Highlights:

- Metaplanet invested $117.3 million in 1,088 BTC, increasing its holdings to over 8,000 tokens.

- The company now needs to purchase an additional 1,112 BTC to meet its target for this year.

- Gerovich attributed Metaplanet’s BTC holdings to abundance and fortune.

On June 2, Japanese Bitcoin (BTC) investment firm Metaplanet reported that it had completed another round of purchases, valued at approximately $117.3 million for 1,088 BTC. Announcing the latest acquisition on X, Simon Gerovich, the company’s Chief Executive Officer (CEO), noted that Metaplanet paid about $107,771 per BTC.

He also noted that the company’s year-to-date (YTD) yield in 2025 has reached about 225.4%. Today’s announcement comes a few days after Metaplanet disclosed 0% ordinary bond issuances on two different occasions. Notably, the company raised a total of $71 million from the exercise on May 28 and 29. As usual, Metaplanet noted that it would use the entire capital to fund its BTC portfolio expansion project.

The CEO added:

“As of 6/2/2025, we hold 8,888 BTC acquired for ~$829.7 million at ~$93,354 per Bitcoin.”

Metaplanet has acquired 1088 BTC for ~$117.3 million at ~$107,771 per bitcoin and has achieved BTC Yield of 225.4% YTD 2025. As of 6/2/2025, we hold 8888 $BTC acquired for ~$829.7 million at ~$93,354 per bitcoin. $MTPLF pic.twitter.com/FYjiHiOIzL

— Simon Gerovich (@gerovich) June 2, 2025

In a separate X post, Gerovich described Metaplanet’s current BTC holdings as a symbol of abundance and fortune. He added that the massive BTC holdings marked the beginning of a new chapter for Metaplanet. Meanwhile, Crypto Patel, a top-ranking crypto key opinion leader (KOL), reacted to Gerovich’s announcement. He stated, “These kinds of moves don’t just ‘happen.” It means their board, investors, and strategy teams are all-in on Bitcoin as digital gold.”

Metaplanet’s QTD Statistics Record Significant Increments

Metaplanet’s quarterly market activities report showed that the company’s Bitcoin holdings increased from 398.832 BTC in September 2024 to 8,888 BTC today. Common shares issued also rose from about 181,692,180 to 600,714,340.

Other statistics showed that Metaplanet’s outstanding fully diluted shares appreciated from 454,201,850 to their current 759,067,925 standing. In addition, BTC’s quarter-to-date gain rose from 59 to about 2,684. Metaplanet also noted that it funded most of its BTC acquisitions via capital market activities and operating income proceeds.

*Metaplanet Acquires Additional 1,088 $BTC, Total Holdings Reach 8,888 BTC* pic.twitter.com/X2clAIKNbR

— Metaplanet Inc. (@Metaplanet_JP) June 2, 2025

Metaplanet Purchased Over $2,500 BTC in May

Last month, Metaplanet completed three Bitcoin purchases. According to reports, the company bought 1,004 BTC, 1,241 BTC, and 555 BTC on May 19, 12, and 7, respectively. Overall, the investment firm spent roughly $284.4 million, purchasing 2,800 BTC in May.

The above figure exceeded the 1,650 BTC acquired for about $149.1 million in April. It also surpassed the 1,115 BTC procured in March. If the company sustains its current trend, it will likely purchase over 3,000 BTC this month, exceeding its 10,000 BTC target for the year. For context, the investment firm only needs to acquire an additional 1,112 BTC to meet its long-term target for 2025.

BTC Records Slight Increments After the Previous Week’s Declines

Global trade tension rose again last week after Donald Trump accused China of violating an initial trade agreement. As expected, Trump’s disclosure elicited market uncertainties, which negatively impacted the crypto market, with BTC dropping from over $110,000 to about $103,000.

