Highlights:

- Metaplanet bought 330 BTC for $28.2 million as the company holdings hit 4,855 BTC.

- In its recent acquisition, the investment firm spent $28.2 million at $85,605 per token.

- Despite BTC’s earlier struggles, Metaplanet’s Q2 yield has reached 12.1%.

On April 21, Metaplanet’s Chief Executive Officer (CEO), Simon Gerovich, tweeted that the company purchased an additional 330 Bitcoin (BTC) for $28.2 million. In the X post, Gerovich stated that the Japanese crypto investment firm spent an average of $85,605 per BTC and has achieved a 119.3% year-to-date yield.

Metaplanet has acquired 330 BTC for ~$28.2 million at ~$85,605 per bitcoin and has achieved BTC Yield of 119.3% YTD 2025. As of 4/21/2025, we hold 4855 $BTC acquired for ~$414.5 million at ~$85,386 per bitcoin. pic.twitter.com/EUFSbUCOPW

— Simon Gerovich (@gerovich) April 21, 2025

Metaplanet’s CEO added that as of April 21, the company boasts 4,855 BTC worth $414.5 million at an average cost of $85,386 per token. The company funded most of its BTC acquisitions through capital market activities and operating income.

Last month concluded the first quarter (Q1) of 2025, and Metaplanet reported 95.6% quarterly-to-date (QTD) returns, exceeding its 35% monthly target. Despite Bitcoin’s price struggles in early April, Metaplanet’s QTD yield for 2025’s Q2 has reached 12.1%, indicating that the company is on track to achieving its quarterly target by the end of June.

Gerovich stated that BTC yield is the most important metric for Bitcoin Treasury Companies. He added that Metaplanet will continue to maximize the Basis Points (BPS) to guide its investment decisions.

📢 BTCイールド更新

🟧 2025年Q2 BTCイールド: 12.1%

🟧 年初来累計BTCイールド: 119.3%

🟧 2025年目標: 四半期ごとに35%BTCイールドはビットコイントレジャリー企業にとって最も重要な指標。引き続きBPSの最大化に取り組みます。

ビットコインと未来へ 🚀 pic.twitter.com/5mYsJuDWMF

— Simon Gerovich (@gerovich) April 21, 2025

Metaplanet’s BTC Acquisition Soars in April

Today’s purchase marked Metaplanet’s fourth acquisition for the month. On April 1, the company bought 696 Bitcoin for $67.8 million, followed by another $13.2 million investment for 160 BTC on April 2. Meanwhile, on April 14, Metaplanet bought 319 BTC for $26.3 million.

Since this month began, Metaplanet has bagged 1,505 BTC, exceeding the 1,115 BTC acquired in March via five different purchases. This aggressive acquisition is bringing the company closer to its long-term target. Earlier this year, Gerovich outlined Metaplanet’s long-term goals.

He said the investment firm plans to boost its BTC holdings to 10,000 by the end of this year and 21,000 by the end of 2026. By increasing its BTC stores to 4,855 BTC, Metaplanet has achieved 48.55% of its acquisition target for the year. This signifies that the company will likely surpass its yearly target.

*Metaplanet Purchases Additional 330 $BTC* pic.twitter.com/Gkjp7wUi4S

— Metaplanet Inc. (@Metaplanet_JP) April 21, 2025

Institutions Continue to Buy BTC Despite Volatility Concerns

Over the years, Bitcoin has faced constant criticism because of its volatile nature. However, its proven tendency to reward investors who showed faith in it has endeared it to companies and individuals seeking profit-making avenues.

On April 14, Strategy, the largest corporate holder of Bitcoin, announced that it bought 3,459 Bitcoin between April 7 and April 13. The purchase cost the company $285.8 million at $82,618 per token. A few days before its April 14 Bitcoin investment, Strategy reported unrealized losses of nearly $6 billion on its holdings. This setback did not deter the company from expanding its Bitcoin holdings, highlighting strong faith in Bitcoin as a sustainable store of value.

In related news, Crypto2Community reported that Semler Scientific has filed a registration statement with the US Securities and Exchange Commission (SEC) to raise $500 million. The company plans to use the capital to fund operations and expand its Bitcoin holdings.

