Highlights:

- Metaplanet expands portfolio with a fresh $112 million Bitcoin investment.

- The company now holds 20,000 BTC worth $2.056 billion, doubling its earlier target for the year.

- Metaplanet also spent over $100 million in bond redemptions between July and August.

Japanese public company, Metaplanet, has purchased 1,009 BTC for $112 million. The firm announced the new acquisition on September 1 amid BTC’s recent price struggles. According to the X post, Metaplanet paid an average of $111,109.87 per token, increasing holdings to 20,000 BTC. The company’s entire Bitcoin holdings are valued at about $2.056 billion, averaging $102,834.51 per BTC.

Metaplanet stated:

“The company has strategically increased its total Bitcoin holdings through acquisitions funded by capital market activities and operating income.”

Today’s purchase comes a few days after the investment firm announced a fundraising program targeted at expanding its Bitcoin treasury between September and October 2025. Per Crypto2Community, Metaplanet expects to raise $881 million in net proceeds from the program.

*Metaplanet Acquires Additional 1,009 $BTC, Total Holdings Reach 20,000 BTC* pic.twitter.com/kwvUkQaFth

— Metaplanet Inc. (@Metaplanet_JP) September 1, 2025

Metaplanet Eyes Bigger Long-Term BTC Holdings Target

Metaplanet has doubled its previous long-term target for Bitcoin acquisition in 2025. Earlier this year, the company’s Chief Executive Officer (CEO), Simon Gerovich, disclosed that his company plans to buy 10,000 BTC before this year ends.

The target was smashed in record time, and Metaplanet now aims to purchase 100,000 BTC by the end of 2026 and 210,000 BTC by the end of 2027. While these targets seem ambitious, Metaplanet has shown consistency in Bitcoin investments, making the target feasible. The company maintained that its interest in BTC stems from the token’s long-term value and potential to shield against inflation risks.

Metaplanet’s Bond Redemptions

Since July, Metaplanet has been making efforts to redeem its $204.18 million (JPY 30 billion ) bond debt issued to EVO FUND at the end of June 2025. The company repaid $40.8 million on July 4 and another $45.94 million on July 14. Subsequently, it redeemed $15.31 million, $20.42 million, and another $20.42 million between August 25 and 27.

The company added:

“Both redemptions were carried out in accordance with the bond terms and funded using proceeds from the exercise of the 20th through 22nd Series of Stock Acquisition Rights, as disclosed in the Notice Regarding Change in Use of Proceeds.”

Aside from redemptions, Metaplanet also recorded large volumes of share exercises tied to its 20th Series of Stock Acquisition Rights. Investors exercised 9 million shares each on July 10 and July 14. Overall, Metaplanet issued over 88 million new shares in multiple batches between July and August 2025.

Hard not to be bullish on @Metaplanet_JP from its shareholder meeting to approve the preferreds. CEO @gerovich made a compelling argument for the company’s ambitious, Japan-centered $BTC treasury strategy. pic.twitter.com/dz3IeK3Uey

