Highlights:

- Metaplanet acquired an additional 108.78 Bitcoin for approximately $6.7 million on October 7.

- Total Bitcoin holdings now stand at 639.503 BTC, valued at around $40.6 million.

- Metaplanet’s stock price surged 11%, maintaining year-to-date gains of 517%.

Japanese investment firm Metaplanet has maintained its aggressive Bitcoin purchasing strategy. In a post on X (formerly Twitter) on Monday, the firm revealed that it had purchased an additional 108.78 BTC for 1 billion yen, roughly equivalent to $6.7 million. Despite market fluctuations, this latest purchase underscores Metaplanet’s commitment to investing in Bitcoin.

The Tokyo-listed firm stated that following the latest Bitcoin purchase, its total holdings have increased to 639.503 BTC, valued at approximately $40.6 million based on current market prices. Metaplanet stated that it purchased the additional 108.786 bitcoins at an average price of 9.19 million yen ($61,880) per bitcoin, bringing its overall average price for all its bitcoins to 9.32 million yen ($62,789).

*Metaplanet purchases additional 108.78 $BTC* pic.twitter.com/Pz2AHupm1T

— Metaplanet Inc. (@Metaplanet_JP) October 7, 2024

Metaplanet has been actively acquiring Bitcoin in recent months, following its announcement in May that it would adopt Bitcoin as its strategic treasury reserve asset. Last week, the firm revealed that it had purchased an additional 107.913 BTC for 1 billion yen ($6.7 million).

Also, last week, Metaplanet increased its Bitcoin holdings by $1.4 million through options trading. The firm successfully sold 223 fully USD-collateralized contracts of $62,000 put options, set to expire on December 27, 2024. This transaction generated 23.97 BTC in option premiums, which will be recognized as revenue.

The company embraced Bitcoin to address traditional economic challenges, especially Japan’s negative interest rates and quantitative easing. Since implementing its Bitcoin strategy, the company’s stock has soared, indicating robust investor support for this approach.

Stock Price Surges After Metaplanet Buys Bitcoin

As of the latest update, Metaplanet’s stock price has risen 11%, trading around the ¥1,024 mark. The stock has maintained similar levels over the past month, with year-to-date gains at 517%. However, it remains 70% below its all-time high reached in May.

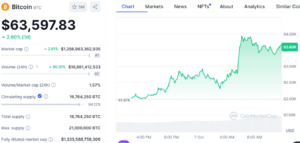

Bitcoin Price Surges Over 2.60% with Analysts Predicting Strong October Rally

Bitcoin rose 2.60% in the last 24 hours, trading at $63,597 after dipping below $60,000 last week. Following a sluggish start to October, with prices dipping below $60,000, analysts forecast a strong rally ahead. In addition to Metaplanet’s activities, several other factors could contribute to the BTC rally in October.

Historical data indicates that after reaching a low in October, Bitcoin typically experiences a surge of 31.72% within the same month. On October 3, the BTC price hit a low of $59,800 before starting to recover. Therefore, if we anticipate a 32% increase from this point, the BTC price could rise to $77.7K by the end of the month.

In its latest research report, 10x Research highlighted:

“October is filled with critical catalysts that could sustain the upward momentum. Geopolitical factors are unlikely to disrupt this bullish trend; they may present intriguing opportunities for savvy traders looking to capitalize on the market’s volatility”.

Moreover, Bitcoin is recognized as a global asset that is rapidly digitizing the gold market, outpacing other asset classes. For example, US Spot Bitcoin ETFs have surged to over $60 billion in assets under management (AUM) in recent months.