US President Donald Trump slams China for violating the trade agreement, says China has “totally violated its agreement with United States,” concerning the tariff war. pic.twitter.com/SVVKIy9qdn

— Aditya Raj Kaul (@AdityaRajKaul) May 30, 2025

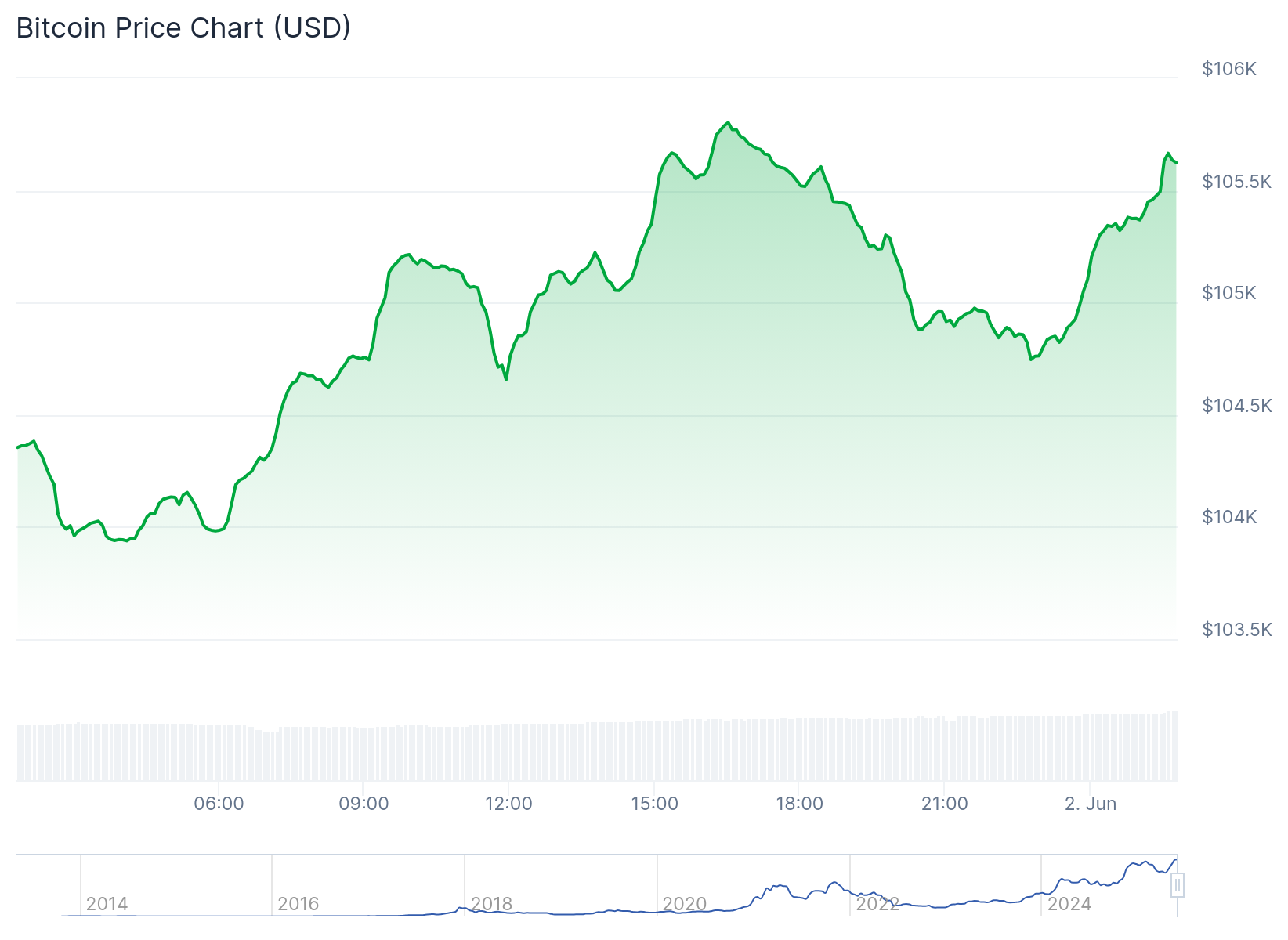

However, the token has recovered slightly. According to CoinGecko’s data, BTC is changing hands at approximately $105,300, reflecting a 1% upswing in the past 24 hours and fluctuating between $103,939 and $105,804. In its 7-day-to-date variable, BTC dropped by 4%, oscillating between $103,414 and $110,370. This price range highlights the token’s recent price struggle and recovery attempts.

Meanwhile, BTC’s long-term data showed the token only suffered a transient decline. For context, the token increased by about 2.9% 14-day-to-date, 9.5% month-to-date and 55.4% year-to-date. In addition, Bitcoin’s market cap and fully diluted valuation remained above $2 trillion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.