Highlights:

- Michael Saylor’s Strategy acquired 1,286 BTC at roughly $90,391, lifting total holdings to 673,783 BTC.

- The company increased its cash reserve to $2.25B for liquidity and strategic flexibility.

- The firm’s BTC stash equals over 3% of the total Bitcoin supply.

Michael Saylor’s Strategy has kicked off the year with a major Bitcoin acquisition. The 1,286 BTC purchased by the company between December 29 and January 4 totalled $116.3 million at an average price of $90,391 per Bitcoin, according to the 8-K filing with the SEC on Monday.

This acquisition increased the overall Bitcoin holdings of the company to 673,783 BTC. The total cost of these coins amounts to $50.55 billion at an average purchase price of $75,026 per coin. Interestingly, the holdings currently constitute over 3% of Bitcoin’s total capped supply of 21 million. The company currently has an asset value of approximately $63 billion.

Strategy has acquired 1,287 BTC to increase its BTC Reserve to ₿673,783 and has increased its USD Reserve by $62 million to $2.25 billion. $MSTR https://t.co/Cv8jD80kQC

— Michael Saylor (@saylor) January 5, 2026

Strategy Expands Treasury and Cash Reserves

Michael Saylor had hinted at the new purchase with a cryptic tweet, “Orange or Green?” referring to Bitcoin or cash reserve additions. This has become a popular sign before such announcements on Sundays.

In addition to its Bitcoin purchase, Strategy boosted its USD reserves by $62 million. The current cash reserve has increased to $2.25 billion. The company disclosed that it used sales of its Class A common stock, MSTR, to finance the purchase and the reserve increase. The additional cash facilitates the payment of dividends on perpetual preferred equity. Internal estimates show that the reserve could be able to pay 32.5 months of such dividends.

Michael Saylor’s Strategy also acquired 1,229 BTC last week at a total cost of $108.8 million, bringing December’s total to over 2,500 BTC. A small tranche of 3 BTC was purchased on the last day of the year, and the rest of the 1,283 BTC was purchased in the first four days of January.

Stock Movement and Regulatory Spotlight

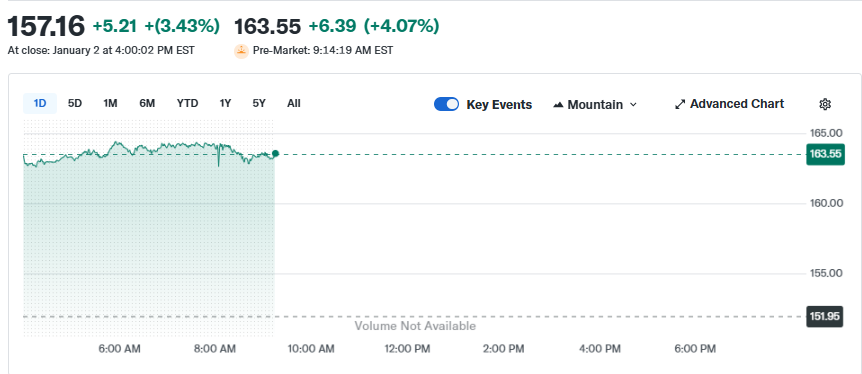

The momentum of the Bitcoin purchase was reflected by the company’s stock. Strategy’s stock (MSTR) closed last Friday at $157.16 and is up over 4% in pre-market trading at around $163.55.

Strategy reported a 48% drop in 2025 despite the short-term boost. The stock declined as the market cap-to-net asset value (mNAV) ratios tightened. Currently, the mNAV is at 0.81, which implies that its market value is less than the value of its Bitcoin holdings.

Michael Saylor’s Strategy also recorded a $17.44 billion unrealized loss in Q4 because of Bitcoin’s value swings. The impact was intensified by the new accounting regulations that mandated fair-value accounting in earnings reports. The company also had a deferred tax benefit of $5 billion in Q4.

Amidst this, MSCI is considering a proposal to reclassify firms such as Strategy as investment funds. Should this be adopted, it can lead to their exclusion from global equity benchmarks. JPMorgan estimates a potential outflow of up to $2.8 billion in case the decision is in favor of the exclusion. The final call is due by Jan. 15, before the rebalancing of the index in February.

Meanwhile, Strategy latest BTC purchase came when Bitcoin climbed beyond $90,000. The leading asset surged up to $93,000 to start 2026, recording a year-to-date increase of 6%.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.