivatives data indicate new money is flowing into the market as the funding rate turns positive.

- The technical outlook indicates rising bullish sentiment, backed by positive momentum indicators, as XMR bulls eye $500.

Monero (XMR) is trading at $453, having bounced back from a critical support level at $416 at the beginning of this week. Bullish indicators are on the rise, as XMR derivatives data show rising Open Interest (OI) and a positive funding rate. Technically, the privacy-oriented coin indicates the rally will continue, with XMR bulls eyeing $500.

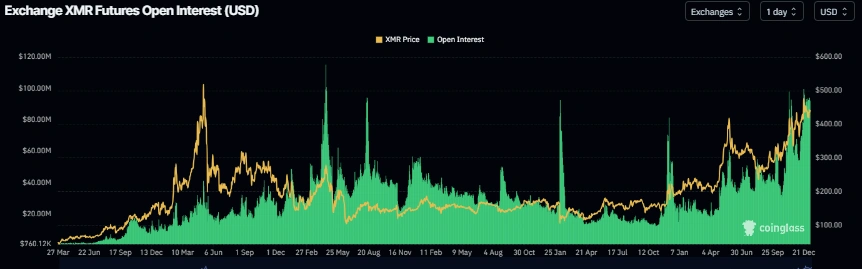

Monero’s derivatives data are biased toward bullish sentiment. According to CoinGlass data, the OI for XMR futures on exchanges rose to $92 million on Thursday, up from $82 million on December 27, and has been steady since then. Increasing OI suggests new money is entering the market and that new purchases are driving the current price increase in XMR.

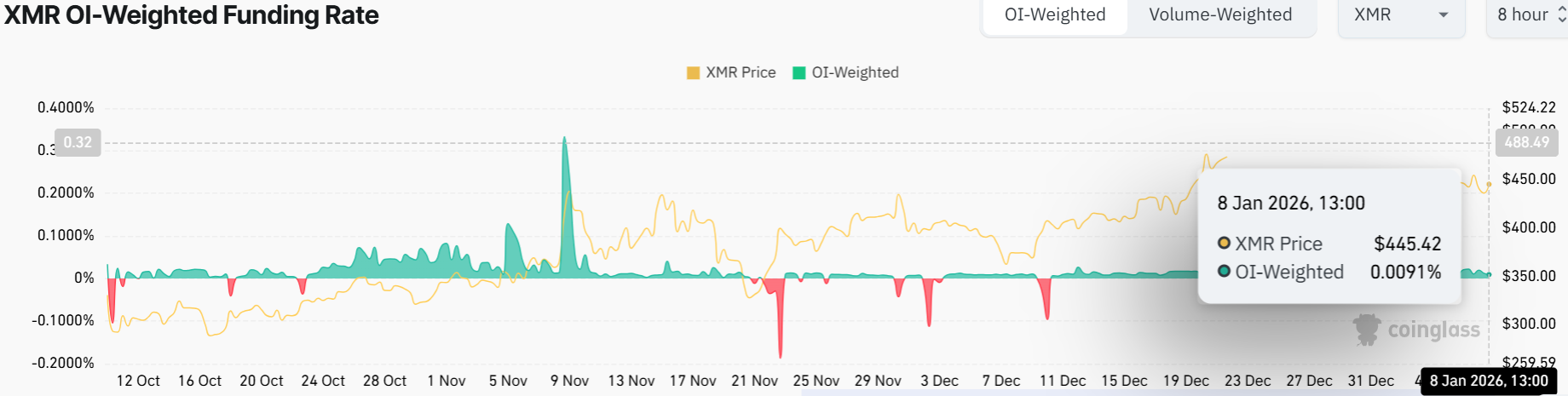

On the other hand, the Coinglass OI-Weighted Funding Rate data indicate that more traders are betting that XMR’s price will increase than those betting that it will decrease. This is evident in the funding rate, which has flipped positive to 0.0091%, indicating that bulls are in the upper hand. When the funding rate turns positive, the price often rallies, and in this scenario, bulls are eyeing the $500 zone.

XMR Bulls Eye $500 as Bullish Sentiment builds

Looking at the chart, XMR has rebounded from a critical support zone near $416. The price is now trading above the 50-day simple moving average, a major level watched by traders. A strong weekly close above $464 would confirm the bullish breakout and open the doors for a rapid move to higher levels.

Key resistance now sits at $464 and $488, where previous rallies paused. If buyers overcome these barriers, upside targets of $500 in the Monero market could come into play. The chart pattern signals that momentum could accelerate quickly if volume continues to increase. This is especially true, as the new uptrend is supported by a rising 50-day moving average ($416), which is well above the long-term 200-day average ($336). Currently, volume is up 11% over the past 24 hours, indicating heightened market activity and strong investor confidence.

The Relative Strength Index (RSI) is sitting at 57.84, above the RSI-based MA, suggesting there’s still room for more price growth before the coin becomes overbought. Looking at the bigger picture, if the current trend holds, Monero’s price could move rapidly toward the $464- $488 resistance zone over the coming weeks. In a highly bullish scenario, driven by market momentum, XMR bulls could reach $500.

However, traders should watch for short-term selling if the price fails to hold above $464. Dips to the $434- $416 range could create opportunities for patient buyers. However, a decisive break below $416 would signal caution in the XMR market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.