Highlights:

- The Monero price is holding well above $400, despite the 3.17% drop today.

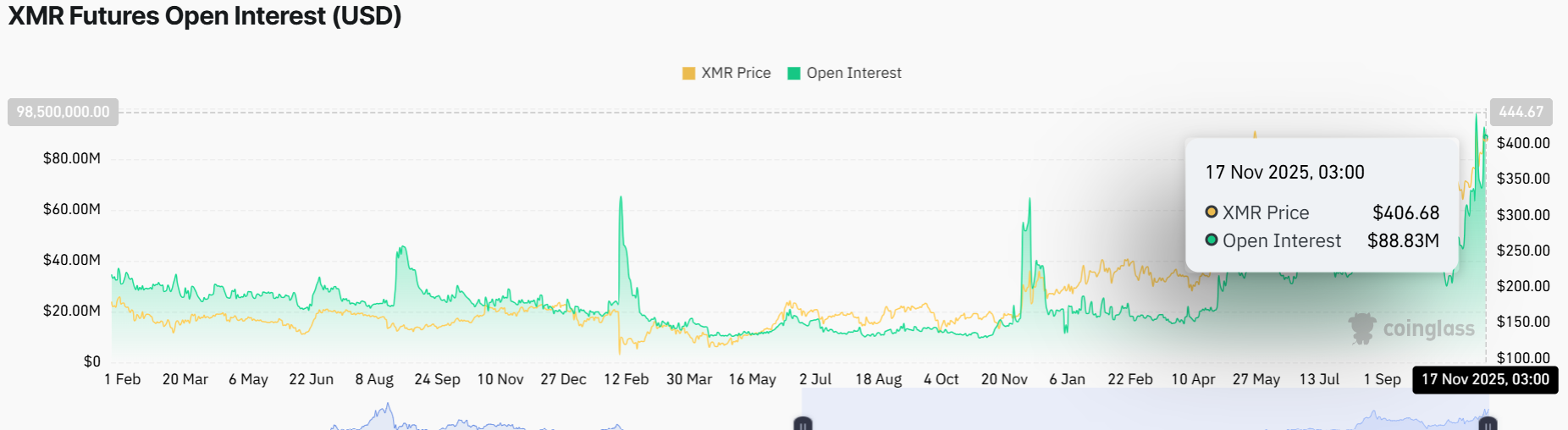

- The derivatives market is showing rising open interest despite the recent pullback.

- The technical outlook portrays further upside with bulls targeting $20-$440 in the short term.

The Monero price is showing strength, above $412, despite a 3.17% drop in the past 24 hours. The intraday pullback in the privacy coin also puts the rising optimism in the XMR derivatives market, indicated by heightened futures Open Interest, at risk. Meanwhile, according to popular analyst Ali Martinez, the Monero price is testing a resistance wall that has never been broken since 2018.

On the other hand, Monero still holds the retail appetite since the privacy coins are doing better than the market. The CoinGlass data shows that the Open Interest (OI), which is the notional value of all open futures contracts, is currently XMR futures at 88.83 million. This is near the annual high of $97.98 million on November 10. This means that the traders have a positive mood and are hopeful of recovery.

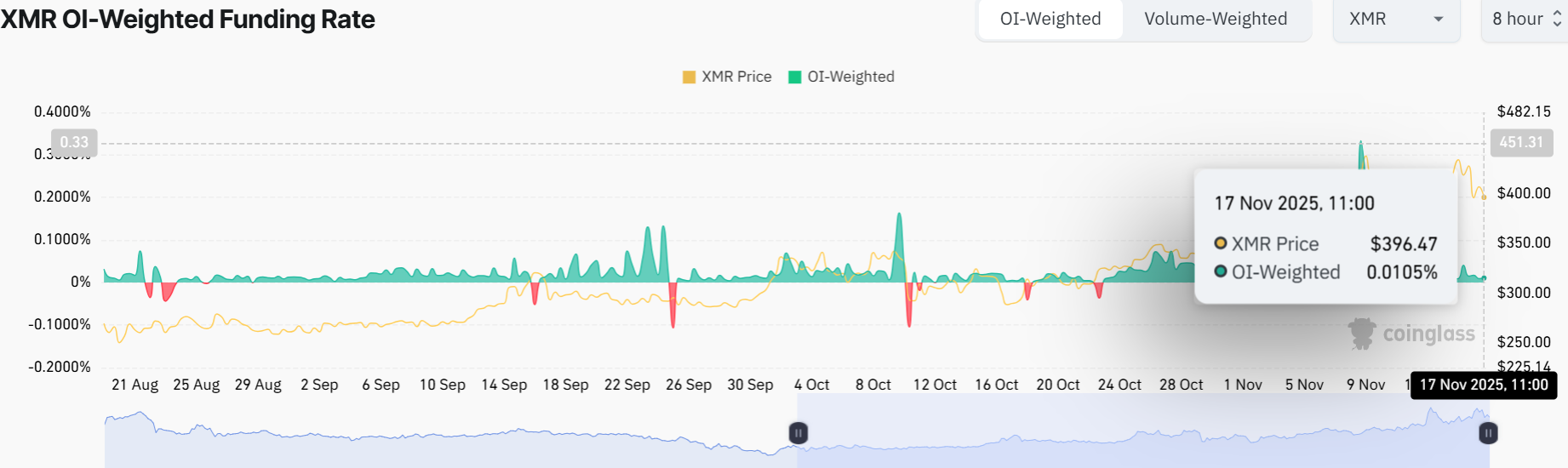

As per the rising OI, the OI-weighted funding rate has turned positive at 0.0105% following a sharp negative change the previous day. This means that buyers will not mind long-term positions. Further, the traders are now betting on the Monero price to surge, which may cause a recovery.

Monero Price Signals a Bullish Breakout Above the Rising Channel

The XMR/USDT chart shows the token’s price action trading above the 50-day and 200-day Simple Moving Average (SMA) at $337 and $314, respectively. These moving averages are also trending upward, signaling a bullish tone as Monera price hovers within a rising channel.

The Relative Strength Index (RSI) sits at 64.51, creeping into overbought territory, which might hint at a potential pullback if the bulls step up above 70+. Meanwhile, its position above 50 indicates that the buyers are having the upper hand, tilting the odds in favour of the bulls. In the meantime, traders are at liberty to rally behind XMR.

The chart is showing the Monero price soaring toward the upper boundary of the rising channel, around $420. The next target for XMR price is $440, if the bulls break out of the channel, targeting the recent ATH at $470. But investors should be cautious, as a rejection at the $420 resistance level could send the Monero price to the next immediate support at $389. A dip below could see the token test the 50-day safety net at $337.

In the short term, as long as Monero price holds above $400, the bulls could continue the upswing towards $420-$440. Long-term, it’s all about holding the support zones and pushing past $440, which may cause the XRM to reclaim the $470 mark before year’s end.

In summary, the Monero price action shows promise, supported by bullish indicators and its position above $400. Traders should aim for $440-$470 if the trend holds, but also keep an eye on those support levels.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.