— Tad Smith (@tadtweets) September 1, 2025

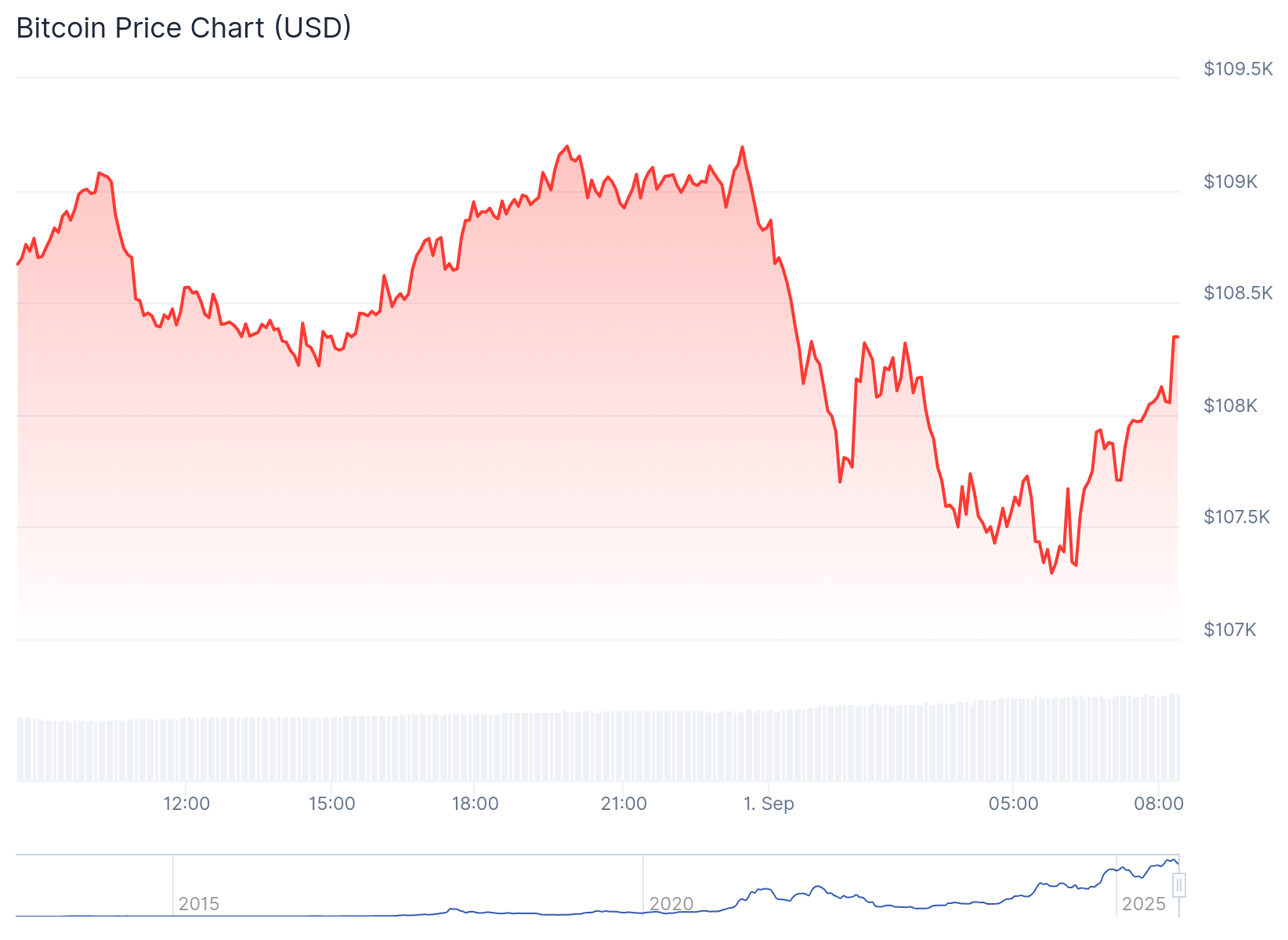

BTC’s Price remains below $110K as Metaplanet Expands Portfolio

At the time of press, BTC is trading at $108,295 following a 0.3% decline in the past 24 hours. Within the same timeframe, Bitcoin fluctuated between $107,295 and $109,198. Bitcoin’s 7-day-to-date price change variable showed that the digital asset dropped 3.2%, oscillating between $107,414 and $113,220. Meanwhile, Coincodex pegged BTC’s volatility at a medium 2.85%, with a neutral sentiment. The Fear and Greed Index showed fear at 46, implying that investors are hesitating to invest in the asset.

BTC Adoption Continues to Grow

On August 28, Crypto2Community reported that Bitplanet has launched a $40 million Bitcoin treasury to become the first South Korean BTC firm. Separately, KindlyMD, a Utah-based healthcare services provider, filed $5 billion at-the-market (ATM) equity program with the United States Securities and Exchange Commission (SEC). The healthcare firm disclosed that it will use the capital to fund corporate expenses and its Bitcoin holdings expansion project.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.