Bitcoin’s Price Nears $88,000 as Metaplanet Increases BTC Holdings

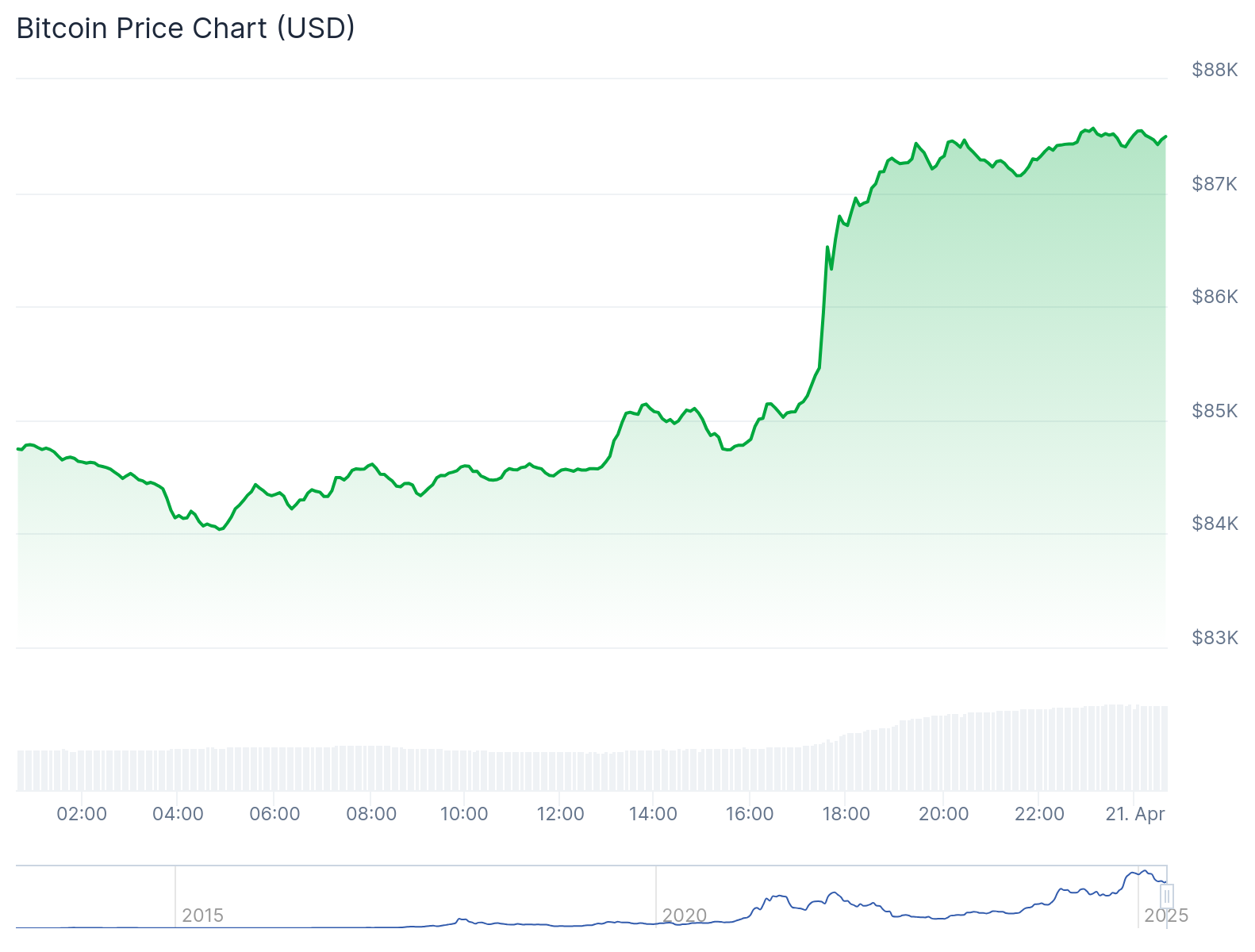

At the time of writing, Bitcoin is up 2.8% in the past 24 hours, trading at approximately $87,500. Its other extended period variables also reflected price upswings. For context, BTC spiked 3.6% 7-day-to-date, 13.9% 14-day-to-date, and 3.9% month-to-date. Bitcoin’s market capitalization has increased slightly to about $1.737 trillion. Similarly, its 24-hour trading volume jumped 92.62% to about $26.49 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.